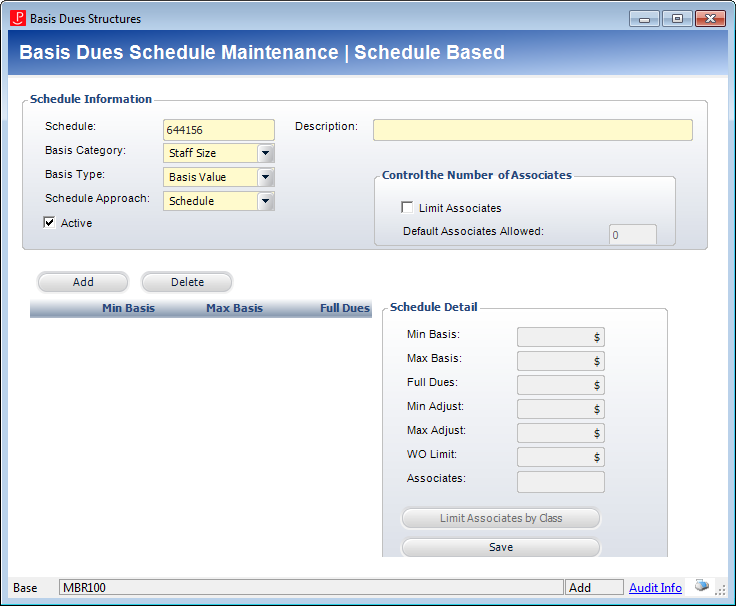

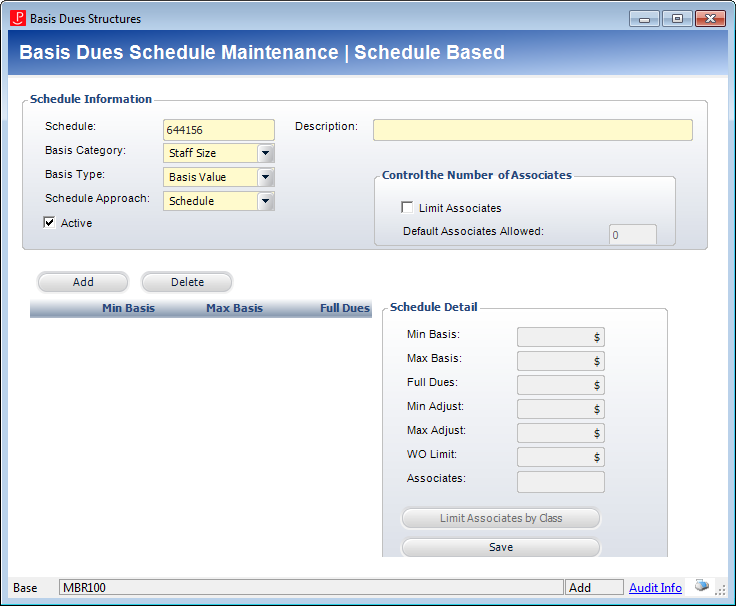

The Basis Dues Schedule Maintenance screen displays, as shown below.

The Basis Dues Schedule Maintenance screen lets you define membership structures as dependent on a schedule rather than a fixed amount. This schedule may be based on the number of members, size of the staff, revenue numbers, etc. For instance, if the company has 100 staff members, they must pay $500, or if the company has sales of $10,000,000, they must pay $5,000. Dues schedules are completed against a basis number which may be the number of staff or size of revenue.

There are two kinds of scheduled that can be setup: Schedule and Commission.

Schedule: the dues amount is a fixed value based on the dues basis range. This is the most popular method of setting up the dues basis range table.

Commission: the dues are calculated by percentage of the basis value that is selected in the basis value range table. A major feature includes the ability to assign an amount for each portion of the whole dues basis and adding them up, which is called Cumulative dues. For example, if there are four ranges, each of 1,000, and the dues basis is 4,000, then for each of the 1,000s the percentage can be different and calculate an amount for each row that is then added together.

Example 1: Basis Value by Schedule

Dues are based on a specific value (could be staff, revenue, etc). The specific value, called a Basis Value, is defined on the constituent record for each member company. That specific value is compared to a range of values, and then a flat dues amount is assigned based on which range the value falls in

If number of staff is between 1-50, dues is $3000 a year

If number of staff is between 51 and 100, dues is $4000 a year

If number of staff is between 100 and 200, dues is $5000 a year

If number of staff is between 201 and 9999999 dues is $10,000 a year

Example 2: Basis Date by Schedule

Dues are based on the number of months past a specific date. This specific date could be a birthdate, a graduation date, or other date. The number of months between the specific date of the member and the current date is then compared to a range of values, and then a flat dues amount is assigned based on which range the number of months falls in

If number of months since graduation is between 1 and 12, dues is $150

If number of months since graduation is between 13 and 24, dues is $300

If number of months since graduation is between 25 and 99999, dues is $500

Example 3: Basis Value by Commission

Dues are charged as a percentage of a basis value rather than a flat amount. For example, dues are charged based on a percentage of revenue. The basis value on a member’s record is compared to a range, and then based on that range, the dues will be calculated as a percentage of the basis value. There can also be a base amount that is added to the percentage that is calculated.

If revenue is between 0 and $1 Million, dues are charged as $100 base amount plus .002% of basis value defined for the member.

If revenue is between $1 Million and $2 Million, dues are charged as $200 base amount plus .003% of basis value defined for the member

If revenue is between $3 Million and $5 Million, dues are charged as $300 base amount plus .004% of basis value defined for the member.

Example 4: Cumulative Basis Value by Commission

Dues are calculated in a cumulative fashion, rather than just calculating by a single percentage based on the range that meets the basis value. If the basis value of a member falls into the third range of the dues schedule, instead of pulling the percentage from that range, it will instead calculate the first portion of the dues by calculating the percentage multiplied times the maximum for that range, and then add it to the calculation for the second range, and so on, so that it is calculated in a cumulative fashion.

The first $1 Million in revenue is calculated at .002% of the $1 Million, then the next $2 Million is calculated at .003% of that $2 Million, etc.

It will add the dues from each range to come up with a cumulative dues amount that is to be charged to the member.

1. If there is no limit to the number of names associates that a corporate member can have, leave the Limit Associates checkbox on the Basis Dues Structure screen unchecked. This will allow you to add as many associates as you want to be attached to the corporate membership. Associates that are added will not be charged a price.

2. If there is a limit to the number of named associates, first check the Limit Associates checkbox, and then define how many named associates are allowed for each row defined in the grid by add the number to the Associates field. For example, if you put the number 3 in the associates field, then a corporate member who buys this membership product that is ties to this dues schedule and whose basis value is in that range, they will be limited to only adding 3 named associates. Associates that are added will not be charged a price.

3. If you wish to limit associates by associate class, for example, some associates are called Junior Associates and some are called Senior Associates, you will first need to define your associate classes in System Types and Codes where Type = ASSOCIATE_CLASS. Next, you will need to check the checkbox for Limit Associates on the Basis Dues Structure screen, define the total maximum associates allowed in the Associates field, and then click Limit Associates by Class. In the modal that pops up, you can indicate the maximum number associates for each type. Associates that are added will not be charged a price.

4. If you wish to limit associates by type, and you charge a fee for your associates and wish for that fee to be added to the order automatically when you assign the named associates, you will create what are called a CAC membership product. These CAC membership products can be linked to an associate class, and then when named associates are assigned, the appropriate CAC member product will be added to the order with the appropriate quantity based on the number of associates that were assigned.

To define a basis dues schedule:

1. On the

Rates and

Pricing screen, check the Price Membership by Schedule checkbox

and click the Schedule link.

The Basis Dues Schedule Chooser search screen displays.

2. Click Create

New Dues Schedule.

The Basis Dues Schedule Maintenance screen displays, as shown below.

3. In the Schedule Information

section, enter the Schedule code.

The system automatically assigns a schedule code, but it can be changed.

4. Enter a Description.

5. Select the Basis Category from the drop-down.

6. Select the Basis Type from the drop-down.

7. Select the Schedule

Approach from the drop-down.

The fields on this screen will change according to the option selected.

See the appropriate section of the table below for more information.

8. Check the Active checkbox, if necessary.

9. To control the number of associates that can use the basis dues schedule, check the Limit Associates checkbox and enter the Default Associates Allowed.

10. Click Add to add a schedule detail.

11. Enter the appropriate information in the Schedule Detail section.

12. Click Save.

Screen Element |

Description |

|---|---|

Schedule Information |

|

Schedule |

Text box. This value is automatically generated by the system. It is a unique ID number associated with the schedule. |

Basis Category |

Drop-down. Indicates this schedule will be based on a history of the customer’s reported revenue. Other categories often include Staff Size and Graduation Date. Values in the drop-down are populated based on the non-fixed codes defined for the MBR "BASIS_CATEGORY" system type. |

Basis Type |

Drop-down. Indicates that the dues assessment will be based on a number provided by the customer. The options include Basis Date and Basis Value. Values in the drop-down are populated based on the fixed codes defined for the MBR "BASIS_TYPE" system type. |

Description |

Text box. A description of the Schedule ID. |

Schedule Approach |

Drop-down. The descriptive name associated with the Schedule code, indicating that the membership rates will be based on this approach. For example, Schedule or Commission. The fields in the Schedule Detail section changes based on the option selected. Values in the drop-down are populated based on the fixed codes defined for the MBR "SCHEDULE_APPROACH" system type. |

Active |

Checkbox. When checked, it signifies the schedule is active. |

Control the Number of Associates |

|

Limit Associates |

Checkbox. When checked, the Default Associates Allowed field is enabled and only a limited number of associates can receive member benefits. For example, if your association has 500 employees, then you can receive two associates. |

Default Associates Allowed |

Text box. Only enabled if the Limit Associates checkbox is selected. This allows you to specify the default limit of associates receiving member benefits. This number defaults in the “Associates” field in the Schedule Detail section of this screen. |

Schedule Details |

|

Add |

Button. When clicked, a row is added to the Schedule Detail table and the corresponding fields are enabled to add a schedule. |

Delete |

Button. When clicked, the selected row is removed from the Schedule Detail table. |

Limit Associates by Class |

Button. When clicked, the Associate Limits within Dues Schedules screen displays. See the Defining Associate Limits within Dues Schedules section for more information. When clicked, the MBR_DUES_SCHEDULE_DETAIL_ASSOCIATE table is populated. |

Schedule Detail (Schedule) |

|

Min Basis |

Text box. Indicates the minimum dues basis for the first range (in number of months). |

Max Basis |

Text box. Indicates the maximum dues basis for the first range (in number of months). |

Full Dues |

Text box. Indicates the dues amount assessed by a member in this basis range. |

Min Adjust |

Text box. Indicates the minimum amount that is required to activate the active member product. |

Max Adjust |

Text box. Indicates that no more than this amount will be accepted as payment for the active member product. |

WO Limit |

Text box. Indicates the maximum dues write-off available to the active basis range. |

Associates |

Text box. This allows you to specify the limit of associates receiving member benefits. When the associates are limited by class, the total of associates allowed are set here across all classes for that level. |

Schedule Detail (Commission) |

|

Min Basis |

Text box. Indicates the minimum dues basis for the first range (in number of months). |

Max Basis |

Text box. Indicates the maximum dues basis for the first range (in number of months). |

Base Amount |

Text box. A default amount that is assigned for this row before the percentage basis is calculated. This amount is optional. |

Percentage |

Text box. Used in the calculation to multiple against the whole dues basis amount if it falls into a range row. If Cumulative is selected for this row, then multiply only that portion of the dues basis that falls into this row. |

Cumulative |

Checkbox. This determines if the dues basis amount is a graduated pricing scheme. All rows must have this checkbox selected, except the last row is not required. If it is not required in the last row you would use a base amount for the highest range. |

See Also:

· Copying a Dues Basis Schedule

· Defining Associate Limits within Dues Schedules