Donor credit card information is required for recurring gifts.

Donor credit card information is required for recurring gifts.Recurring gifts have no pre-defined end date and do not create AR. Only "CASH" gifts can be setup as recurring via the "Allow Recurring Gift" checkbox checked on the General Setup screen in Gift Code Maintenance. When a recurring gift donation is created, the donor can specify the next recurring gift date; payments are collected monthly thereafter via the FND680 - Recurring Gift Processing batch process until the donor notifies the organization to end the recurring gift.

Donor credit card information is required for recurring gifts.

Donor credit card information is required for recurring gifts.

To create a recurring gift donation:

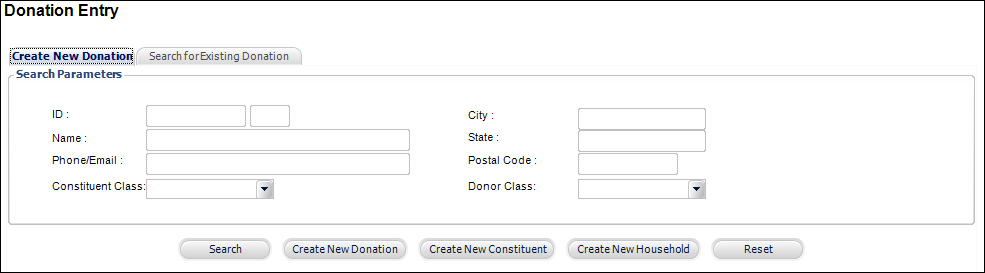

1. From the Personify360 main toolbar, select Take Donations > Flexible Donation Entry.

The Donation Entry search screen displays, as shown below.

2. Search for the appropriate constituent and click Create New Donation.

Alternatively, if you do not find the constituent you are looking for, click Create New Constituent. Additionally, as of 7.4.2, if the USE_HOUSEHOLDING application parameter is set to "Y", click Create New Household to create a new household for which to create a donation.

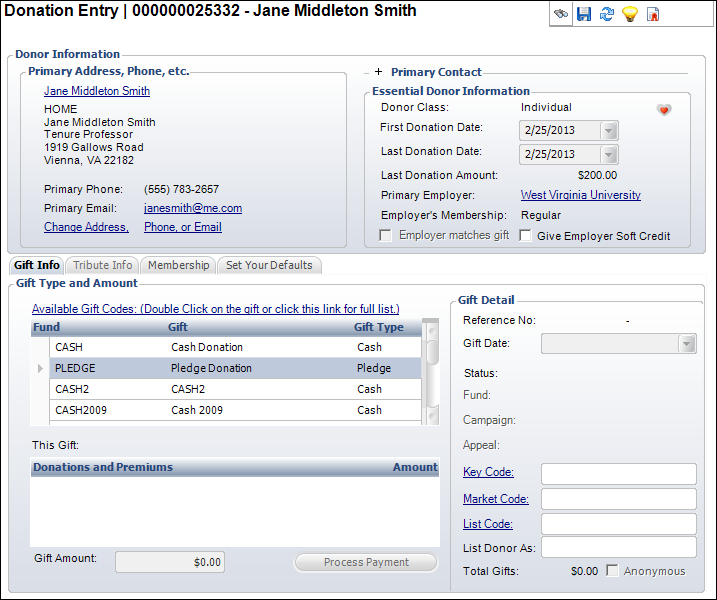

The Donation Entry screen displays, as shown below.

3. If necessary, check the Give Employer Soft Credit checkbox.

Soft credits can be given to the employer linked to the donor for Cash and Pledge fundraising products. All other fundraising products (including credits entered manually) are considered soft credits. If this checkbox is checked, the soft credit will display on the Transactions screen for the constituent's primary employer in Donor360®.

4. From the Gift Info tab, double-click the default donation type in the table or click the Available Gift Codes link to select from a list of all donation types.

If you add a gift in error, you can right-click the line item and select Delete.

If you add a gift in error, you can right-click the line item and select Delete.

5. The Gift Amount automatically populates based on the amount defined selected Gift Code. If necessary, change this.

The gift amount must be greater than zero.

If the selected gift has an agency discount, the Gift Amount field is read-only and will be updated when payment is applied.

If the selected gift has an agency discount, the Gift Amount field is read-only and will be updated when payment is applied.

6. The Status cannot be changed for “CASH” gift types. By default, cash gifts are created as Proforma.

7. If necessary, select the Fund/Campaign/Appeal for which the gift was made.

Please note that if the selected appeal has defined premiums, the Premiums tab will display. Please see Adding a Premium to a Donation for more information.

8. If necessary, click the Key Code link to select a key code.

This code identifies the combination of the marketing piece (e.g., brochure, mailing, etc.) and list code used to solicit the customer. Selecting a value automatically populates the Market Code and List Code. For more information on key codes, please see Processing a New List.

9. If necessary, click the Market Code link to select a market code.

This code identifies the source of an order if it is based on a promotion created for a marketing campaign. Market codes are validated against the order detail date. For more information on market codes, please see Defining a Market Code.

10. If necessary, click the List Code link to select a list code.

This code identifies the mailing list from which the customer was solicited. For more information, please see Creating a New Marketing List.

11. Enter the List Donor As name, which is how the donor’s name will appear in a list of donors.

12. Select whether the donor wishes to remain Anonymous.

When checked, the List Donor As field automatically populates with “Anonymous”.

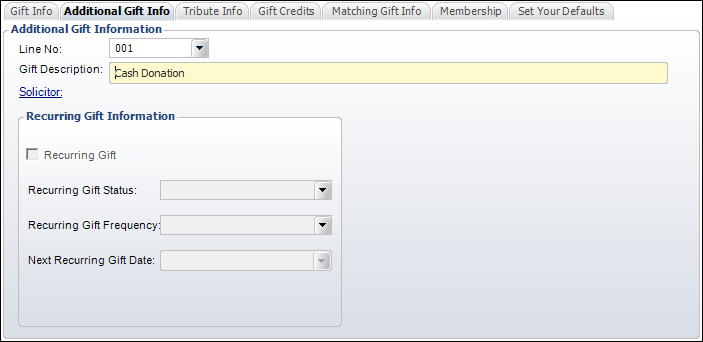

13. Access the Additional Gift Info tab, as shown below.

The Line No displays the line number selected on the Gift Info tab. The Gift Description populates according to the selected Gift Type from the Gift Information tab.

14. Check the Recurring Gift checkbox.

If this checkbox is NOT enabled, verify that the selected CASH gift has the "Allow Recurring Gift" checkbox checked on the General Setup screen in Gift Code Maintenance.

If this checkbox is NOT enabled, verify that the selected CASH gift has the "Allow Recurring Gift" checkbox checked on the General Setup screen in Gift Code Maintenance.

15. The Recurring Gift Status defaults to "Active".

This status will be updated to "Renewed" when the FND680 or FND681 batch process is run. If the FND680 or FND681 is currently being run, this status will be "In Process". This status will display as "Rejected" if the donor's credit card information needs to be updated. Update this status to "Cancelled" to stop the recurring gift. Values in the drop-down are populated based on the fixed codes defined for the FND "RECURRING_GIFT_STATUS system type.

16. Select the Recurring Gift Frequency from the drop-down.

Values in the drop-down are populated based on the non-fixed codes defined for the FND "GIFT_FREQUENCY" system type.

17. The Next Recurring Gift Date automatically populates based on the Recurring Gift Frequency selected. For example, if "Monthly" is selected as the recurring gift frequency, this date will default to one month from today's date since the current donation counts as the first recurring donation. If necessary, change this date.

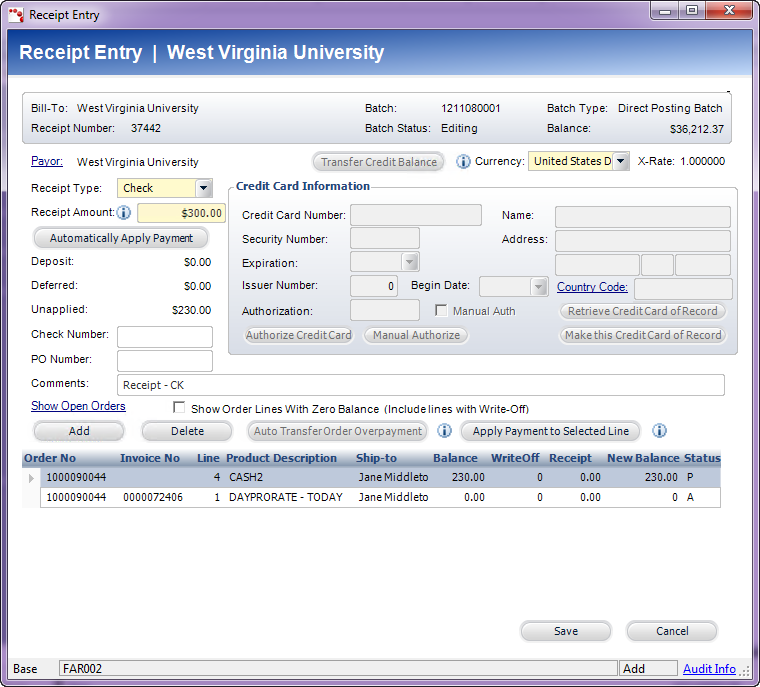

18. From the Gift Info tab, click Process Payment.

If a batch is not already opened, the system prompts you to open a batch. Click Yes and select the batch from the list. If no batches display in the list, you must access the Batch Control screen and create a new batch.

As of 7.4.0SP1, if your donation contains more than one cash product, the Receipt Entry screen will display when you click Process Payment, as shown below. This screen will also open from Order Entry. Additionally, as of 7.5.2, if there is a credit balance on the order, the system will display the following message: "There is a credit balance on the order from a previous order line. If you want to transfer this credit balance along with this payment, click the “Auto Transfer Order Overpayment” button. Once the credit is distributed, then apply the payment." For more information on the Receipt Entry (FAR002) screen, please see Entering a Receipt.

As of 7.4.0SP1, if your donation contains more than one cash product, the Receipt Entry screen will display when you click Process Payment, as shown below. This screen will also open from Order Entry. Additionally, as of 7.5.2, if there is a credit balance on the order, the system will display the following message: "There is a credit balance on the order from a previous order line. If you want to transfer this credit balance along with this payment, click the “Auto Transfer Order Overpayment” button. Once the credit is distributed, then apply the payment." For more information on the Receipt Entry (FAR002) screen, please see Entering a Receipt.

By default, the Show Order Lines With Zero Balance checkbox is selected. Click Automatically Apply Payment to distribute the payment to all fundraising products in the order in order by line number. For cash product order lines, an amount equal to the base total amount of the order line will be updated to the Receipt column. If there is money remaining after all of the fundraising order lines have had a receipt amount allocated to the order line, the remaining payment amount will be applied to the first cash fundraising order line. If there is not enough money to distribute the full amount of the order line base total amount for each cash fundraising product order line, the system will distribute the full amount, if possible, to the first cash fundraising product order line, then as much as possible to each remaining cash product order line up to the base total amount of each order line. If one, some, or all fundraising cash product order lines have a price of $0, the system will distribute the payment to each fundraising cash product order line that has a base total amount > $0, and then the remaining payment will be applied to the first fundraising cash product order line where the price = $0.

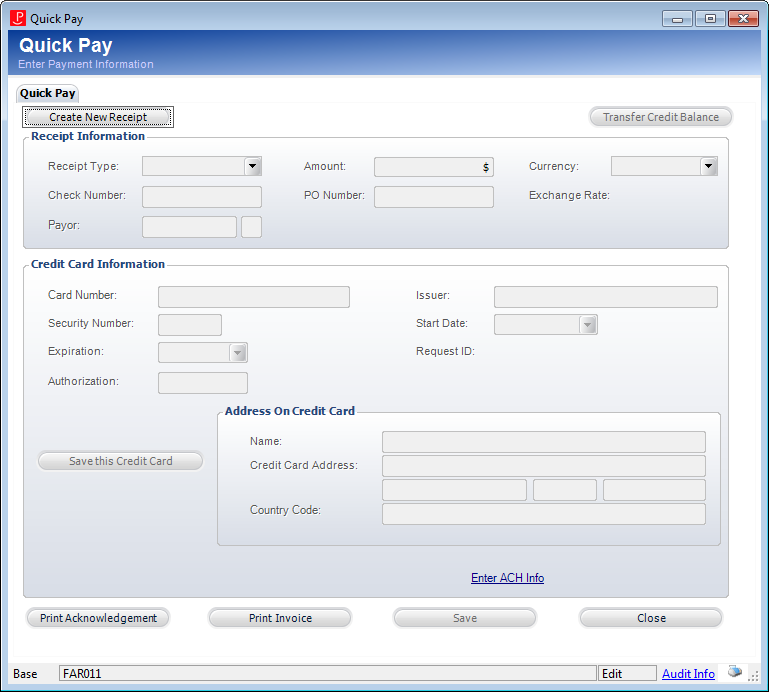

The Quick Pay screen displays, as shown below.

19. Enter payment information. For more information on this screen, please see Performing a Quick Pay.

Electronic checks (eChecks) should NOT be used as a payment method for FND pledges or recurring gifts.

Electronic checks (eChecks) should NOT be used as a payment method for FND pledges or recurring gifts.

20. Click Save.