A

financial company can only be assigned to one organization unit, but multiple

financial companies can be assigned to a single organization unit.

A

financial company can only be assigned to one organization unit, but multiple

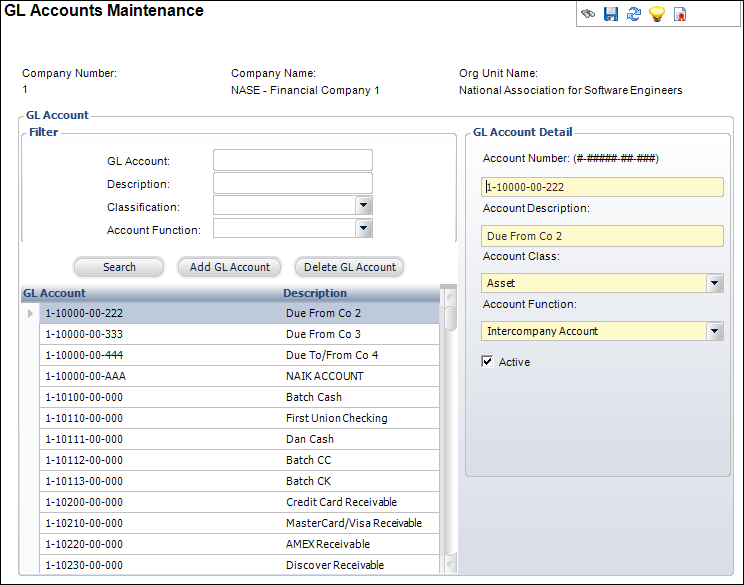

financial companies can be assigned to a single organization unit.A General Ledger (GL) is defined by an organization and shared across organization units within that organization. Some characteristics (e.g., account length and format, close date, etc.) are at the organization level. Each GL account number is identified with a financial company. An account number must be unique within the organization. One way to achieve a parallel account structure is to use the leading segment in the account number to refer to the financial company. The remaining characters can then be identical to accounts in other companies. For each company, a due from (debit) and due to (credit) account must be set up with every other company within the organization.

A

financial company can only be assigned to one organization unit, but multiple

financial companies can be assigned to a single organization unit.

A

financial company can only be assigned to one organization unit, but multiple

financial companies can be assigned to a single organization unit.

When revenue for a product is shared between companies, the company of the receivable account is the owner of the order line. For example, revenue is shared between company 1 and company 2. The receivable account belongs to company 1. In this case, there will be a due from (debit) created for company 2 (from company 1) and a due to (credit) for company 1 (to company 2). The due to/due from is created based on the company of the AR or PPL account being different from the company of the (deferred) revenue account.

When one receipt is applied to multiple order lines, each of which are in different companies, the company of the cash account is the owner of the receipt. For example, one receipt is applied to both order line 1 in company 1 and order line 2 in company 2. The cash account is received into company 1. In this case, there will be a due from (debit) created for company 2 (from company 1) and a due to (credit) for company 1 (to company 2). The due to/due from is created based on the company of the cash account being different from the company of the AR or PPL account. This has implications for all financial transactions that affect order lines in multiple companies.

The GL definition applies to all financial companies within the organization, and therefore, to all organization units as well. In this screen, you can add new GL accounts or modify existing accounts, or define accounts by masked copy.

You must have permissions

to view the organization in order to view the GL accounts on this screen.

If you cannot view this screen, you can either change the organization

you are logged in to, log in as another user, or contact your system administrator

to change your permissions.

You must have permissions

to view the organization in order to view the GL accounts on this screen.

If you cannot view this screen, you can either change the organization

you are logged in to, log in as another user, or contact your system administrator

to change your permissions.

This screen changes

if account segments need to be defined.

This screen changes

if account segments need to be defined.

Please

refer to Uploading GL

Accounts for more information on uploading the GL accounts.

Please

refer to Uploading GL

Accounts for more information on uploading the GL accounts.

To add new GL accounts:

1. From the toolbar, select System Admin > Organization Structure > Organization Unit Definition.

2. Search

for an organization unit and select it.

The General System Parameters screen in Organizational Unit Maintenance

displays.

3. From the Default GL Accounts task category, click Define New GL Accounts.

4. Search

for an organization or organization unit and select it.

The GL Accounts Maintenance screen displays.

5. If necessary, you can filter the accounts that are displayed. Enter information in any of the following filter fields and click Search:

· GL Account

· Description

· Classification

· Account Function

6. Click

Add GL Account.

The GL Account Detail fields are enabled. Please note that you cannot delete

a GL account if the account is currently being used in Personify.

7. In the

GL Account Detail section, enter the Account

Number.

The segment length and separator format displays next to the Account Number

caption.

GL account

numbers may contain the following characters: ".", "+",

and "-".

GL account

numbers may contain the following characters: ".", "+",

and "-".

8. Enter the Account Description.

9. Select the Account Class from the drop-down.

10. Select the Account Function from the drop-down.

11. If necessary, check the Active checkbox.

12. Click Save.

Screen Element |

Description |

|---|---|

Filter |

|

GL Account |

Text box. The account number of the GL account for which you want to search. |

Description |

Text box. The description of the GL account for which you want to search. |

Classification |

Drop-down. The class of the GL account for which you want to search. For example, Asset or Liability. |

Account Function |

Drop-down. The function of the GL account. Used to identify the kind of account referenced when setting up products and other account search functions. This is set so users do not inadvertently use the incorrect account. For example, Credit Balance or Accounts Receivable. Accounts are only searchable on the Product Maintenance screen if the Account Functions are defined properly here. Values in the drop-down are populated based on the fixed codes defined for the APP "ACCOUNT_FUNCTION" system type. See Account Function Code Descriptions for more information about the available options. |

Search |

Button. Click this button to search for GL accounts based on the filter information added. |

Add GL Account |

Button. When clicked, a row is added to the table and the corresponding fields are enabled to add a GL account. |

GL Account Detail |

|

Account Number |

Text box. The account number of the GL account. This must be unique within the organization unit. It also must be the specified segment length and use the segment separator. All accounts should exist here that are used throughout the system. Account lookups use the accounts defined here. The account segment length and separator are defined on the Organization Maintenance screen.

|

Account Description |

Text box. The description of the GL account. |

Account Class |

Drop-down. This is used as a filter for account selection to enforce the appropriate use of accounts as per the functionality. For example, the lookup for a Revenue account should use “Revenue” as a filter so that no other types of accounts are made available for revenue account selection. Values in the drop-down are populated based on the fixed codes defined for the FGL "ACCOUNT_CLASS" system type. |

Account Function |

Drop-down. The function of the GL account. Used to identify the kind of account referenced when setting up products and other account search functions. This is set so users do not inadvertently use the incorrect account. For example, Credit Balance or Accounts Receivable. Accounts are only searchable on the Product Maintenance screen if the Account Functions are defined properly here. See Account Function Code Descriptions for more information on the available options. |

Active |

Checkbox. When checked, indicates the account is active. Only active accounts display in the lookup and can be used for product setup or in transactions.

|

Delete GL Account |

Button. When clicked, the highlighted row from the table is deleted.

|