FAR670 – Revenue Recognition Process

The FAR670 batch process updates deferred revenue transactions so that

revenue that is due to be recognized is moved to real revenue GL accounts.

"Deferring revenue" is an accounting practice process which

postpones recognition of revenue until the purchased product of service

is provided or delivered to the customer. In the case of memberships that

span a period of time, such as 12 months, revenue is typically recognized

after each month of the membership. For subscriptions that span a period

of time, using the same example of 12 months, revenue is typically recognized

after each issue is fulfilled (or sent) to the subscriber. Revenue from

meeting registrations is usually deferred until either the meeting start

date or end date.

Revenue recognition, then, is the process whereby the revenue amount

that is shown on an organization's income statement is "recognized"

either over the life of an order or some triggering event. The revenue

amounts are moved from deferred revenue GL accounts to real revenue GL

accounts based on the product revenue account setup defined in the PRODUCT_REVENUE_DISTRIBUTION

and FGL_Shipping_Account tables for the purchased product. If an order

line includes discounts or shipping charges, those amounts are also deferred

and recognized using the same recognition method as the revenue on the

order line. For instance,

a subscription for $120 for 12 issues will move $10 per issue from the

deferred revenue account to the real revenue account.

As

of 7.4.2, whenever the Revenue Distribution on the product is set to "By

Priority" and the order quantity is greater than 1, then the revenue

will be distributed amongst the accounts in the following manner:

As

of 7.4.2, whenever the Revenue Distribution on the product is set to "By

Priority" and the order quantity is greater than 1, then the revenue

will be distributed amongst the accounts in the following manner:

Revenue a/c 1: [Total revenue on the order-(Amt within Priority 1*order

qty)-(Priority 2*order qty)]* % within the priority

Revenue a/c 2: [Total revenue on the order-(Amt within Priority 2*order

qty)-(Priority 1*order qty)]* % within the priority

How Revenue Recognition Works

When the FAR670 batch process is run, the process evaluates each selected

order line where revenue has not been completely recognized and determines

what amount of deferred revenue can now be recognized, based on the date

entered for the Transaction Date parameter. Then, financial transaction

records are created for the amount of revenue that can be recognized and

for the amount of revenue that is still deferred. If all revenue is recognized,

the process updates the recognition status code on the order line to 'C'

(for Complete).

Deferred revenue is usually recognized by issue for subscriptions, but

can be done monthly as well. For subscription orders where revenue is

being recognized by issue, revenue is recognized after the issue date

where records exist in Sub_Issue_Fulfillment for the order line for the

issue. If a subscription is back-dated, revenue recognition does not happen

until after back-issues have been generated.

The FAR670 process is "self-correcting", which means that

if the amount of the order changes over time, or if the term of the membership

or subscription changes, the next time the revenue recognition process

runs, it will recalculate the correct amount that should have been recognized

to date, adding or subtracting from the recognized amount to bring it

in line with the new amount or new term length.

FAR670 skips cancelled orders, because the process of cancellation adjusts

(if necessary) and completes revenue recognition.

The

FAR670 batch process does recognize revenue for expired order lines.

The

FAR670 batch process does recognize revenue for expired order lines.

FAR670

will not recognize revenue for transactions prior to the GL close date.

If you try to run FAR670 for the same, FAR607 will fail with the following

error message: “Transaction Date for the revenue recognition transaction

cannot be equal to or prior to the GL Close Date”. If you want to run

the FAR670 for a specific date that is prior to the GL Close Date, you

must reset the GL Close Date, run the FAR670, and complete the month-end

close reconciliation process again as of that date.

FAR670

will not recognize revenue for transactions prior to the GL close date.

If you try to run FAR670 for the same, FAR607 will fail with the following

error message: “Transaction Date for the revenue recognition transaction

cannot be equal to or prior to the GL Close Date”. If you want to run

the FAR670 for a specific date that is prior to the GL Close Date, you

must reset the GL Close Date, run the FAR670, and complete the month-end

close reconciliation process again as of that date.

Subscription Revenue Recognition

As of 7.5.2, the new Subscription Recog.

Date field has been added to the GL Accounts screen in Product

Maintenance, which identifies whether subscription revenue should be recognized

by issue date or fulfill date.

The new Subscription

Recog. Date only applies

to subscription products where the Recognition

Method field is set to

"Issue". If the Recognition

Method field is set to

"Monthly", FAR670 will recognize subscription revenue

as it currently does.

When the Subscription Recog. Date

field is set to “Fulfill Date” and the Recognition

Method field is set to "Issue", FAR670 will recognize

revenue for fulfilled issues for subscription orders where the issue Fulfill

Date is <= the value entered for the FAR670 "Transaction date"

parameter. What this means is that as of 7.5.2 the logic that excludes

orders where the Cycle Begin Date is > than the FAR670 "Transaction

date" parameter has been changed for subscription orders where Recognition Method field is set

to "Issue" and the Subscription

Recog. Date field is set to “Fulfill Date” to exclude subscription

orders where the issue Fulfill Date is > the FAR670 "Transaction

date" parameter.

When the Recognition Method

field is set to “Issue Date”, FAR670 will recognize subscription revenue

as it currently does by issue date.

Short-Month Revenue Recognition

When memberships and subscriptions are created, they can be created

to start from the order date, rather than the first of the month, if desired.

When revenue is recognized monthly, the user can specify whether revenue

for memberships and subscriptions that have a short month should be recognized

at the beginning of the membership or subscription term or at the end

of the membership or subscription term.

Revenue Recognition Options in Personify360

Personify360 provides a number of ways that revenue can be deferred

and recognized. The recognition method for each product is defined on

the GL Accounts screen in Product Maintenance:

· On Invoice –

All revenue is recognized on invoicing. This recognition method can be

used for all subsystem products. Order_Detail.RECOGNITION_STATUS_CODE

is set to 'C' on order creation.

· Specific Date –

This is typically used for meeting (MTG) and exhibition (XBT) products.

With this recognition method, a date is also set for when revenue can

be completely recognized. This recognition method can be used for all

subsystem products. Order_Detail.RECOGNITION_STATUS_CODE is set to 'A'

on order creation. When FAR670 is run on or after the specified date,

all revenue is recognized and Order_Detail.RECOGNITION_STATUS_CODE is

updated to 'C'.

· Year End –

All revenue is recognized at year end. This recognition method can be

used for all subsystem products, but is rarely used. Order_Detail.RECOGNITION_STATUS_CODE

is set to 'A' on order creation. When FAR670 is run on or after 12/31

of any year, all revenue from that year is recognized and Order_Detail.RECOGNITION_STATUS_CODE

is updated to 'C'.

· Begin Date –

All revenue is recognized on the begin date of the order. This can be

used for advertising, exhibition, facility, meeting, membership, or subscription

products. For products using the "Begin Date" recognition method,

FAR670 evaluates Order_Detail.CYCLE_BEGIN_DATE. Order_Detail.RECOGNITION_STATUS_CODE

is set to 'A' on order creation if the Order Date is before Order_Detail.CYCLE_BEGIN_DATE.

FAR670 updates Order_Detail.RECOGNITION_STATUS_CODE to 'C' when it is

run on or after Order_Detail.CYCLE_BEGIN_DATE.

· End Date –

All revenue is recognized on the end date of the order. This can be used

for advertising, exhibition, meeting, membership, or subscription products.

For products using the "End Date" recognition method, FAR670

evaluates Order_Detail.CYCLE_END_DATE. Order_Detail.RECOGNITION_STATUS_CODE

set to 'A' on order creation if the Order Date is before Order_Detail.CYCLE_END_DATE.

FAR670 updates Order_Detail.RECOGNITION_STATUS_CODE is updated to 'C'

when it is run on or after Order_Detail.CYCLE_END_DATE.

· Monthly –

Revenue is recognized monthly based on the order date for some specified

number of months. Monthly recognition is typically the smallest unit of

time over which revenue is recognized. The only time a smaller unit of

time might be needed is for publications, which may be weekly and organizations

may want to recognized revenue after each issue is fulfilled. This method

is available for advertising (web orders), membership, subscription, and

transcript products. Order_Detail.RECOGNITION_STATUS_CODE is set to 'A'

on order creation.

· By Issue –

Used for publications where the batch process references the issues fulfilled

table. Available for subscription products only. Order_Detail.RECOGNITION_STATUS_CODE

is set to 'A' on order creation.

Understanding How GL Accounts are Selected

FAR670 uses the GL accounts in effect for real and deferred discounts,

real and deferred agency discounts, and real and deferred shipping charges

at the time for the order date for all subsystem order lines. FAR670 uses

GL accounts for real and deferred revenue in effect at the time of the

order date for all subsystems except for Memberships and Subscriptions.

FAR670 selects real and deferred revenue GL accounts in effect at the

time of the "Cycle Begin Date" of Membership or Subscription

order lines.

Prerequisite Setup

FAR670 will process transactions for order lines that have a LINE_STATUS_CODE

where 'REVERECOGNITION' is in App_Code. OPTION_1 for the line status code.

In the base application, only line status codes of 'A' have 'REVRECOGNITION'

in the OPTION_1 column. This was executed for organizations that customize

order entry to use different line status codes.

When to Run FAR670

Revenue recognition is typically run on a monthly basis.

Before FAR670 is run, the following activities should be done:

· The SUB670/SUB671

processes should be run for the month before running revenue recognition,

because revenue is typically defined to be recognized by issue on Subscription

orders, which means that revenue is recognized after the issue is fulfilled.

· If revenue

is deferred for web advertising orders that span multiple months, ADV620

should be run to invoice the web ad orders.

· All deferred

batches should be posted, so that order lines that will be activated and

invoiced because of a payment will have appropriate financial transactions

created.

· If the

organization has pending adjustments to make to AR or PPL, those should

be done before running FAR670.

FAR670 should be run before running FAR700

to transfer transactions to GL.

Technical Implementation

Parameters

Parameter |

Description |

Required? |

Subtitle |

This field is used to enter in a subtitle

that appears as part of the report header on each page. |

No |

Run Mode |

· EDIT: this mode will not update

the database; it will only generate the report using input parameters

· PROD: this mode will produce

a report of records selected, but will additionally update the

order tables

· REGENERATE: this mode will only

produce output reports for an already processed JOB_ID |

Yes |

Transaction date |

The FAR_TXN.txn_date. This is also

the date that is used when comparing to “Specific Date” recognition

method. For Monthly recognition use only the month value

to determine which month, then recognize for the last day of that

month.

It is important to note that

with this parameter, you cannot go back in time; there is a detailed

report about real revenue accounts and not deferred revenue accounts. It is important to note that

with this parameter, you cannot go back in time; there is a detailed

report about real revenue accounts and not deferred revenue accounts.

|

Yes |

Subsystem |

The subsystem (product type) for which

to run the revenue recognition. Select "ALL" to allow

the process to run against all orders at one time. |

Yes |

Organization |

The Organization ID for which to run the

process. |

Read-only |

Organization Unit |

The Organization Unit ID for which to

run the process. |

Read-only |

Parent Product Code |

The parent product code for which to run

the revenue recognition (optional). |

Yes |

Product Code |

The product code to limit the revenue

recognition for a specific product (optional). |

No |

Report Format |

· Summary: will only print a listing

of account totals.

· Detail: will also print summary

information but will also include detail order information to

back up summary totals. |

Yes |

Short Month Processing |

This parameter only applies to MONTHLY

revenue recognition method code. MONTHLY revenue recognition is

applicable for MBR or SUB Subsystems. The valid values are "BEGIN"

or "END". Enter BEGIN to recognize the short month at

the beginning of the Membership/Subscription term. Enter END to

recognize the short month at the end of the Membership/Subscription

term. |

No |

Advanced Job Parameters |

Filter |

Enter in an SQL statement to be included

in record selection as an additional clause in the report query.

The criteria can be based on far670_vw view. For example: FAR670_VW.PRODUCT_CODE

= 'NEWBOOK' |

No |

Commit Frequency |

Enter the commit frequency. This determines

the frequency after which the database changes are committed. |

No |

Sort Order |

Enter the sort order for the report. Detailed

report will be sorted based on this parameter.

The sort parameter applies to

only those fields which are displayed in the detail report. The sort parameter applies to

only those fields which are displayed in the detail report.

|

No |

Regenerate Job ID |

Enter the TRS Job ID from the previous

run of FAR670. This is required in REGENERATE mode only. |

No |

Advanced Filter

You can add further filter criteria using the "Select Criteria"

filter in the Advanced Job Parameters tab. You can select any field from

the FAR670_VW view for additional filtering.

Selection Logic

The FAR670 batch process selects records from the FAR670_VW view for

order lines that are active*, invoiced, and that have not had revenue

completely realized (i.e., Order_Detail.RECOGNITION_STATUS_CODE <>

'C'). Note that fundraising order lines and package order lines are not

selected for deferred revenue recognition. Technically, the process selects

records Order_Detail where LINE_STATUS_CODE = App_CODE.CODE and App_Code.SUBSYSTEM

= Order_Detail.SUBSYSTEM and App_Code.TYPE = 'LINE_STATUS' and App_Code.OPTION_1

= 'REVRECOGNITION'. Amounts are calculated from sales (Far_Txn.TXN_TYPE_CODE

= '4') and adjustment (Far_Txn.TXN_TYPE_code = '6') transactions for posted

transactions (Far_Txn.POSTED_FLAG = 'Y').

Order lines with products defined to have revenue recognized on a specific

date are excluded if the date defined for revenue to be recognized is

in the future.

Additionally, subscription and membership orders where the begin date

is in the future are excluded.

The process also filters records based on values entered for the FAR670

parameters. The process selects Order_Detail records where the INVOICE_DATE

is less than or equal to the date selected for the "Transaction Date"

parameter. If the user has entered a value other than ALL for the subsystem

parameter, or if the user has entered any parameter values for "Parent

Product" or "Product Code", FAR670 will selected order

lines with those subsystem, parent product, and/or product code values.

Processing Logic

The FAR670 batch process uses the FAR670_SP stored procedure. Records

are selected from the FAR670_VW view and inserted for processing into

the following tables:

· FAR670_Table

· FAR670_FTD_DEF

· FAR670_FTD_REAL

· FAR670_INTER_COMP

· FAR670_FAR_TXN

· FAR670_FAR_TXN_DETAIL

· FAR670_SUB_ORDERS

· TMP_FAR670_FAR_TXN

For all order lines where revenue is being recognized by issue, the

process calculates the number of issues fulfilled for each subscription

order line where the Subscription issue date is less than or equal to

the FAR670 "Transaction Date" parameter and subscription issue

fulfillment type is either P (production), B (back issue), S (single issue

sale), or T (grace issue transferred).

For membership order lines where revenue is being recognized monthly,

the process calculates the number of months between the begin date and

the FAR670 transaction date.

The process then creates new Type 7 (Far_Txn.TXN_TYPE_CODE = '7') records

in Far_Txn and Far_Txn_Detail for the new revenue amount that can be recognized

and for the same amount to reduce the deferred revenue amount remaining.

If any Due-To/Due-From transactions are required, those are also created.

A value is updated to Far_Txn.BATCH that is a tilde (~) followed by 8

numbers that represent the year (YYYY), the month (MM) and the day (DD)

the process was run, and "FAR670" followed by the same 8 digits

that identify the date the process was run is set as the value in the

ADDOPER field. The Far_Txn.TXN_DATE is set to the date value defined for

the FAR670 "Transaction Date" parameter.

For all subscription order lines, the process updates the Sub_Issue_Fulfillment

record for each issue for which revenue was recognized, settling the value

for Sub_Issue_Fulfillment.TRS_JOB_ID to the FAR670 TRS Job ID, Sub_Issue_Fulfillment.REVENUE_RECOGNITION_TXN

to the Far_Txn.FAR_TXN_NO of the Type 7 transaction and Sub_Issue_Fulfillment.REVENUE_AMOUNT

to the amount of revenue that was recognized for that issue.

If all revenue will be completely recognized, Order_Detail.RECOGNITION_STATUS_CODE

is updated to 'C'.

Last, the process inserts records into the following tables to be used

to generate the FAR670 reports:

· FAR670_SUMMARY_REPORT

· FAR670_SKIPPED_ORDERS

The Detail report is generated off of the FAR670_Table table.

Sort Order

The FAR670 Detail report can be sorted by any field used in the report;

for example, by Order_No, Product_Code, or Parent_Product.

Data Updates

When run in PROD mode, the process updates creates records in Far_Txn

with a TXN_TYPE_CODE = '7' and the BASE_AMOUNT set to $0. Records are

also created in Far_Txn_Detail with TXN_FUNCTION_CODE values of REVENUE

and DEFFREV, with the Far_Txn_Detail.BASE_AMOUNT for the 'REVENUE' record

equal to the amount of revenue that was able to be recognized for the

order line, and Far_Txn_Detail.BASE_AMOUNT for the 'DEFREV' record equal

to the revenue amount that is still deferred.

If all revenue has been recognized on an order line, the process updates

Order_Detail.RECOGNITION_STATUS_CODE to 'C' (for complete).

For subscription order lines, TRS_JOB_ID, REVENUE_RECOGNITION_TXN, and

REVENUE_AMOUNT are updated in the Sub_Issue_Fulfillment table for all

issues for which revenue was recognized.

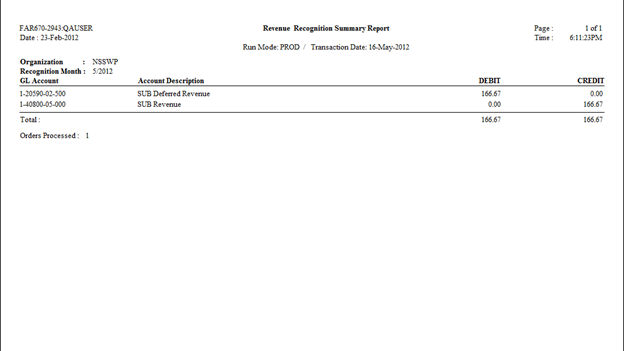

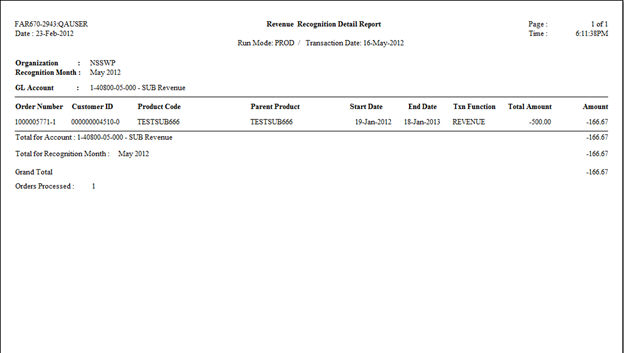

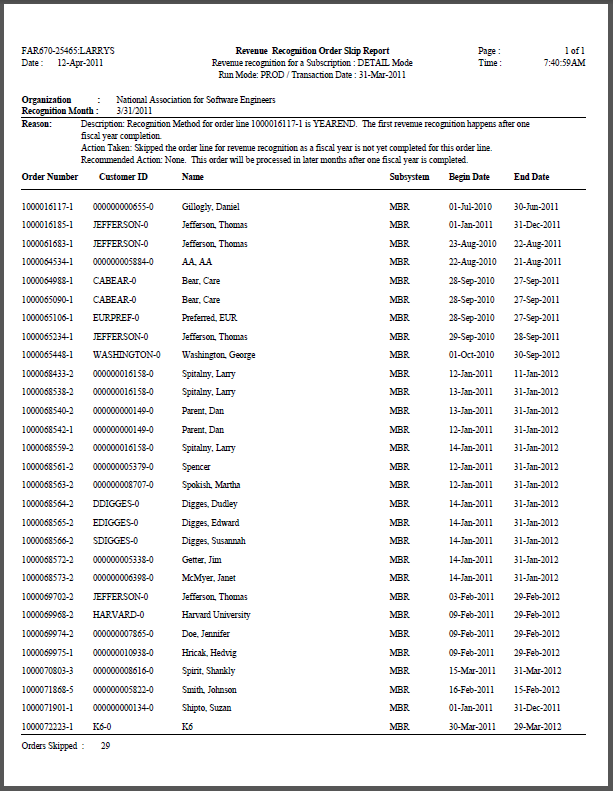

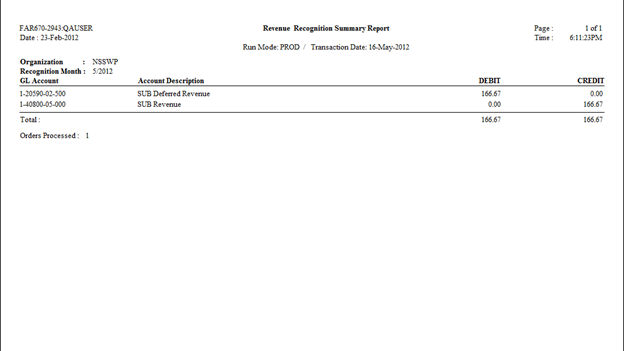

Reports and Output

This batch process generates the following reports (see below for sample

reports):

· FAR670 Summary: displays a listing

of totals by GL account. On the reports, deferred accounts should mostly

have debit numbers and revenue accounts should mostly have credit numbers.

· FAR670 Detail: gives details about

real revenue accounts, not deferred revenue accounts, which means that

most of the amounts should be credit amounts.

Do a search

for "Total for", which will bring you to the subtotal line of

the next GL account. Continue to find "Total for" to review

GL account subtotals for recognized revenue.

Do a search

for "Total for", which will bring you to the subtotal line of

the next GL account. Continue to find "Total for" to review

GL account subtotals for recognized revenue.

· FAR670 Skip: displays a list of

orders that could not have revenue recognized because of one of the following

reasons:

o Invalid

Account - Either deferred or AR account is no longer valid

o Mismatch

- This mostly will apply to back-issues for publications where there is

no issue inventory to send. This will occur when periods to recognize

income exceed the number of rows in SUB_ISSUE_FULLFILLMENT table for an

order. Therefore, revenue cannot be recognized

o Data

entry errors, such as a membership or subscription end date is before

the begin date.

Make sure to check the FAR670Skip exception report and resolve errors.

FAR670 Summary Report

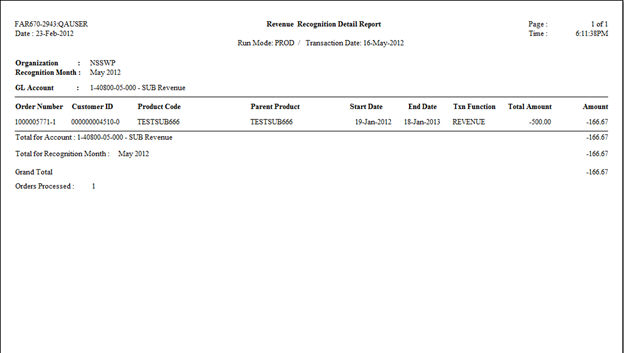

FAR670 Detail Report

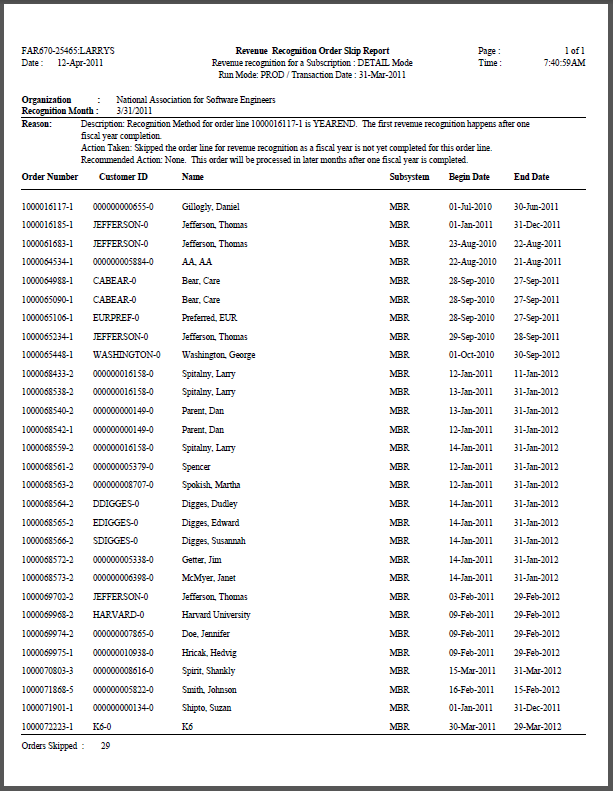

FAR670 Skip Report

As

of 7.4.2, whenever the Revenue Distribution on the product is set to "By

Priority" and the order quantity is greater than 1, then the revenue

will be distributed amongst the accounts in the following manner:

As

of 7.4.2, whenever the Revenue Distribution on the product is set to "By

Priority" and the order quantity is greater than 1, then the revenue

will be distributed amongst the accounts in the following manner: The

FAR670 batch process does recognize revenue for expired order lines.

The

FAR670 batch process does recognize revenue for expired order lines.