The

EFT680 batch process has the capability to unencrypt a bank account number

if it has been encrypted.

The

EFT680 batch process has the capability to unencrypt a bank account number

if it has been encrypted.This batch process creates a file containing pre-notification and deduction transactions to be sent to the bank. Typically, pre-notifications are created just once for individuals when their EFT order is established. If their transit number or account number changes, another pre-notification is created.

The source of this change can be either of the following:

· The bank informs the association through a notification of change or the rejected pre-notification transaction. In this case the association must run the EFT681 process to mark the individuals.

· The customer informs the association of a change. In this case the association must use the ORD001 – Order Entry – EFT tab to change the customer’s bank information (account/transit number) and mark the pre-note flag. Then the next run of EFT680 will generate another pre-notification transaction.

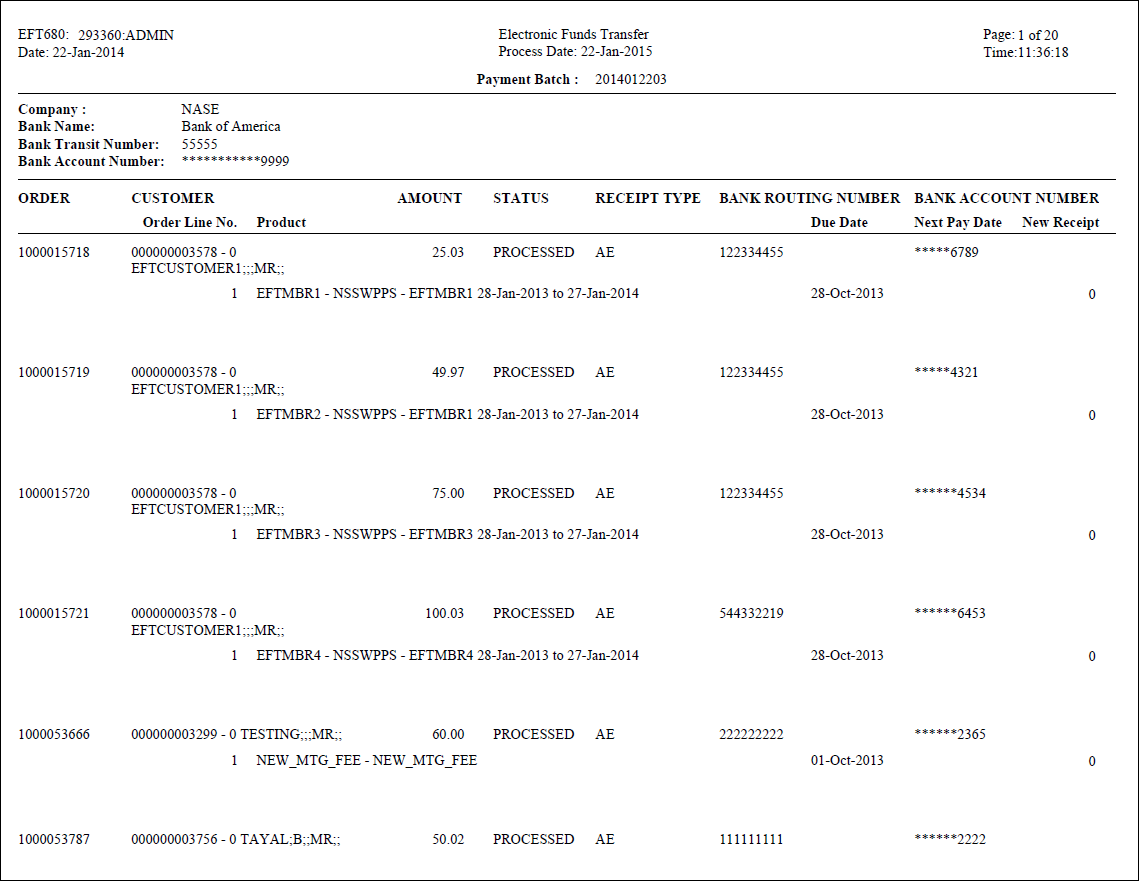

In addition to pre-notifications, the EFT680 application is used to create the actual deduction transactions which move money from the customer's account to the association's account. The EFT680 process creates a file as an ACH file.

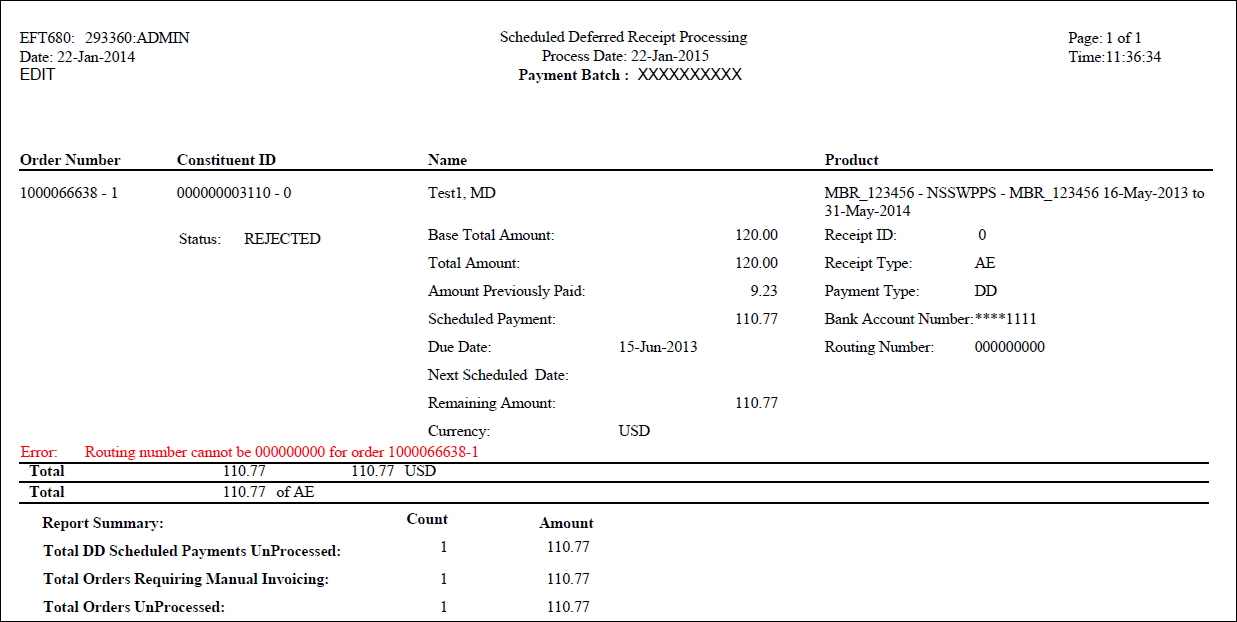

When EFT680 is not able to successfully process an EFT scheduled payment successfully, the REJECTED_PAYMENT_FLAG on the scheduled payment is updated to ‘Y’ and the payment status is set to ‘PENDING’.

As of 7.4.1SP1, when there is no capacity available for the product on an order line that is being activated by EFT680, the process will not fail. Instead, the order will be displayed on the exception report.

The

EFT680 batch process has the capability to unencrypt a bank account number

if it has been encrypted.

The

EFT680 batch process has the capability to unencrypt a bank account number

if it has been encrypted.

Parameter |

Description |

Required? |

|---|---|---|

Organization |

The Organization ID for which you want to run the report. |

Read-only |

Organization Unit |

The Organization Unit ID for which you want to run the report. |

Read-only |

Run Mode |

Mode in which the report runs: · EDIT - will not update the database only use the parameters and query to select records for reporting · PROD - will update the database along with the printing a report of records selected. · RESUBMIT - In case previous submission is a failure, this mode would process all the records and produce ACH file for the entire batch. |

Yes |

Process Mode |

· PRENOTE - selects only records requiring prenote processing. · DEBIT - selects only records which are eligible for cash transfer. |

Yes |

Effective Date |

This is the date that will be treated as a pre-note date and also will be used to define the deduction date. This date is compared to the order_payment_schedule.due_date for selection of records to process. Records selected with have order_payment_schedule.payment_status_code='Pending' and a date <= the effective date. It will also be used as the batch date. |

Yes |

Subtitle |

The report subtitle as you want it to print as part of the report header. |

Yes |

Company |

The company number to run the report for. |

Yes |

Profile Code |

The bank profile code for the association's bank. |

Yes |

Create Batch |

If Create Batch is set to 'N', parameter Batch is required. If Create Batch is set to 'Y', process will create a batch by the name specified. If left blank it will create a batch by itself. |

Yes |

Batch ID |

When the process is run, a Direct Entry batch with application as EFT will be automatically created. Batch detail will have a transaction type of EFT and use the GL Account associated with the bank information defined for the company number. |

No |

Company Entry Description |

10 character term used in company/batch header record. |

Yes |

Job ID |

This parameter gives the ability to regenerate the data files and the report for the processed job. It works only with RESUBMIT mode. |

No |

Skip Bank Accounts |

As of 7.5.2, if a direct-debit payment is processed for payment but is rejected, and if the bank account is good, the customer’s bank account status is set to “Collection Failed”. · N - EFT680 will attempt to process payments for customers using a bank account that has a status of “Collection Failed”. · Y - EFT680 will skip processing scheduled payments for customers using a bank account that has a current bank account status of “Collection Failed”.

|

Yes |

Process Rejected Payments? |

As of 7.5.2: · N - EFT680 will not attempt to collect rejected payments. · Y - EFT680 will attempt to collect rejected payment.

|

Yes |

Output File Location |

The path for the output file. |

No |

Advanced Job Parameters |

||

Selection Criteria |

Currently, the system allows filtering against Order_Master, Order_Detail, Far_Txn_Summary_View, and Order_Payment_Schedule. |

No |

As of 7.5.2:

· EFT680 selects records from Order_Payment_Schedule and Order_Detail where:

o Order_Payment_Schedule.PAYMENT_STATUS_CODE = ‘PENDING’,

o Order_Payment_Schedule.DUE_DATE <= date value of EFT680 “Effective Date” parameter,

o Order_Detail.LINE_STATUS_CODE <> ‘C’.

· For the selected records, EFT680 evaluates Cus_Eft_Info.BANK_ACCOUNT_STATUS_CODE where Order_Payment_Schedule.ORDER_NO = Order_Master.ORDER_NO and Order_Master.BILL_MASTER_CUSTOMER_ID, BILL_SUB_CUSTOMER_ID = Cus_Eft_Info.MASTER_CUSTOMER_ID, SUB_CUSTOMER_ID and Order_Payment_Schedule.ORDER_NO = Order_Detail_Eft_Info.ORDER_NO and Order_Payment_Schedule.ORDER_LINE_NO = Order_Detail_Eft_Info.ORDER_LINE_NO and Order_Detail_Eft_Info.CUS_EFT_INFO_ID = Cus_Eft_Info.CUS_EFT_INFO_ID.

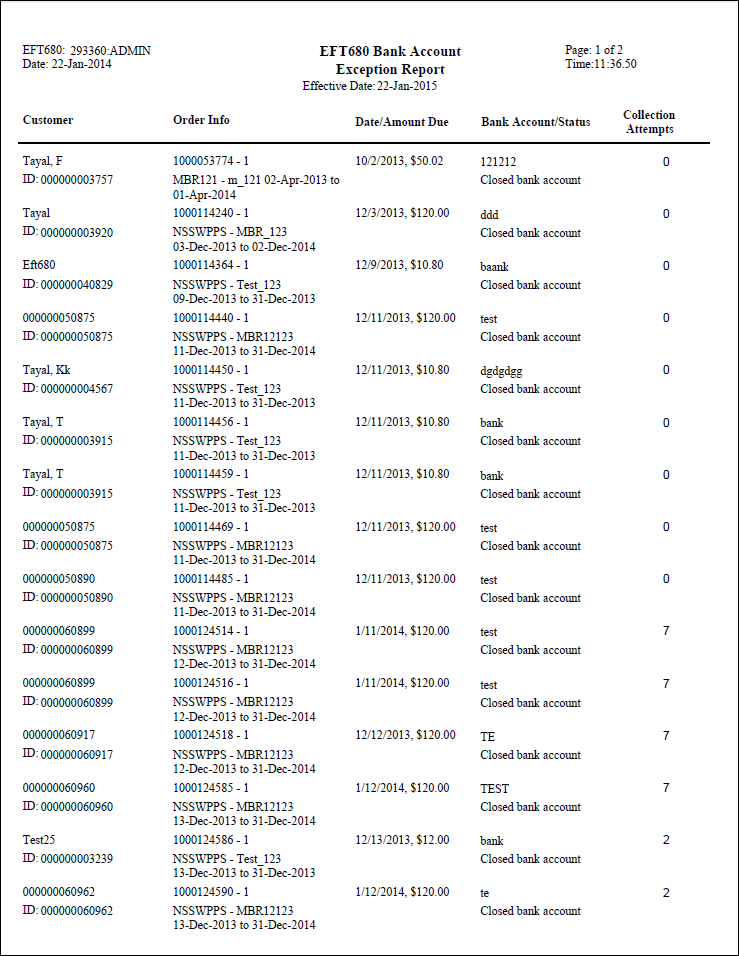

o If BANK_ACCOUNT_STATUS_CODE = ‘CLOSED’, ‘DO_NOT_USE’ or ‘INVALID’, scheduled payment is selected for inclusion on the “Bank Account Status Exceptions” report.

o If BANK_ACCOUNT_STATUS_CODE = ‘COLLECTION_FAILED’ and if the EFT680 “Skip Collection Failed Bank Accounts” parameter = ‘Y’, the scheduled payment is selected for inclusion on the “Bank Account Status Exceptions” report.

o If BANK_ACCOUNT_STATUS_CODE = ‘COLLECTION_FAILED’, and if the EFT680 “Skip Collection Failed Bank Accounts” parameter = ‘N’, if “Process Rejected Payments” = ‘Y’, and if scheduled payment “Rejected Pymt Collection Attempts” value >= “Maximum Rejected Pymt Collection Attempts” defined for the org unit bank, the scheduled payment is selected for inclusion on the “Unprocessed Payments” report.

o Otherwise, If BANK_ACCOUNT_STATUS_CODE = ‘COLLECTION_FAILED’, and if the EFT680 “Skip Collection Failed Bank Accounts” parameter = ‘N’, if “Process Rejected Payments” = ‘Y’ and if scheduled payment “Rejected Pymt Collection Attempts” value < “Maximum Rejected Pymt Collection Attempts” defined for the org unit bank, the scheduled payment is selected for processing.

As of 7.5.2:

· If value for EFT680 “Process Mode” parameter = PRENOTE, EFT680 selects records from Order_Payment_Schedule, Order_Detail_EFT_Info, Cus_EFT_Info and Order_Detail where:

o Order_Payment_Schedule.PAYMENT_STATUS_CODE = ‘PENDING’,

o Order_Payment_Schedule.DUE_DATE <= date value of EFT680 “Effective Date” parameter,

o Order_Payment_Schedule.ORDER_NO = Order_Detail_EFT_Info.ORDER_NO and Order_Payment_Schedule.ORDER_LINE_NO = Order_Detail_EFT_Info.ORDER_LINE_NO and Order_Detail_EFT_Info.CUS_EFT_INFO_ID = Cus_Eft_Info.CUS_EFT_INFO_ID and Cus_Eft_Info.PRENOTE_STATUS_CODE = ‘PENDING’ and Cus_Eft_Info.BANK_ACCOUNT_STATUS_CODE not in (‘CLOSED’, ‘INVALID’),

o Order_Payment_Schedule.ORDER_NO = Order_Detail.ORDER_NO and Order_Payment_Schedule.ORDER_LINE_NO = Order_Detail.ORDER_LINE_NO and Order_Detail.LINE_STATUS_CODE <> ‘C’.

· Customers where the bank account status code is CLOSED, DO_NOT_USE, or INVALID are selected for the bank account status exception report.

· For bank accounts selected for pre-noting, EFT680 will set Cus_EFT_Info.PRENOTE_STATUS_CODE to PRENOTED. All records for the customer in Order_Detail_EFT_Info for the same bank account where PRENOTE_REQUIRED_FLAG = ‘Y’ will have PRENOTE_DATE set to current date.

As of 7.5.2, when the EFT680 process excludes scheduled payments because of the customer’s current bank account status or because a rejected payment has been submitted to the bank the maximum number of times, those scheduled payments will display on the EFT680_Bank_Account_Exception report.

See also: EFT File Layout (ACH) Format Exported by EFT680