Reviewing Credit Card Requests

As of the 7.3 release, the Credit Card Request Review screen allows you to view credit card request and response information from credit card processors. This information is visible for all credit card receipts and vouchers. This screen is read-only and displays records from the CCP_Req_Ans table, which stores records created by CCP610. Only records related to credit card receipts or vouchers that exist in the CCP_Req_Ans table can be viewed on this screen. Pre-settled credit cards do not have records in the CCP_Req_Ans table, so they would not display here.

You can search for a credit card processing record by searching for a receipt or a voucher. Unlike check refunds, credit card refunds only apply to a single credit card receipt. Therefore, searching for a voucher will only return a single receipt.

A credit card receipt can have a record in CCP_Req_Ans but not in the FAR_Receipt table in Personify360. This can happen if the initial credit card record authorization is successful but Personify360 does not approve the transaction because the credit card failed with CVV or address validation.

As of 7.6.0, if the IGNORE_CVV parameter for your payment handler is set to "N" and you want to require the security number (CVV) in the back office, you MUST add the "NULL" value to the REJECT_CVV_RESULT_CODES parameter for your payment handler. If the value has been added to the parameter, if the credit card security number is NOT entered in the back office, the following error message will display: Your credit card cannot be charged at this time. You may have left the CVV2 number blank. Please try again making sure you entered the correct CVV2 number.

As of 7.6.0, if the IGNORE_CVV parameter for your payment handler is set to "N" and you want to require the security number (CVV) in the back office, you MUST add the "NULL" value to the REJECT_CVV_RESULT_CODES parameter for your payment handler. If the value has been added to the parameter, if the credit card security number is NOT entered in the back office, the following error message will display: Your credit card cannot be charged at this time. You may have left the CVV2 number blank. Please try again making sure you entered the correct CVV2 number.

You can access this screen by performing one of the following:

· Clicking Review CC Requests on the Receipt Analysis tab of the Customer Financial Analysis screen. The Credit Card Request Review screen displays with the receipt number highlighted.

· Clicking Review CC Requests on the Unapplied Receipt tab of the Customer Financial Analysis screen. The Credit Card Request Review screen displays with the receipt number highlighted.

· Clicking Review CC Requests on the Refund Analysis tab of the Customer Financial Analysis screen. The Credit Card Request Review screen displays with the voucher number highlighted.

· Clicking Review CC Requests on the Receipt Review screen. The Credit Card Request Review screen displays with the receipt number highlighted.

· Selecting Accounting > Receipts > Review CC Requests from the toolbar. The Credit Card Request Review search screen displays where you must search for the appropriate receipt.

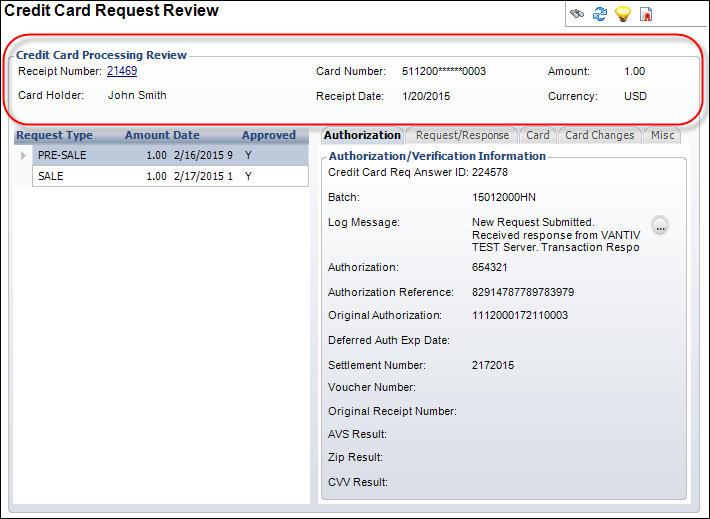

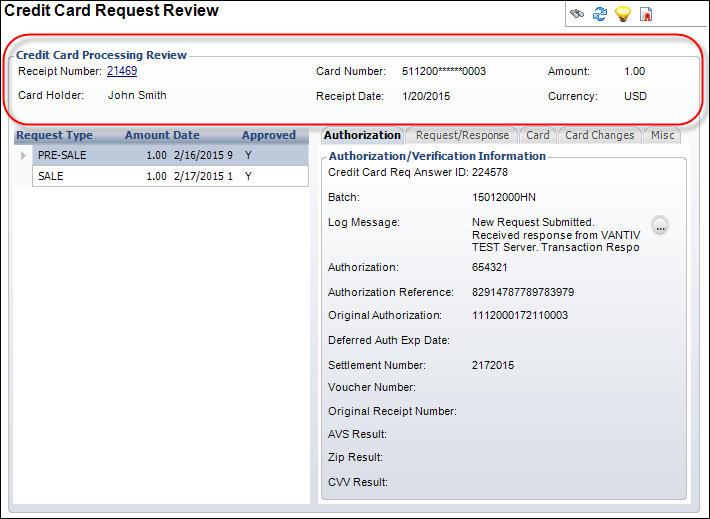

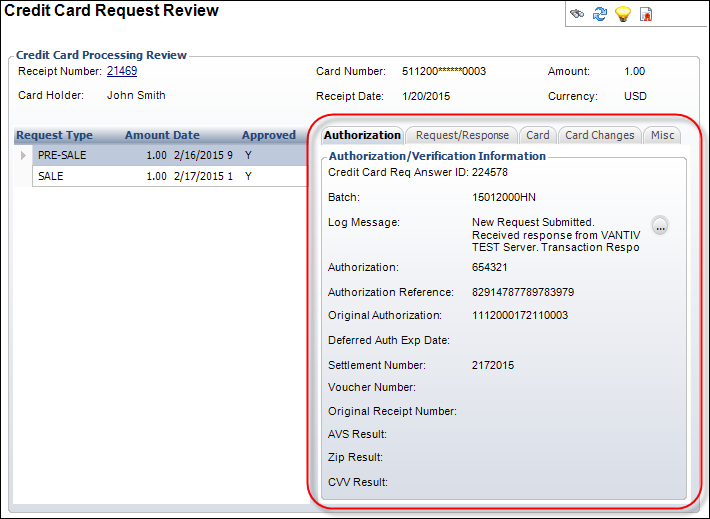

The Credit Card Processing Review section displays high-level information about the credit card, such as:

· Receipt Number – the receipt number stored in the CCP_REQ_ANS table.

· Card Number – the masked credit card number if payment was made by credit card; as of 7.6.1, "PayPal" will display if payment was made with a PayPal account.

· Amount – the amount of the credit card receipt. If the receipt was made in the base currency, then this amount is the same as the Base Amount.

· Card Holder – the name of the credit card holder. This is the same value as the “Name” field on the Card tab.

· Receipt Date – the date the selected receipt was created.

· Currency – the currency used on the receipt. This is pulled from the Receipt table, so it will display blank if there is no matching receipt.

The Request Type table displays the requests made for the credit card for the specified receipt. The Request Types can include Pre-Sale, Pre-Auth, Sale, and Credit.

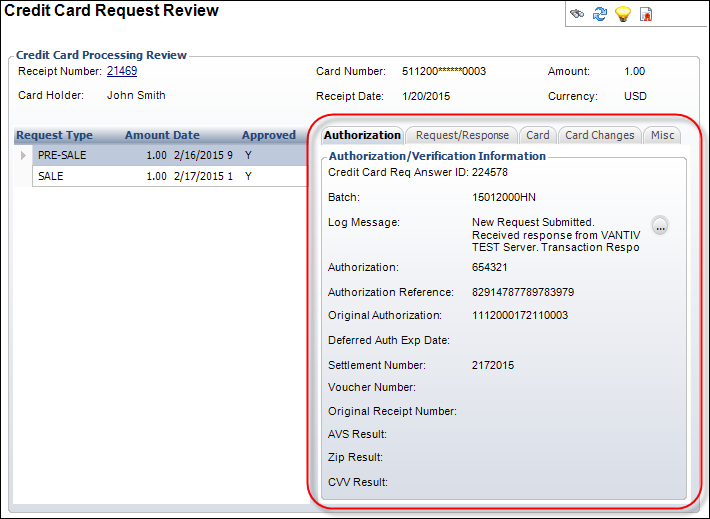

Authorization Tab

The Authorization tab displays the following authorization/verification information:

· Credit Card Req Answer ID – the system-generated ID number in the CCP_REQ_ANS table.

· Batch – the Batch ID of the batch used for the payment.

· Log Message – this varies based on the answer received to the request. A concatenation of several fields. Use the icon next to this field to view more text.

· Authorization – the number of the authorization. You can use this number to void a transaction online.

· Authorization Reference – the token used in the authorization.

· Original Authorization – the token used in the original authorization. Used for all subsequent transactions (settlements, refunds, void transactions).

· Deferred Auth Exp Date – the answer timestamp plus the number of days from the CCP_Auth_Hold_Period application parameter.

· Settlement Number – the settlement number. If the transaction was good, then the settlement number is the date timestamp. If the transaction was bad, then the settlement number is set to a negative date/timestamp. If the transaction was pre-settled, then the settlement number is set to “-1.”

· Voucher Number – a system-generated ID that identifies the Personify voucher. If some or all of a credit card payment is to be or has been refunded, then this field will store the voucher ID. A value of zero indicates no voucher exists for the credit card receipt.

· Original Receipt Number – displays the original receipt number.

· AVS Result – “Y” indicates the street address passed the authorization. “N” indicates the street address did not pass the authorization.

· ZIP Result – “Y” indicates the zip/postal code passed the authorization. “N” indicates the zip/postal code did not pass the authorization.

· CVV Result – “Y” indicates the CVV code passed the authorization. “N” indicates the CVV code did not pass the authorization.

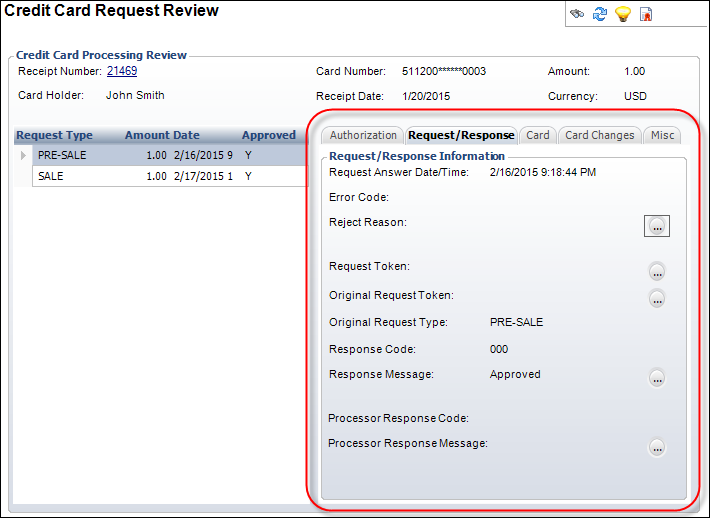

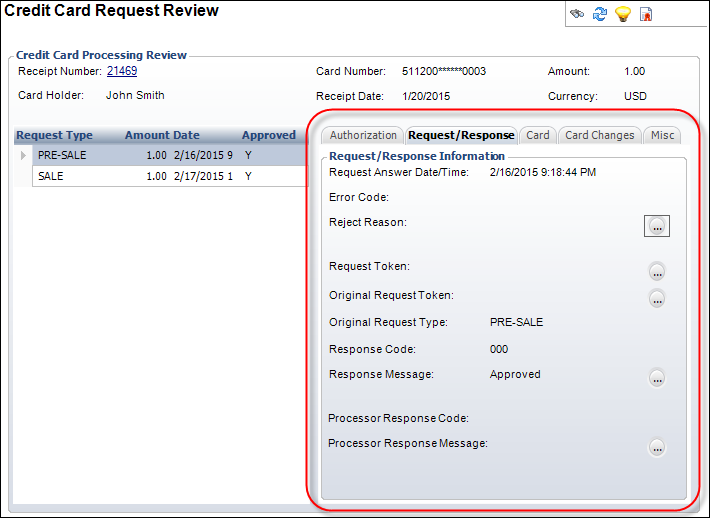

Request/Response Tab

The Request/Response tab provides information on the processor’s response to the credit card request:

· Request Answer Date/Time – the date and time the payment handler answered the request.

· Error Code – the error code returned by the credit card processor (if applicable). For more information, please see Handling Errors from CCP610.

· Reject Reason – the reason the credit card was rejected (if applicable). This field is when the answer is received and it will be blank if the request was approved. Click the "..." button next to this field to view more text.

· Request Token – the encrypted AUTH_REFERENCE from CyberSource or Vantiv. This is not used with PayPal. Click the "..." button next to this field to view more text.

· Original Request Token – the encrypted ORIGINAL_AUTH_REFERENCE from CyberSource or Vantiv. This is not used with PayPal. Click the "..." button next to this field to view more text.

· Original Request Type – the request type of the original request from CyberSource or Vantiv. This is not used with PayPal.

· Response Code – the code for the type of response from the payment handler.

· Response Message – the response message from the payment handler. Click the "..." button next to this field to view more text.

· Processor Response Code – the code for the type of response from the processor.

· Processor Response Message – the response message from the processor. Click the "..." button next to this field to view more text.

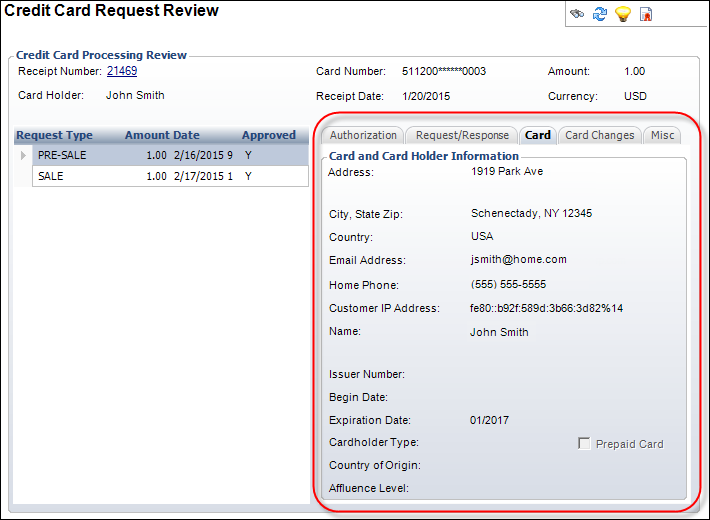

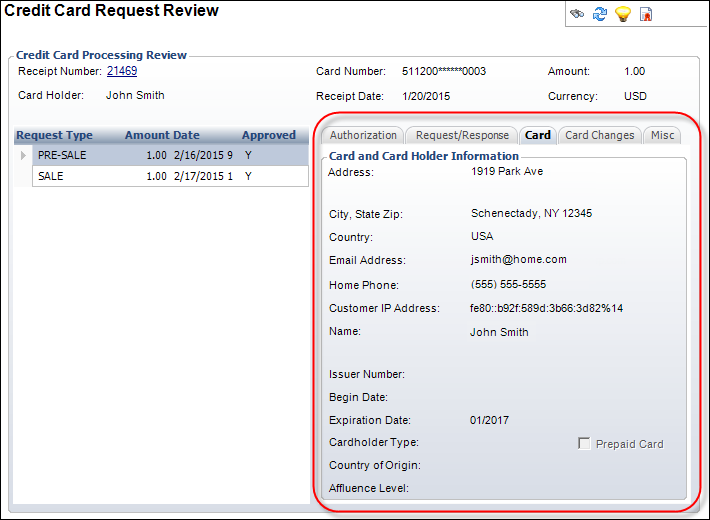

Card Tab

The Card tab lists all of the card and card-holder information:

· Address – the first line of the credit card holder’s billing address. Processors use the numeric street number to execute AVS (address verification service) verification. Payor does not need to be in our system.

· City, State, Zip – the city, state, and zip code for the billing address of the credit card holder.

· Country – the country name for the billing address of the credit card holder.

· Email Address – the email address of the credit card holder.

· Home Phone – the home phone number of the credit card holder.

· Customer IP Address – this functionality is not yet implemented.

· Name – the name of the credit card holder.

· Issuer Number – this is only used on European credit cards.

· Begin Date – this is only used on European credit cards.

· Expiration Date – the expiration date of the credit card.

· Cardholder Type – identifies whether the cardholder is a consumer or a commercial entity.

· Prepaid Card – identifies whether the card used for the payment is a prepaid card.

· Country of Origin – identifies the issuing country of the credit card.

· Affluence Level – identifies whether the cardholder is considered high income (Mass Affluent) or high-income/high-spending (Affluent).

The Cardholder Type, Prepaid Card, Country of Origin, and Affluence Level fields are only populated if you are using Vantiv as your payment handler and you have enabled these features. This data is written to the CCP_Req_Ans table without being validated and the following system types and codes are provided for informational purposes only: AFFLUENT and CARDHOLDER_TYPE.

The Cardholder Type, Prepaid Card, Country of Origin, and Affluence Level fields are only populated if you are using Vantiv as your payment handler and you have enabled these features. This data is written to the CCP_Req_Ans table without being validated and the following system types and codes are provided for informational purposes only: AFFLUENT and CARDHOLDER_TYPE.

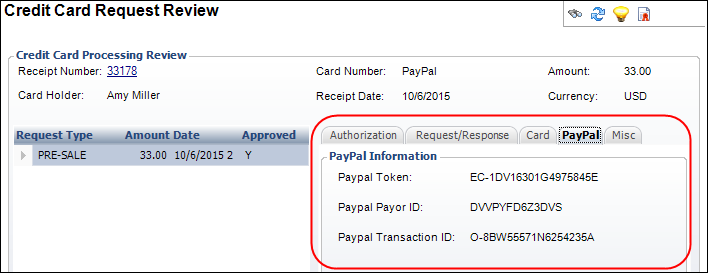

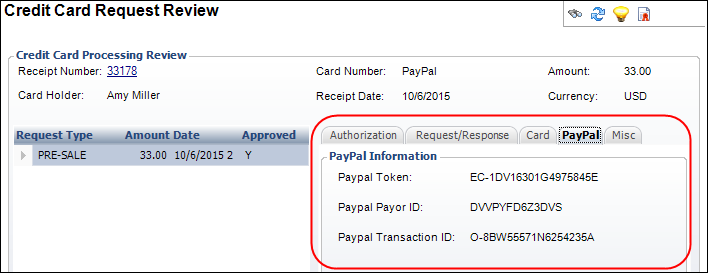

PayPal Tab

As of 7.6.1, the PayPal tab displays if payment was made via a PayPal account and it provides the following information on the PayPal transaction:

· Paypal Token – The token for the PayPal payment.

· Paypal Payor ID – The Payor ID for the customer making the PayPal payment.

· Paypal Transaction ID – The transaction ID assigned by PayPal to the PayPal payment. The PayPal transaction ID is used by CCP610 to settle the payment; once the payment is settled, the PayPal transaction ID can no longer be used.

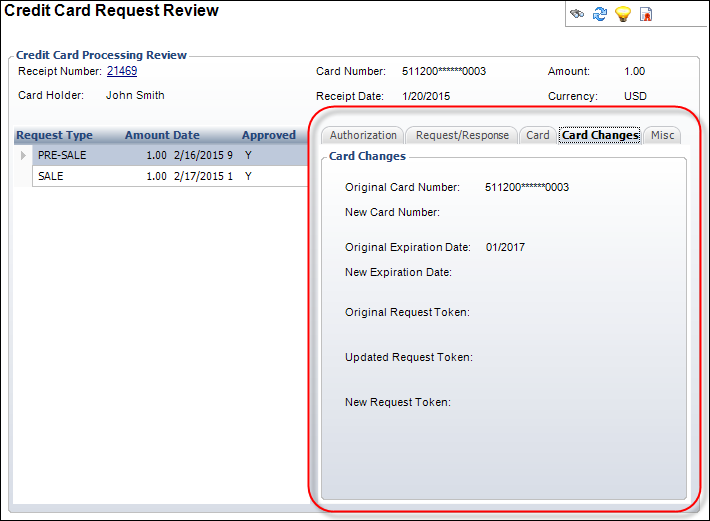

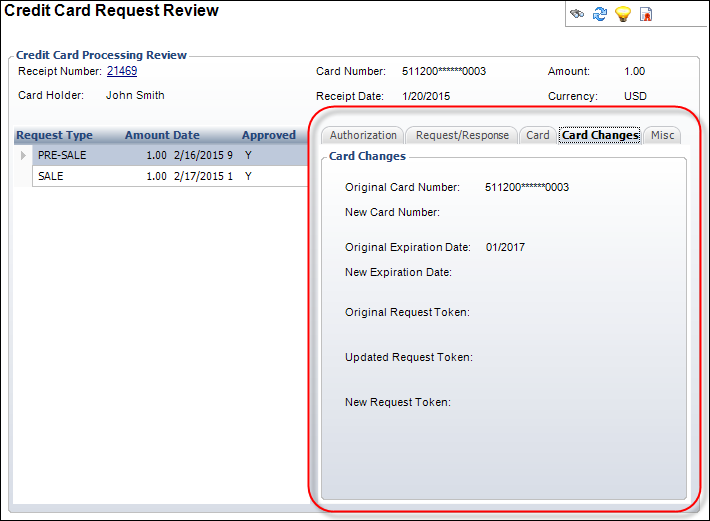

Card Changes Tab

As of 7.6.0, the Card Changes tab displays if payment was made via credit card and it provides information on any changes made to a credit card:

· Original Card Number – the credit card number used in the transaction (CCP_REQ_ANS.CC_ACCT_NO).

· New Card Number – if the organization is using the auto-updater service, and if the customer’s credit card number has changed, the auto-updater service will populate this field with the new credit card number (CCP_REQ_ANS.NEW_CC_ACCT_NO).

· Original Expiration Date – the expiration date on the card used in the transaction (CCP_REQ_ANS.CC_EXP_DATE).

· New Expiration Date – if the organization is using the auto-updater service, and if the customer’s credit card expiration date has changed, the auto-updater service will populate this field with the new expiration date (CCP_REQ_ANS.NEW_CC_EXP_DATE).

· Original Request Token – the original request transaction. Typically, this field is NULL, but if the transaction is a reference transaction, the system will generate a new token (CCP_REQ_ANS.ORIGINAL_REQUEST_TOKEN).

· Updated Request Token – the token for the transaction (CCP_REQ_ANS.REQUEST_TOKEN).

· New Request Token – if the organization is using the auto-updater service, and if the token for the customer’s credit card has changed, the auto-updater service will populate this field with the new token (CCP_REQ_ANS.NEW_REQUEST_TOKEN).

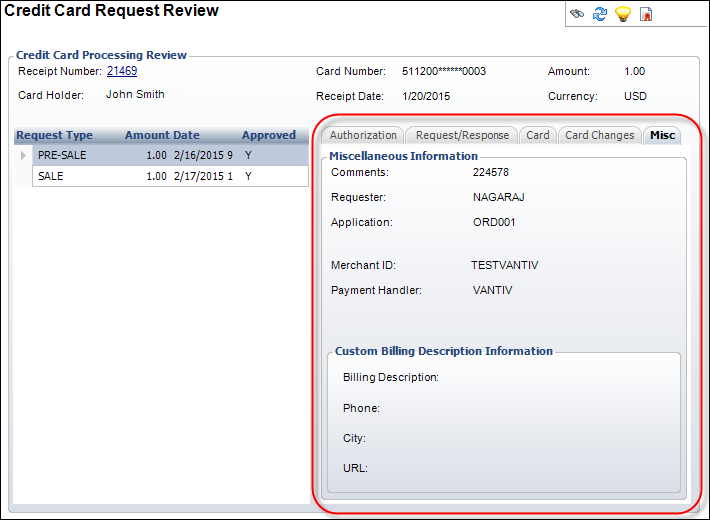

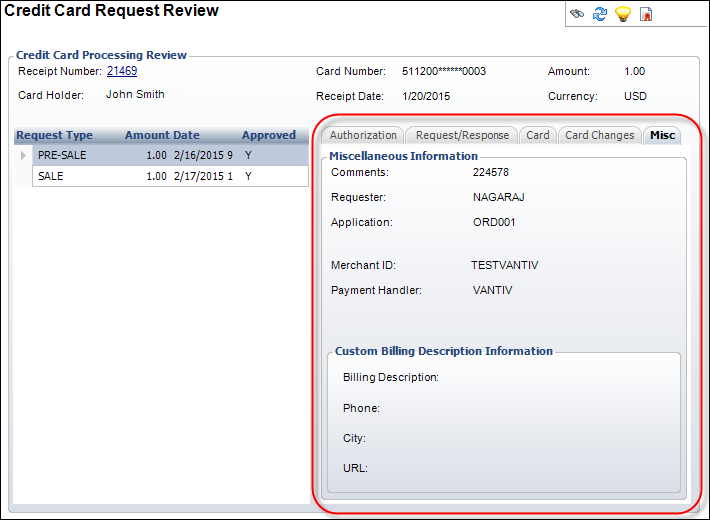

Misc Tab

The Misc tab provides the following information regarding the credit card request:

· Comments – this is the same as the Credit Card Req Answer ID, but PayPal refers to it as “Comments.”

· Requester – User ID of the logged in user that initiated the credit card transaction.

· Application – the Personify screen or batch process that generated the credit card activity.

· Merchant ID – the Merchant_ID used to process the credit card activity.

· Payment Handler – identifies the payment handler used for the credit card transaction. Personify360 supports PayPal (Verisign), CyberSource, and Vantiv payment handlers.

· Billing Description – as of 7.6.0, the custom credit card billing description defined for the product on the Custom Credit Card Billing Description Information screen in Product Maintenance.

· Phone – as of 7.6.0, the custom credit card billing description phone number defined for the product on the Custom Credit Card Billing Description Information screen in Product Maintenance.

· City – as of 7.6.0, the custom credit card billing description city defined for the product on the Custom Credit Card Billing Description Information screen in Product Maintenance.

· URL – as of 7.6.0, the custom credit card billing description URL defined for the product on the Custom Credit Card Billing Description Information screen in Product Maintenance.

Custom credit card billing descriptions are defined at the product level. For more information, please see the Advertising, Certifications, DCD, Exhibitions, Facilities, Fundraising, Inventoried Products, Meetings, Membership, Miscellaneous Invoices, Packages, Subscriptions, Transcripts, and Umbrella Products sections.

Custom credit card billing descriptions are defined at the product level. For more information, please see the Advertising, Certifications, DCD, Exhibitions, Facilities, Fundraising, Inventoried Products, Meetings, Membership, Miscellaneous Invoices, Packages, Subscriptions, Transcripts, and Umbrella Products sections.

As of 7.6.0, if the IGNORE_CVV parameter for your payment handler is set to "N" and you want to require the security number (CVV) in the back office, you MUST add the "NULL" value to the REJECT_CVV_RESULT_CODES parameter for your payment handler. If the value has been added to the parameter, if the credit card security number is NOT entered in the back office, the following error message will display: Your credit card cannot be charged at this time. You may have left the CVV2 number blank. Please try again making sure you entered the correct CVV2 number.

As of 7.6.0, if the IGNORE_CVV parameter for your payment handler is set to "N" and you want to require the security number (CVV) in the back office, you MUST add the "NULL" value to the REJECT_CVV_RESULT_CODES parameter for your payment handler. If the value has been added to the parameter, if the credit card security number is NOT entered in the back office, the following error message will display: Your credit card cannot be charged at this time. You may have left the CVV2 number blank. Please try again making sure you entered the correct CVV2 number.

The Cardholder Type, Prepaid Card, Country of Origin, and Affluence Level fields are only populated if you are using Vantiv as your payment handler and you have enabled these features. This data is written to the CCP_Req_Ans table without being validated and the following system types and codes are provided for informational purposes only:

The Cardholder Type, Prepaid Card, Country of Origin, and Affluence Level fields are only populated if you are using Vantiv as your payment handler and you have enabled these features. This data is written to the CCP_Req_Ans table without being validated and the following system types and codes are provided for informational purposes only: