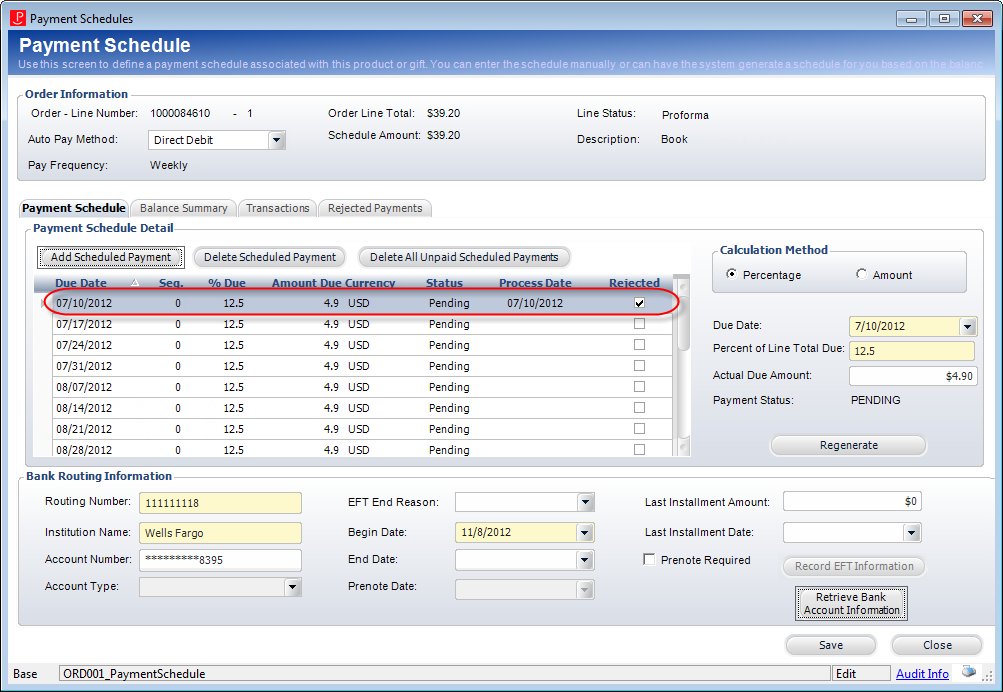

If a pending credit card or EFT scheduled payment was not successfully processed when the FAR680 or EFT680 batch process was run, the batch process will check the Rejected checkbox and update the Status to “Pending”, as highlighted below.

As

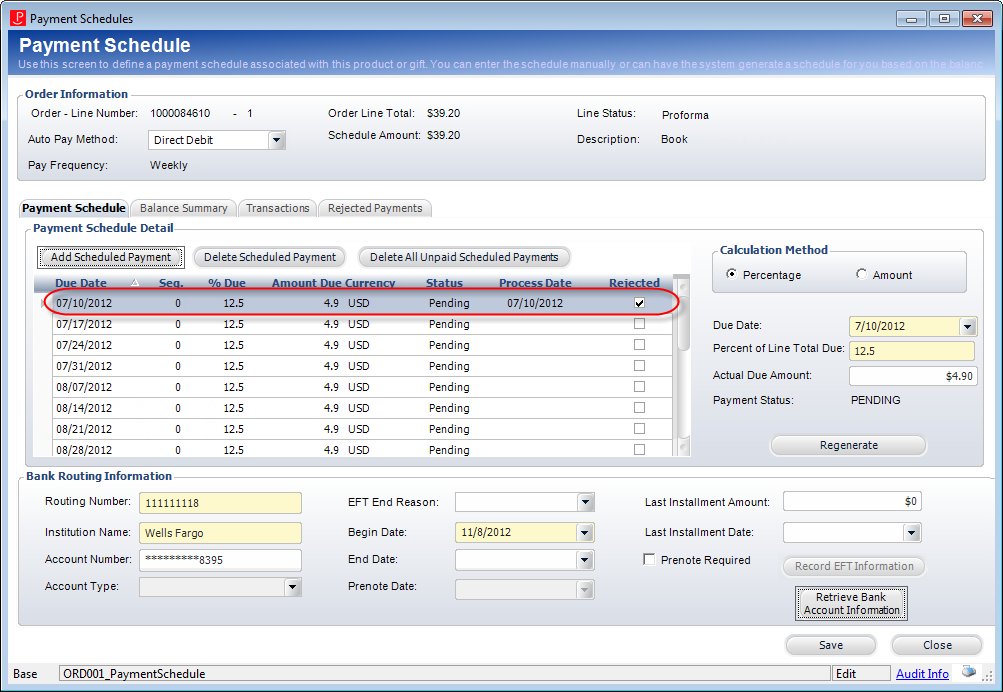

of 7.5.2, if a receipt or a receipt transfer updates the payment status

to PAID on a rejected

scheduled payment, and if the Cus_EFT_Info.BANK_ACCOUNT_STATUS_CODE

= ‘COLLECTION_FAILED’ for the bank account used for the rejected EFT payment,

the system will present a dialog to the user asking if the the customer’s

bank account status be updated to “GOOD”. If the user selects Yes,

the system will update Cus_Eft_Info. BANK_ACCOUNT_STATUS_CODE to ‘GOOD’

for that bank account for that customer.

As

of 7.5.2, if a receipt or a receipt transfer updates the payment status

to PAID on a rejected

scheduled payment, and if the Cus_EFT_Info.BANK_ACCOUNT_STATUS_CODE

= ‘COLLECTION_FAILED’ for the bank account used for the rejected EFT payment,

the system will present a dialog to the user asking if the the customer’s

bank account status be updated to “GOOD”. If the user selects Yes,

the system will update Cus_Eft_Info. BANK_ACCOUNT_STATUS_CODE to ‘GOOD’

for that bank account for that customer.

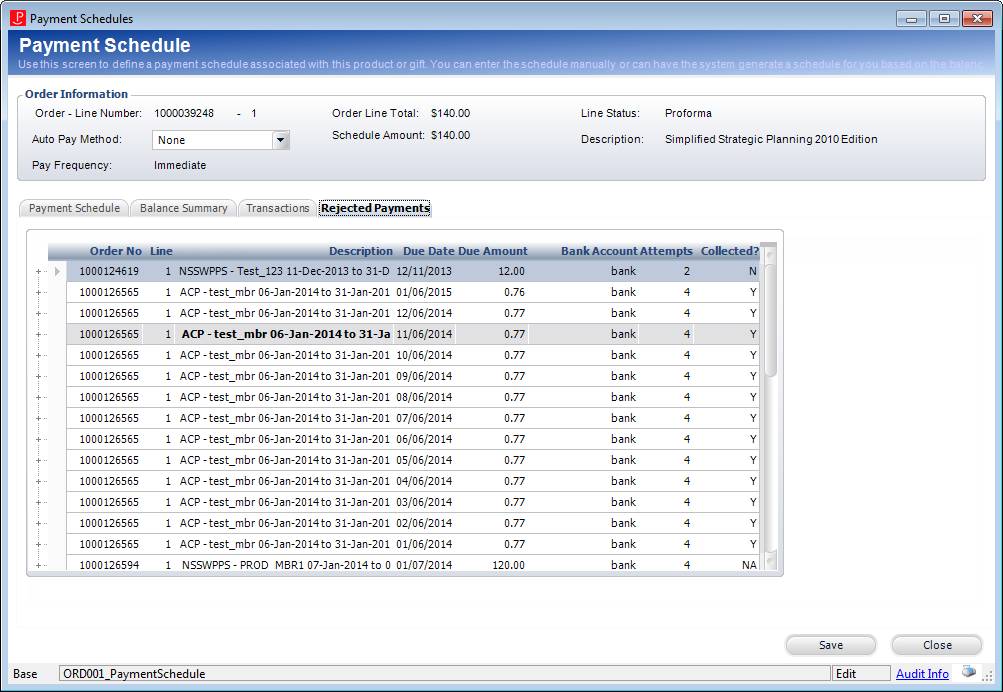

Additionally, as of 7.5.2, if any records exist in Order_Detail_Rejected_Pymt for the selected order number/order line number, the Rejected Payments tab displays, as shown below.

The following information is displayed in the grid:

Column |

Description |

|---|---|

Order No |

The rejected order number (Order_Detail_Eft_Rejected_Pymt.ORDER_NO). Double-click the order number to open the ORD001 screen for non-ADV or FND orders. For advertising orders, the Insertion Orders screen (ADV002) screen will open. For fundraising orders, the Donation Entry (FND002) screen will open. |

Line |

The line number on the rejected order (Order_Detail_Eft_Rejected_Pymt. ORDER_LINE_NO). |

Description |

The line number description on the rejected order (Order_Detail.DESCRIPTION where Order_Detail.ORDER_NO = Order_Detail_Eft_Rejected_Pymt.ORDER_NO and Order_Detail.ORDER_LINE_NO = Order_Detail_Eft_Rejected_Pymt. ORDER_LINE_NO). |

Due Date |

The due date of the scheduled payment for which the direct debit payment failed. |

Amount |

The amount due for the scheduled payment for which the direct debit payment failed. |

Bank Account |

The description of customer’s bank account used for the direct debit payment. |

Attempts |

The number of collection attempts that have been made to collect the direct debit payment. This is set by EFT681.

|

Collected? |

If the payment status code of the scheduled payment is PAID, a "Y" is displayed. If the payment status code is PENDING, an "N" is displayed.

If the due date no longer exists in the payment schedule, “NA” is displayed. |

The following information is displayed when you expand a row in the grid:

| Column | Description |

|---|---|

| Collection Attempt Date | The date that EFT680 attempted to collect the scheduled payment. If a payment is applied manually, a new record is also created in this table, and the collection attempt date is set to the receipt batch date. |

| ACH Return Code | If the record is being created for a rejected direct-debit payment, the ACH return code is recorded here. Values in the grid column are populated based on the description of the fixed codes defined for the EFT "RETURN_RSN" system type. |

| EFT681 Job ID | The TRS Job ID of the EFT681 job that created the record is recorded here. |