FAR680 - Scheduled Deferred Receipt Processing

This batch

report selects pending scheduled payments and updates them for processing.

FAR680 picks only those records whose process date is null or Rejected

flag is Yes with status code= "Pending". Any updated scheduled

payments being paid by credit card are then authorized for payment. Updated

scheduled payments not paid by credit card are ready for invoicing or

direct debit payment processing via the associated batch process (e.g.,

EFT680 or

CCP610).

If

a payment schedule has credit card info, FAR680 is going to collect scheduled

payments that are due/overdue, regardless whether an invoice or a notice

was sent to the customer. The payment is overdue based on the due date

of the scheduled payment.

If

a payment schedule has credit card info, FAR680 is going to collect scheduled

payments that are due/overdue, regardless whether an invoice or a notice

was sent to the customer. The payment is overdue based on the due date

of the scheduled payment.

If

a status is "PAID", this means that a payment or transaction

has been applied to reduce the balance. Usually, this happens as a result

of a Type 1 payment transaction, but this status can also result from

a reversal of a Type 2 refund, Type 3 transfer transaction, or Type 5

write-off.

If

a status is "PAID", this means that a payment or transaction

has been applied to reduce the balance. Usually, this happens as a result

of a Type 1 payment transaction, but this status can also result from

a reversal of a Type 2 refund, Type 3 transfer transaction, or Type 5

write-off.

FAR680

does not look for the CVV result when it performs a reference transaction.

FAR680

does not look for the CVV result when it performs a reference transaction.

When FAR680 is run, it sets the Order_Detail.DUE_DATE based on

the payment due date of associated scheduled payments. FAR680 selects

order lines based Order_Detail.DUE_DATE, so that all of the scheduled

payments that are due are selected. When FAR680 is run to process

credit card payments, it will select all payment amounts that are due

that do not have a payment status of 'PENDING'. A scheduled

payment that is due that has a payment status of INVOICED is still due;

if FAR680 can collect the payment by processing the credit card,

that's what it will do.

Along with updating the scheduled payments, FAR680 adjusts the deferred

receipt transaction amount to the amount still considered due in the future.

For scheduled payments, the FAR680 process is run periodically to reset

the deferred receipt amount against an Order_Detail line based on a specific

due date. For instance, if the customer has a schedule of $10/month for

12 months and has paid $20 for the first two months and the current date

is within that second month, there would be a single deferred receipt

transaction for -$100. If you sum FAR_Txn.Base_Amount for that order line,

you should return a balance of zero, i.e., the customer does not owe anything

at the current time. At the beginning of month three, the process would

reset the deferred receipt amount to -$90 to reflect that $10 is now due.

If you now sum FAR_Txn.Base_Amount, you will have a balance due of $10.

At the same time, the due date for the Order_Detail line is reset to the

earliest of any scheduled payment due.

· Order

at two months:

o Sales

$120

o Receipt

($20)

o Deferred

Receipt ($100)

· Due today

Balance $0

o Order

at three months (after running FAR680)

o Sales

$120

o Receipt

($20)

o Deferred

Receipt ($90)

o Due today

Balance $10

FAR680 performs different tasks to update the schedule payment for processing

depending on the type of order the scheduled payment is associated with.

The types of orders that FAR680 affects differently (including the associated

follow-up batch process needed to complete the transaction) are the following:

· Scheduled

Payments with No Automatic Payments (ORD660)

· Fundraising

Pledge Payments (CCP610,

then FND660)

· Membership

Renewal Order Payments (ORD650)

· EFT Payments

(EFT680)

· Credit

Card Payments (CCP610)

Scheduled Payments with No Automatic Payment

For scheduled payments that are not set up to be automatically paid

(for example, exhibitions), running FAR680 completes the following tasks:

· Creates

the Notice_Invoice_Date

· Sets

the Processing Date on the order line

· Sets

the Due Date on the order line

· Decrements

the Type 9 deferred receipt transaction by the amount of the scheduled

payment.

After you run FAR680, you need to run ORD660

to invoice the scheduled payments due.

Please

be sure to post deferred batches before running this batch process. FAR680

will NOT update the payment status for any scheduled payments where the

receipt was taken with a deferred batch and the batch has not been posted.

Please

be sure to post deferred batches before running this batch process. FAR680

will NOT update the payment status for any scheduled payments where the

receipt was taken with a deferred batch and the batch has not been posted.

Fundraising Pledge Payments

For fundraising pledge scheduled payments that are not automatically

being paid, running FAR680 completes the following tasks:

· Sets

the Processing Dates on the order line

· Creates

the Notice_Invoice_Date

After you run FAR680, you need to run CCP610

or EFT680

to pick up any automatic payments, and then FND660

to pick up payments not set up for automatic payment.

Membership Renewal Order Payments

When you run the Renewal process (ORD650)

on membership renewal orders, the application creates a proforma order

and a deferred receipt for a membership order defined to automatically

renew by credit card.

After running ORD650,

you need to run FAR680 to get the authorization for the deferred receipt.

EFT Payments

For EFT payments, running FAR680 completes the following tasks:

· Sets

the Processing Date on the order line

· Updates

the Type 8 transaction by the amount of the scheduled payment

After running FAR680, you need to run EFT680

to collect the direct debit. If the EFT680

cannot successfully process the direct debit payment successfully, the

REJECTED_PAYMENT_FLAG on the scheduled payment is updated to ‘Y’ and the

payment status is set to ‘PENDING’.

Credit Card Payments

For selected scheduled payments that are being paid by credit cards,

the process sends an authorization request to the credit card processor.

If the credit card is authorized, the system performs the following tasks:

· Creates

a Far_Txn type 1 receipt (credit card only)

· Creates

a Far_Txn_Detail record (credit card only)

· Creates

a Far_Receipt record (credit card only)

· Decrements

Type 9 deferred receipt transaction by the amount of the scheduled payment

· Updates

the scheduled payment with a status of “Paid”

As of 7.6.1, for organizations using Vantiv as their payment handler,

FAR680 checks the PROCESS_EXPIRED_CC

merchant

parameter to determine whether expired credit cards should be selected

for processing. If the credit card defined for a payment schedule has

expired, if the PROCESS_EXPIRED_CC

merchant

parameter is set to "N", FAR680 will not select scheduled

payments with expired credit cards that are due to be paid. Ccp_Req_Ans.REJECT_REASON

will be filled with “Credit card is expired.” Ccp_Req_Ans.ERROR_CODE will

be set to 24 for Verisign, 202 for Cybersource, and 305 for Vantiv. If

the PROCESS_EXPIRED_CC merchant

parameter is set to "Y", FAR680 will transmit credit card

payments to Vantiv even if the credit card is expired. When Vantiv returns

the authorization request response, if the organization is using Vantiv’s

"Account Updater" service, the response file will include the

updated credit card expiration date, as well as any other changes that

may have been made to the credit card, such as change of name, change

of credit card number or change of credit card type.

After running FAR680, you need to run CCP610

to settle the credit card.

If FAR680 is not able to successfully process a credit card scheduled

payment successfully, the REJECTED_PAYMENT_FLAG on the scheduled payment

is updated to ‘Y’ and the payment status is set to ‘PENDING’. If the receipt

cannot be finalized (bad credit card, paper invoice, etc.) when you run

FAR680, then the deferred receipt is still updated, resulting in a balance

due today for the order.

Payments

which result in an overpayment of the order will check for deferred receipt

transactions and make the appropriate correction.

Payments

which result in an overpayment of the order will check for deferred receipt

transactions and make the appropriate correction.

The FAR680 batch job must be run on a monthly basis to update the deferred

receipt based on the schedule. That same job automatically creates credit

card receipts if the order was defined to do this and the credit card

information exists.

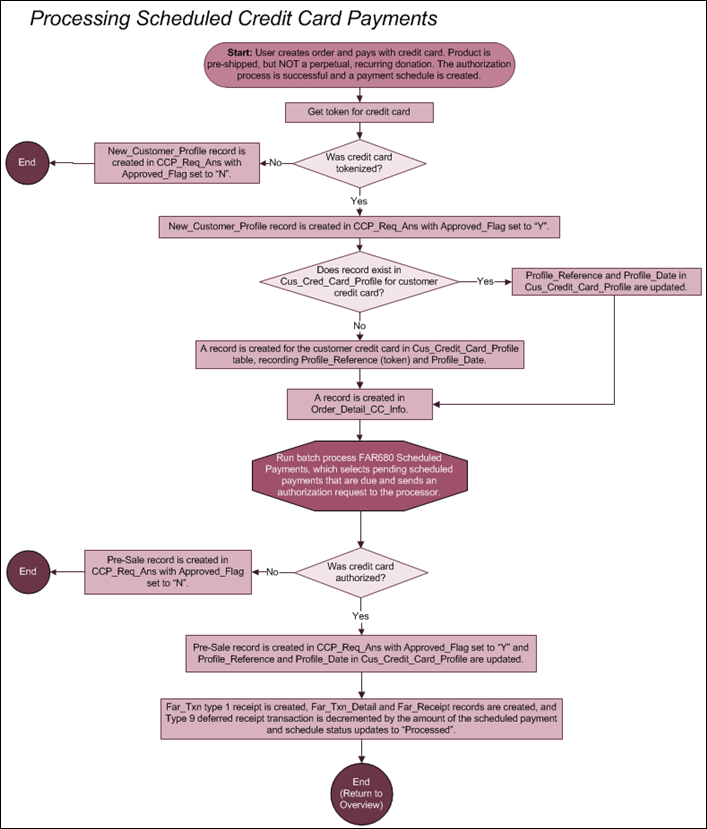

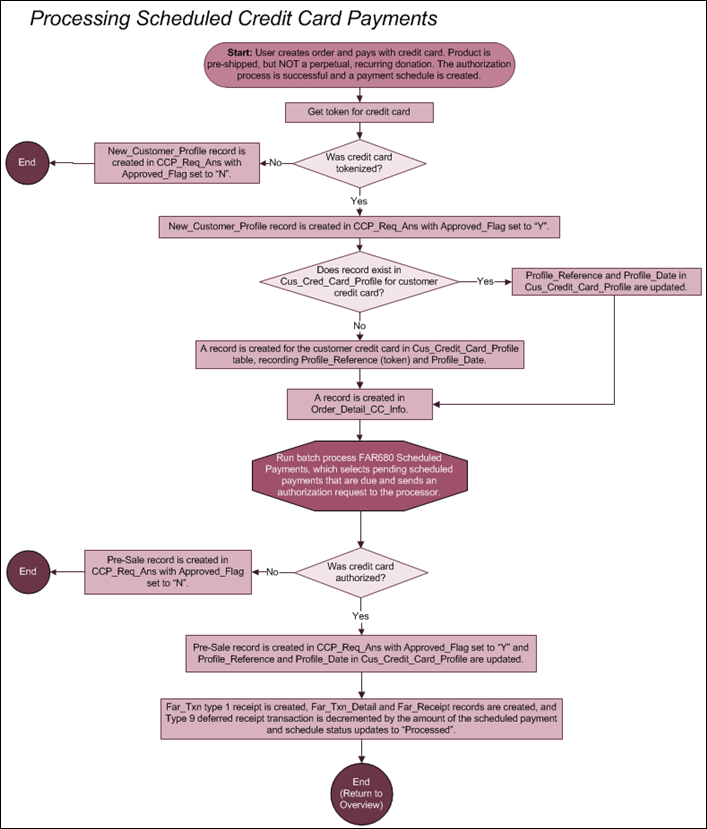

The workflow that appears next walks you through processing scheduled

credit card payments made for pre-shipped product orders. This includes

steps necessary to complete before running FAR680 and what happens after

you run FAR680.

You can find this workflow and similar credit card functionality workflows,

such as Shipping INV Products with Deferred Credit Card Payments, in the

Credit

Card Processing Data Flow Diagrams section.

FAR680

must be run separately for every merchant account.

FAR680

must be run separately for every merchant account.

Parameters

Parameter |

Description |

Required? |

Organization |

The Organization ID for which the report

will be run. The system sets this to the organization ID of the

logged in user running the batch process. |

Read-only |

Organization Unit |

The Organization Unit ID for which you

want to run the report. The system sets this to the organization

unit of the logged in user running the batch process. |

Read-only |

Run Mode |

Mode in which the report runs:

· EDIT

– prints the report.

· PROD

– prints the report and updates the database tables. |

Yes |

Batch |

If a batch is entered, the system will

use this batch to create the receipts. If the Create Batch parameter

below is set to ‘N’, this field is required. |

No – if Create Batch = Y

Yes – if Create Batch = N |

Process Date |

This date is used to select scheduled

payments that have a due date on or before the date selected and

that have a payment status of “Pending”. |

Yes |

Create Batch |

Determines whether the process creates

a new batch.

· Y

– creates a new batch to process the payments into based on the

App_Next_Number naming convention.

FAR680 uses receipt types to create a batch where Availability

is NOT NONE, the Credit Card Receipt flag is checked, and the

Default for Personify flag is checked.

When FAR680 automatically creates

a batch, the system automatically creates batches with receipt

types with Far_Receipt_Type.AVAILABILITY_CODE <> NONE,

where Fgl_Cash_Account.DEFAULT_FLAG = 'Y', and where Fgl_Cash_Account.DEFAULT_FOR_WEB_FLAG

= 'Y'. When FAR680 automatically creates

a batch, the system automatically creates batches with receipt

types with Far_Receipt_Type.AVAILABILITY_CODE <> NONE,

where Fgl_Cash_Account.DEFAULT_FLAG = 'Y', and where Fgl_Cash_Account.DEFAULT_FOR_WEB_FLAG

= 'Y'.

· N

– does not create a new batch, instead you must enter an existing

batch number in the Batch parameter. You may want to use this

option as a way to maintain your organization’s naming conventions

or designate a batch as being a result of running this process. |

Yes |

Use Vantiv Batch Processing? |

As of 7.6.1, if you are using Vantiv as

your credit card processor/payment handler, you have the option

to submit credit card pre-authorization transactions in a single

batch file instead of individual transactions. If using the batch

processing option, you also have the option to activate authorization

recycling so that Vantiv can attempt for a period of days (typically

16 for VISA, 28 for all other credit cards) to obtain authorizations

for declined transactions. To enable the authorization recycling

option, set this parameter to "Y" AND also set the AUTH_RECYCLING_MERCHANT merchant

parameter to ''Litle'' for the selected Vantiv payment handler.

If it is set to "Y", then recycling

will be activated for all receipts where the Vantiv payment handler

record is active. If it is set to "N", or if it is set

to "Y" and Vantiv is not being used, then the system

will disregard this parameter.

If this is set to "Y",

FAR680 will create an EXPORT file (and place the file in the location

as defined by the "REQUEST DIRECTORY" interface

parameter) and FAR681

then needs to be run to IMPORT the response file from Vantiv (from

the location as defined by the "RESPONSE DIRECTORY"

interface

parameter). For more information, please see Processing

the Bulk Transaction Files. If this is set to "Y",

FAR680 will create an EXPORT file (and place the file in the location

as defined by the "REQUEST DIRECTORY" interface

parameter) and FAR681

then needs to be run to IMPORT the response file from Vantiv (from

the location as defined by the "RESPONSE DIRECTORY"

interface

parameter). For more information, please see Processing

the Bulk Transaction Files.

This parameter is ignored if the organization

is not using Vantiv as their credit card payment handler. |

Yes |

Advanced Job Parameter |

Filter |

Reduces the record selection further based

on the SQL statement entered. The filter can be applied on the

order_detail table. For example, "order_detail.product_code

= 'BOOK' " would select only those orders which are placed

for BOOK.

If the application requires you

to enter a value for the filter, but your organization does not

want to include an advanced filter, enter “1=1” for the filter

value to meet the value requirement without affecting the batch

process. If the application requires you

to enter a value for the filter, but your organization does not

want to include an advanced filter, enter “1=1” for the filter

value to meet the value requirement without affecting the batch

process.

|

Yes |

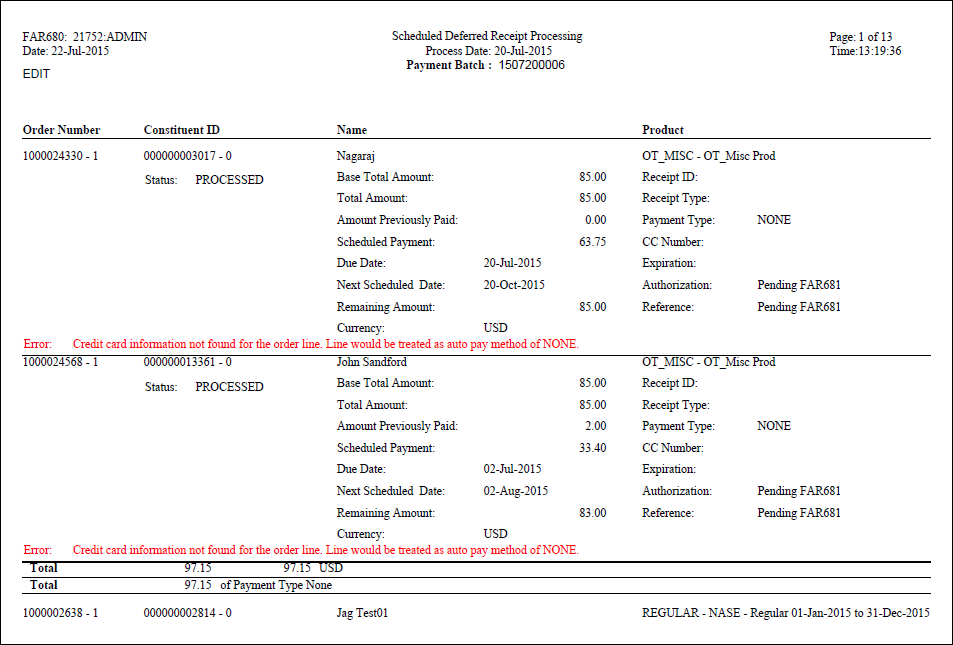

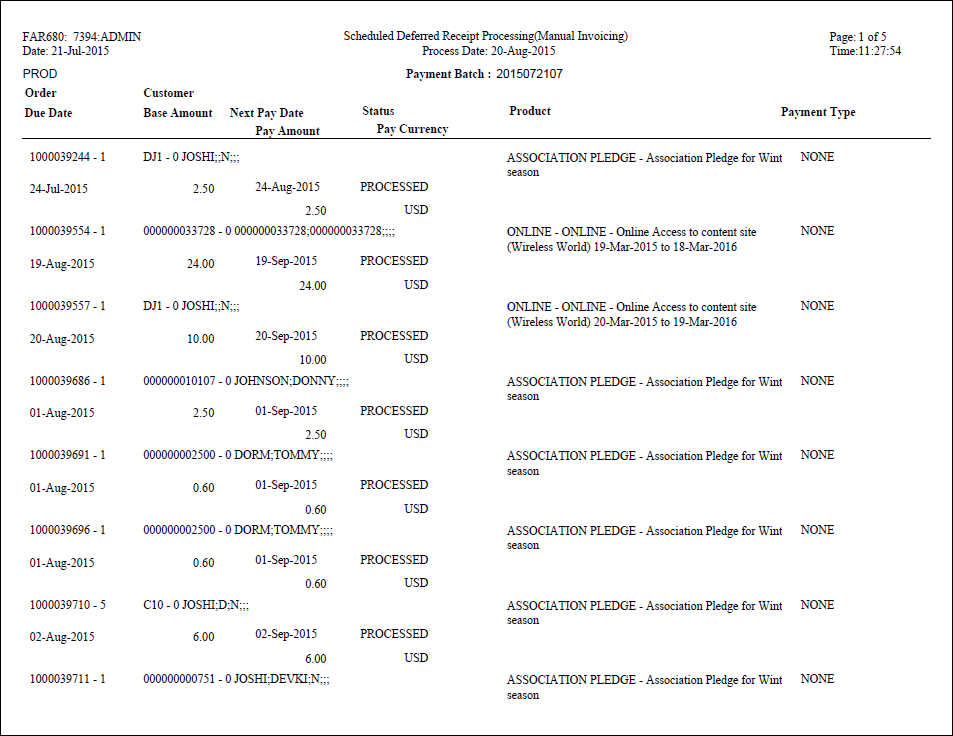

Sample Reports

Orders

that have NOT been paid will display on the report even if you previously

ran FAR680 (e.g., you ran FAR680 on 4/30/2014 and again on 5/31/2014).

The reason for this is so you can easily identify the total balance owed

by the customer to date.

Orders

that have NOT been paid will display on the report even if you previously

ran FAR680 (e.g., you ran FAR680 on 4/30/2014 and again on 5/31/2014).

The reason for this is so you can easily identify the total balance owed

by the customer to date.

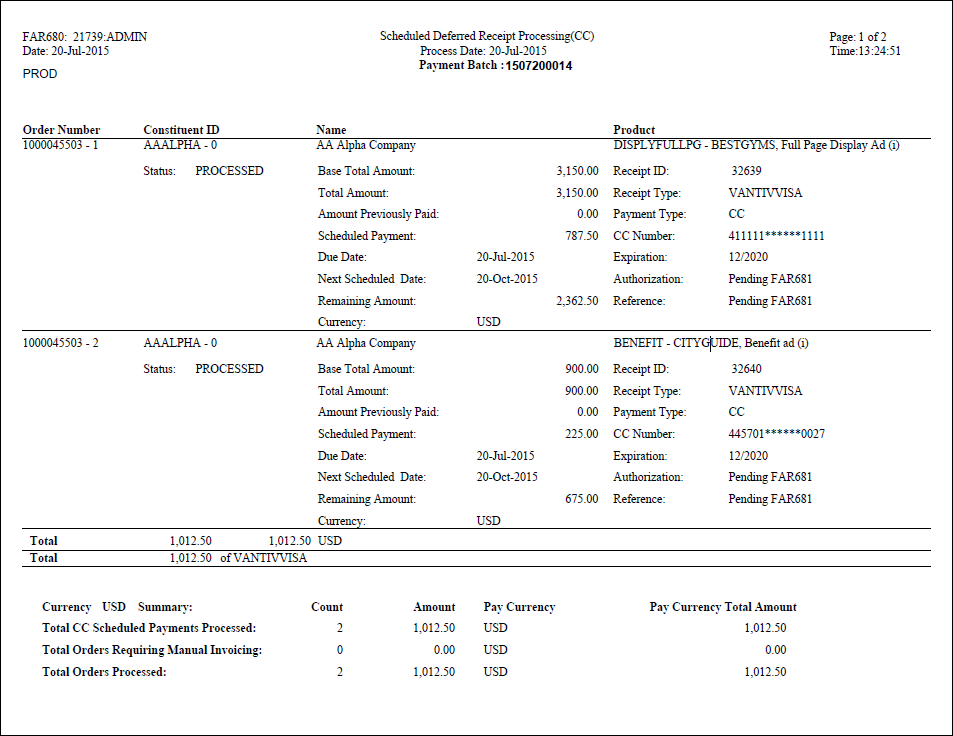

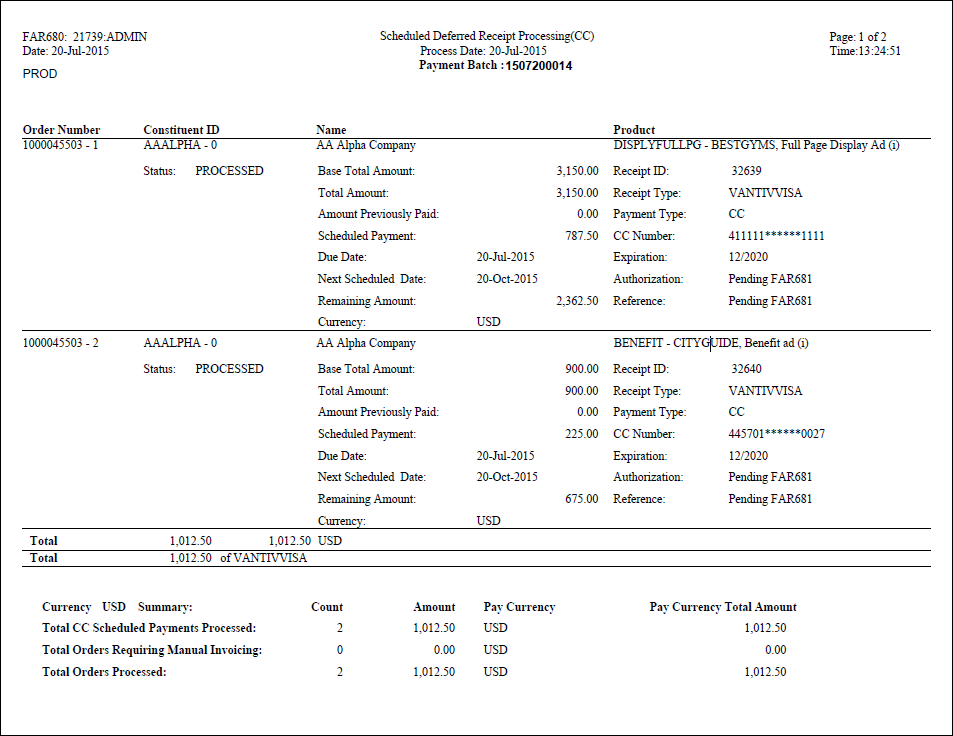

FAR680_ScheduledDeferredReceiptProcess

This report displays the records processed where Auto Pay Method = "CC"

(i.e., payment received through credit card). It will display records

that actually PAID in the FAR680 run and will NOT display already paid

records.

As of 7.6.1, this report has been updated to show details about scheduled

payments that have been processed for payment, including details about

the record created for the deferred payment in CCP_Req_Ans. The report

will display "Pending FAR681" next to the Authorization

and Reference fields if those

fields are null. If the fields are not null, the values in the CCP_Req_Ans.CC_AUTHORIZATION

and CCP_Req_Ans.AUTH_REFERENCE fields will display on the report. All

receipts going through authorization recycling will show a value of "Processed"

in the Status field.

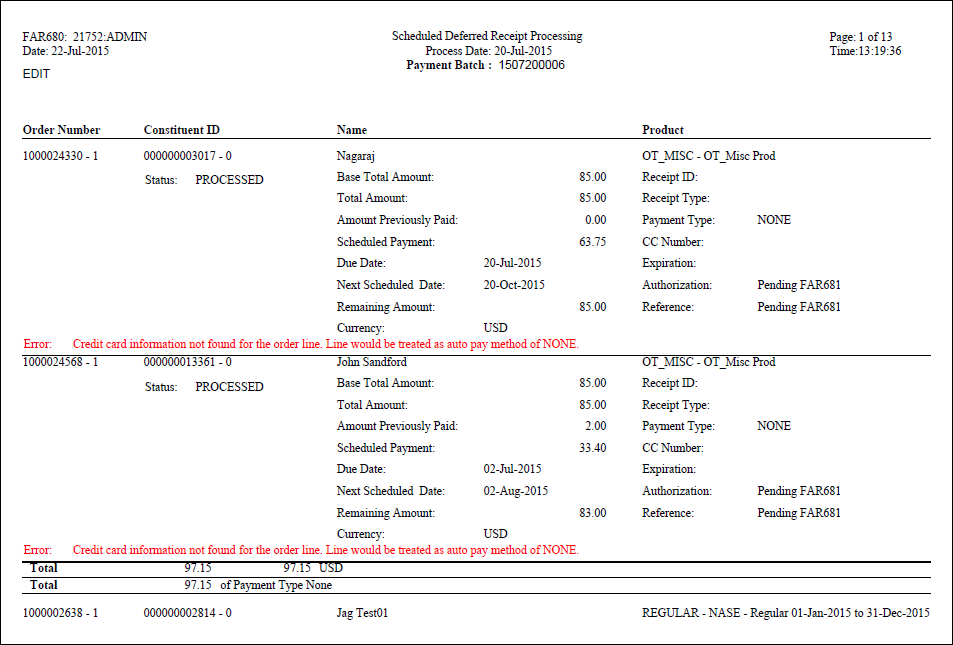

FAR680_ScheduledDeferredReceiptUnprocess

This report displays all failed orders. Failure could be due to expired

token, data corruption such as missing type 9 transaction, zero due amount

or any generic exception in the process.

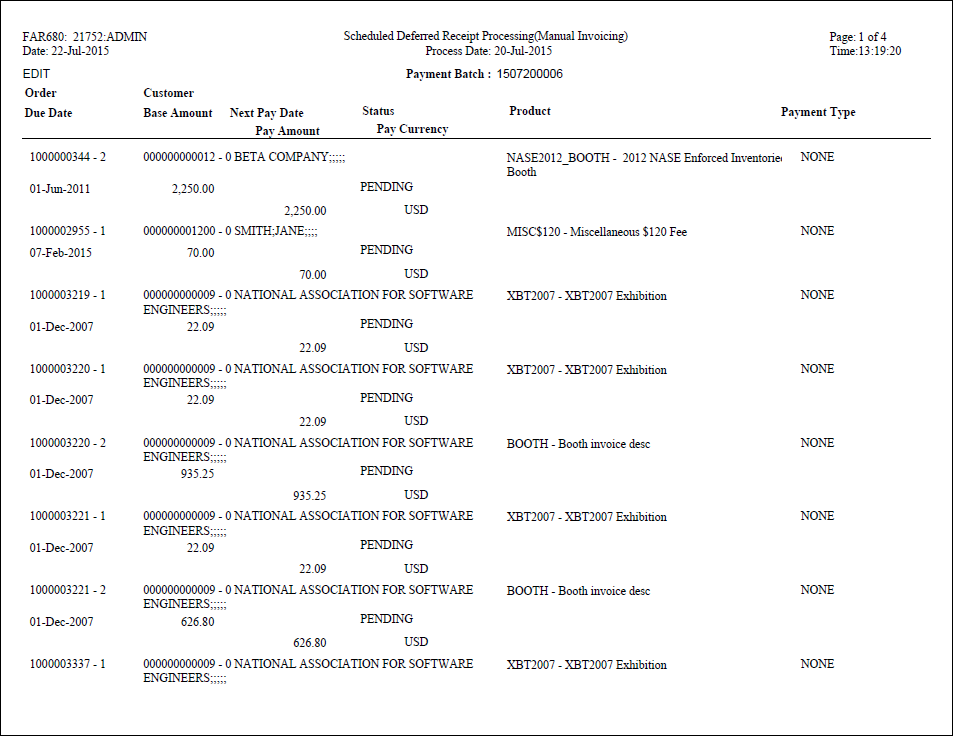

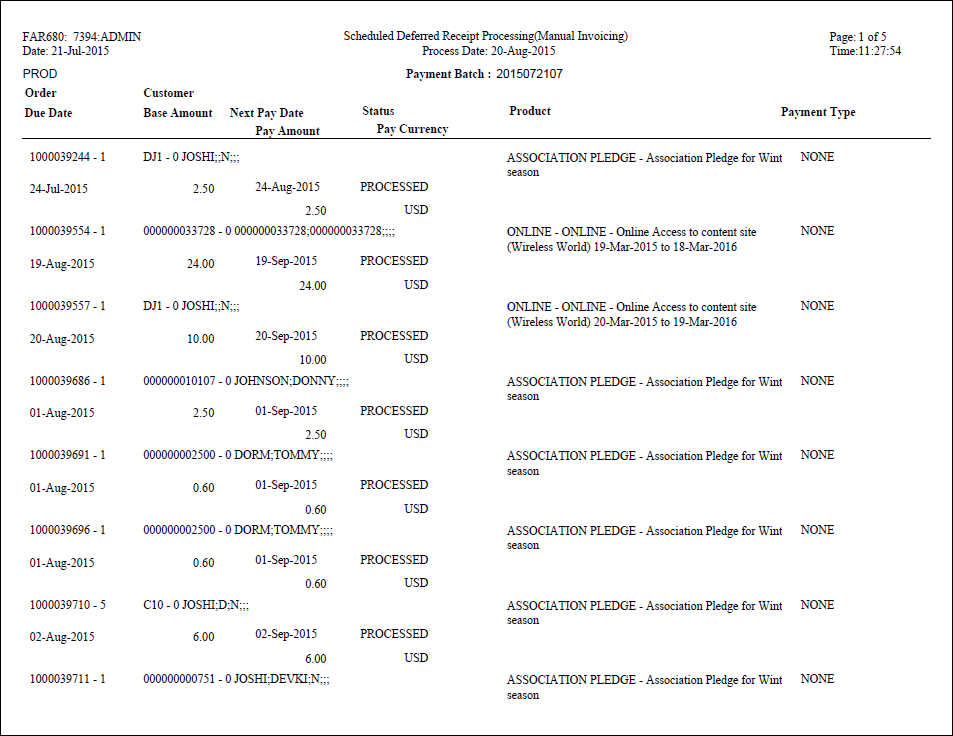

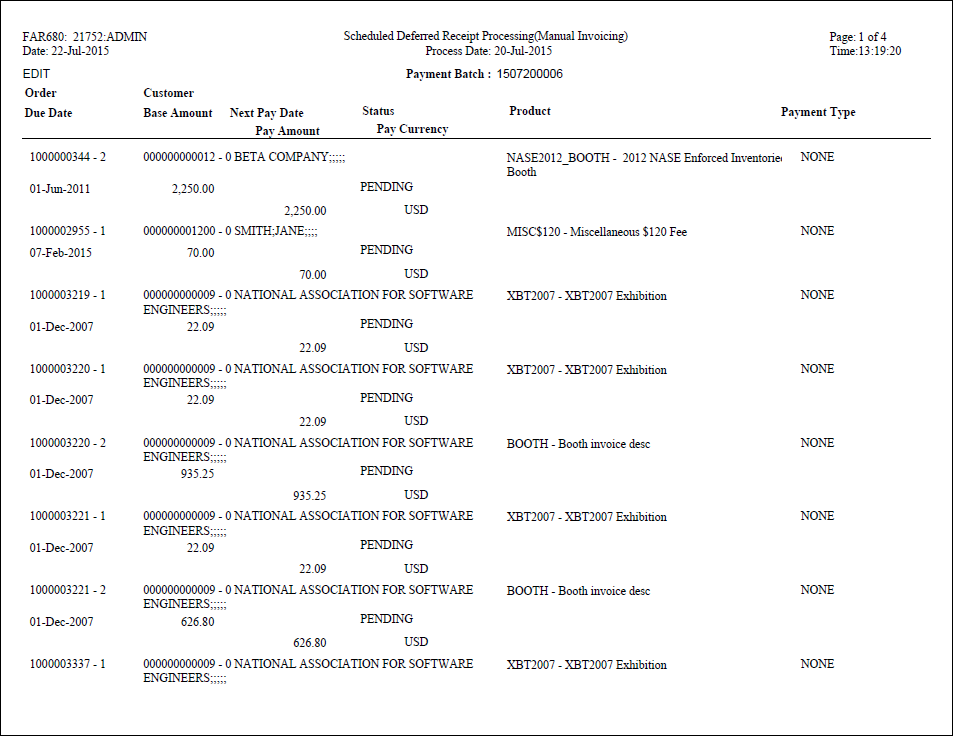

FAR680_Manual_Invoice

This report displays all orders with payment schedule and Auto Pay Method

is either "NULL" or "NONE".

FAR680_Deferred_Receipt_Updates

This report displays the same orders from FAR680_Manual_Invoice for

which type 9 was updated. Action depends on the error reported. Some may

need data correction or token update, etc.

If

a payment schedule has credit card info, FAR680 is going to collect scheduled

payments that are due/overdue, regardless whether an invoice or a notice

was sent to the customer. The payment is overdue based on the due date

of the scheduled payment.

If

a payment schedule has credit card info, FAR680 is going to collect scheduled

payments that are due/overdue, regardless whether an invoice or a notice

was sent to the customer. The payment is overdue based on the due date

of the scheduled payment. Please

be sure to post deferred batches before running this batch process. FAR680

will NOT update the payment status for any scheduled payments where the

receipt was taken with a deferred batch and the batch has not been posted.

Please

be sure to post deferred batches before running this batch process. FAR680

will NOT update the payment status for any scheduled payments where the

receipt was taken with a deferred batch and the batch has not been posted.

When FAR680 automatically creates

a batch, the system automatically creates batches with receipt

types with Far_Receipt_Type.AVAILABILITY_CODE <> NONE,

where Fgl_Cash_Account.DEFAULT_FLAG = 'Y', and where Fgl_Cash_Account.DEFAULT_FOR_WEB_FLAG

= 'Y'.

When FAR680 automatically creates

a batch, the system automatically creates batches with receipt

types with Far_Receipt_Type.AVAILABILITY_CODE <> NONE,

where Fgl_Cash_Account.DEFAULT_FLAG = 'Y', and where Fgl_Cash_Account.DEFAULT_FOR_WEB_FLAG

= 'Y'.