Creating an Advanced Adjustment

An adjustment transaction adjusts the revenue accounts for an order. This

differs from a write-off, which

is specifically a transaction that changes a balance in Accounts Receivable

for an order line item and records that change against a write-off account.

Adjustments are only made to the sales side of a transaction, so typically

they affect the receivable account versus the revenue accounts and possibly

the discount accounts.

Adjustments transactions are created only for invoiced line items. If

an adjustment is made to an uninvoiced line item (i.e., there is no active

sales transaction and just a proforma sales transaction), then the system

updates the proforma FAR_TXN.Base_Amount and does not generate any FAR_Txn_Detail

records for any distribution.

Transaction Structure

When the receivable balance increases:

DR |

Accounts Receivable |

CR |

(Deferred) Revenue Accounts |

When the receivable balance decreases:

DR |

(Deferred) Revenue Accounts |

CR |

Accounts Receivable |

Discount accounts may also play into this scenario.

The

sign of the adjustment in Far_Txn.Base_Amount indicates whether the AR

(the amount owed) is increased or decreased. An adjustment with a positive

sign means that you are increasing the price of the product. An adjustment

with a negative sign, means that you are decreasing the price of the product.

The

sign of the adjustment in Far_Txn.Base_Amount indicates whether the AR

(the amount owed) is increased or decreased. An adjustment with a positive

sign means that you are increasing the price of the product. An adjustment

with a negative sign, means that you are decreasing the price of the product.

Source of the Accounts

When the receivable balance increases:

Debit: The AR account

is found at the order_detail level (Order_Detail.AR_Account).

Credit: Found in

Product_Revenue_Distribution for the product referenced in the order_detail

line based on the order_date versus the effective date in Product_Revenue_Distribution.

When the receivable balance decreases:

Debit: Found in Product_Revenue_Distribution

for the product referenced in the order_detail line based on the order_date

versus the effective date in Product_Revenue_Distribution.

Credit: The AR account

is found at the order_detail level (Order_Detail.AR_Account).

Deferred Versus Real Revenue Accounts

If Order_Detail.Recognition_Status_Flag doesn’t = ‘C’, then the system

uses the deferred account accounts. Otherwise, the system uses

the non-deferred accounts. In this case it is deferred revenue versus

revenue.

Distribution of the Amount

It is possible to have multiple revenue or deferred revenue accounts

referenced in an adjustment transaction. The amount is then based

on the original distribution rules for the product. Rather than trying

to determine the rules within the adjustment transaction, the system simply

recalculates the distribution based on the revised product price (i.e.,

the price less the adjustment), use the central distribution routine,

compare it to what was already distributed, and record a transaction for

the differences.

Things to Consider before Performing an Advanced Adjustment

· If you need to have

less money in AR for a cancelled order line, then you should do a write-off.

· If you’re trying to

get more money in AR to be available for a refund for a cancelled order

line, perform an advanced adjustment. For example, a cancellation fee

was charged and shouldn’t have been because you want to refund all the

money.

· If the cancellation

fee went to the wrong account, perform an advanced adjustment.

· If you have a credit

memo scenario, use special receipt type.

· If there is a data

integrity issue, do NOT perform an advanced adjustment.

· If there is a balance

in deferred revenue and there shouldn’t be, do NOT perform an advanced

adjustment.

· Advanced adjustments

are typically performed on cancelled order. If the order is not cancelled,

then there’s probably another way to make the adjustment. However, an

exception would be if a product setup has the wrong deferred account

(this includes deferred revenue, deferred discount, deferred agency discount).

If so, perform the following:

a. Correct the product

setup.

b. Enter a new order line

and invoice/activate it.

c. Make sure the deferred

account is correct. If it is not correct, go back to step a.

d. Cancel the order line(s)

with the wrong deferred account.

e. Perform an auto-adjust

to move the money to the correct line.

Another

exception is for miscellaneous invoices that recognize revenue on invoice.

In this case, you can perform an advanced adjustment to change the revenue

account.

· If you wrote off a balance and then receive the

money, perform the following:

a. Enter

the payment against the order line (even though there’s no balance).

b. The payment

will automatically reverse the write-off.

Write-offs

created via an advanced adjustment will NOT be automatically reversed

by payment. Advanced adjustments can only be manually reversed.

Write-offs

created via an advanced adjustment will NOT be automatically reversed

by payment. Advanced adjustments can only be manually reversed.

Special Situations with Adjustments

Adjustments to Uninvoiced Orders

Users often want to adjust the price of line items within orders and

to record the reason for the adjustment. This is easy to do for invoiced

transactions since the system simply creates a standard type=6 transaction. For

proforma or uninvoiced orders, the system uses a transaction type that

is simply a memo transaction (txn_type=’8’). The reason for the adjustment

will be maintained in the FAR_TXN.COMMENTS in the memo transaction. Memo

transactions must be ignored in all calculations of balances though the

amount of the adjustment should be maintained in the amount column. When

the order is invoiced, the adjustment column in order_detail will be factored

into the transaction against the revenue accounts.

If the order is uninvoiced, the system automatically creates a Memo

(type=8) transaction rather than a type=6.

Space Credits and Trades for Services

These are special adjustment transactions in that they do not affect

the revenue accounts but rather affect a special space credit or trades

account

The account for space credits is stored in the product_account table.

It is an expense or contra-revenue account that offsets accounts receivable.

The structure of this is the same thing as a standard adjustment transaction:

The debit account comes from Product_Account.space_credit_account or

Product_Account.Trade_for_Services_Account.

Users will be able to define space credits against a specific show with

the option of creating a financial adjustment to that same show. If no

financial adjustment is created for the current show that credit can later

be transferred to a future show once that order has been created at which

time the user will be able to move the credit and create a financial transaction

at that time.

Write-offs

The system uses the following logic to calculate the net write-off amount

while doing auto write-off reversal on a payment:

1. Take the

sum off normal write-off.

2. If it is negative,

then calculate sum of advance write-off.

3. If sum of advance write-off

is positive, then sum up the two write-offs.

4. If it comes out to

be negative, then consider that as the net write-off.

Minimum information needed for the process:

· Order

Number and Line Number

· Adjustment

Reason

· Amount

of Adjustment (Positive increases the price; negative decreases

the price.)

· Type

(Optional: Adjust (default), Space Credit, Trade)

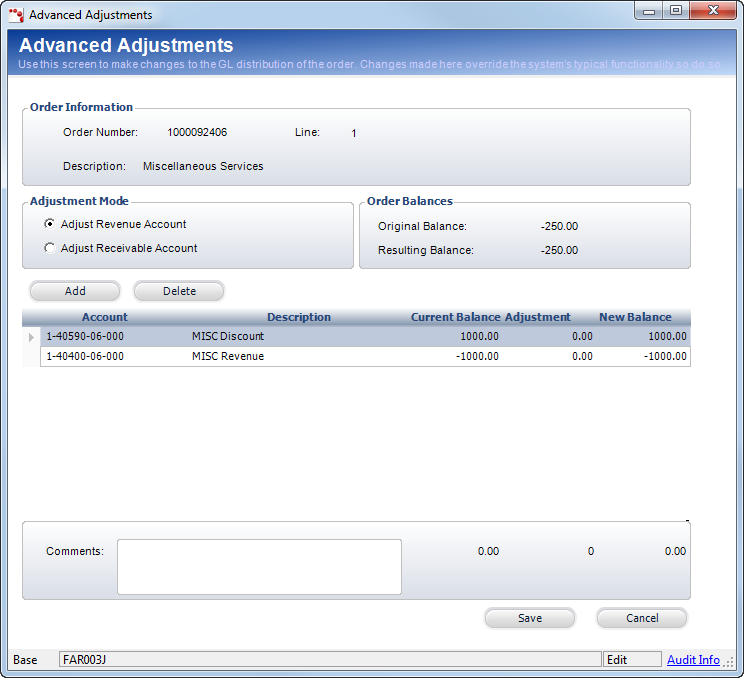

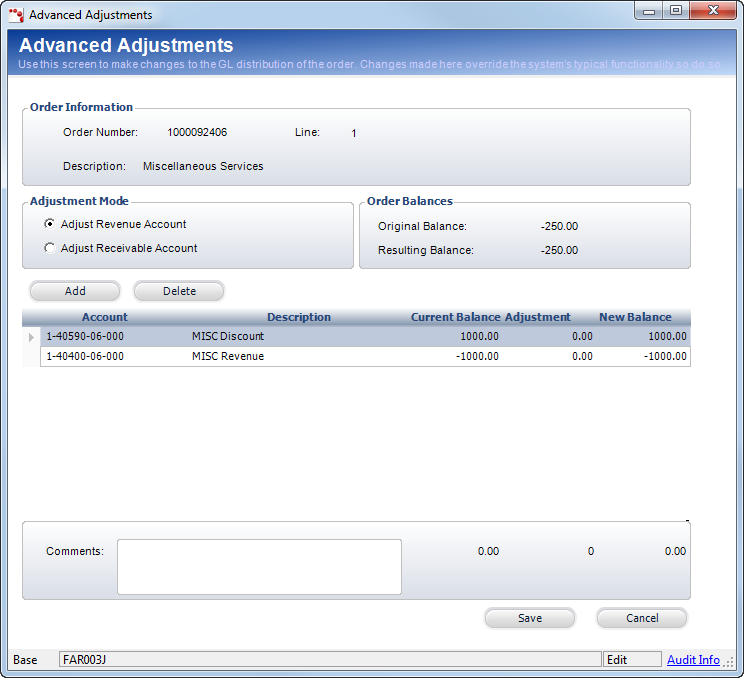

On the Advanced Adjustments screen, you can define advanced criteria

for an order line item price adjustment, such as selecting to adjust a

specific revenue or receivable account. A Journal Entry (Type J) transaction

is created for adjustments to the revenue account. A Write-Off (Type 5)

transaction is created for adjustments to the receivable account.

This functionality

should only used by the Finance department. Personify recommends you set

up security for this screen.

This functionality

should only used by the Finance department. Personify recommends you set

up security for this screen.

The advanced adjustments functionality is used if you accidentally charge

to the wrong revenue account or to refund a cancellation fee. To refund

a cancellation fee, debit the cancellation account and reverse the debit/credit

memo (adjust receivable account). If revenue recognition is “On Invoice,”

you can change the revenue account.

If revenue can

still be recognized (the order is active and not cancelled), then you

cannot perform a revenue adjustment.

If revenue can

still be recognized (the order is active and not cancelled), then you

cannot perform a revenue adjustment.

Advanced adjustments are only needed on cancelled orders because if

the order is active, you have more options without using this screen (such

as writing off a balance or adjusting a price). Only perform an advanced

adjustment when the order has a $0 balance for Accounts Receivable (AR).

To create an advanced adjustment:

1. On the

Customer Financial Analysis

screen, select the appropriate line item from the Order and Transaction

Analysis tab and click the Advanced Adjustment

button.

The system runs the following query:

select F.ACCOUNT_FUNCTION_CODE, T.account,

F.[Description]

from FAR_TXN_DETAIL T, FGL_ACCOUNT_MASTER F

where T.order_no = '[n]' and T.order_line_no = [n]

and t.org_id = f.org_id and T.account = F.account

and t.txn_function_code not in ( 'AR', 'PPL', 'CASH', 'DUEFROM', 'DUETO')

As of 7.5.0,

the system will not prevent the Advanced Adjustments screen from opening

if the revenue account has an account class of "Asset".

As of 7.5.0,

the system will not prevent the Advanced Adjustments screen from opening

if the revenue account has an account class of "Asset".

The Advanced Adjustments screen displays,

as shown below.

2. Select the appropriate

Adjustment Mode radio button:

· Adjust Revenue Account – If an adjustment is made

to this account, Journal Entries for transaction type and registration

revenue are created. The credit amount must equal the debit amount for

a revenue account adjustment.

· Adjust Receivable Account – If an adjustment is

made to this account, a write-off transaction type and a Journal Entry

for the registration revenue are created.

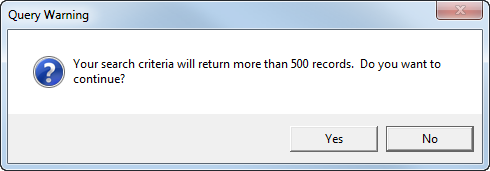

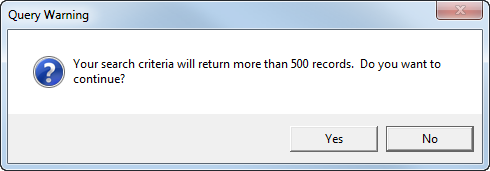

3. Click Add.

The GL Account Chooser displays. Please note that if the system contains

more than 500 accounts, the following message will display. Click Yes to continue.

4. Search for and select

the appropriate account.

5. Click inside the Adjustment table cell and enter the adjustment

amount.

The New Balance calculates automatically.

6. Enter Comments

related to the adjustment.

Comments are required for this screen.

7. Click Save.

See Also:

· Overview:

Customer Financial Analysis

· Viewing

Financial Summary

· Writing

Off a Balance

· Creating

a Refund

· Receipt

Transfers

· Paying

the Selected Order

· Paying

Open Orders

· Viewing

Transaction Details

· Reversing

a Receipt

· Reversing

a Refund

The

sign of the adjustment in Far_Txn.Base_Amount indicates whether the AR

(the amount owed) is increased or decreased. An adjustment with a positive

sign means that you are increasing the price of the product. An adjustment

with a negative sign, means that you are decreasing the price of the product.

The

sign of the adjustment in Far_Txn.Base_Amount indicates whether the AR

(the amount owed) is increased or decreased. An adjustment with a positive

sign means that you are increasing the price of the product. An adjustment

with a negative sign, means that you are decreasing the price of the product. Write-offs

created via an advanced adjustment will NOT be automatically reversed

by payment. Advanced adjustments can only be manually reversed.

Write-offs

created via an advanced adjustment will NOT be automatically reversed

by payment. Advanced adjustments can only be manually reversed.