Adding Tax Information to a Constituent's Record in CRM360®

As of 7.5.0, tax exemption information can be defined at the state level for individual, company, committee, and subgroup records. Additionally, the Federal Tax ID and VAT ID, also located on the Demographics screen, can also be defined on the Tax Exempt Information screen in CRM360. Please note that any changes made to the Federal Tax ID and VAT ID fields will automatically update on the Demographics screen.

Sales tax is calculated based on the ship-to location, but the tax exemption is owned by the bill-to customer. If the bill-to customer is tax exempt in the ship-to location (i.e., state, country, etc.), the order will remain tax exempt. For more information on sales tax, please see Defining Sales Tax.

Sales tax is calculated based on the ship-to location, but the tax exemption is owned by the bill-to customer. If the bill-to customer is tax exempt in the ship-to location (i.e., state, country, etc.), the order will remain tax exempt. For more information on sales tax, please see Defining Sales Tax.

For a video demonstration on adding tax information, please see Video Demo: Adding Tax Information.

For a video demonstration on adding tax information, please see Video Demo: Adding Tax Information.

To add tax exempt information:

1. From the Financial Data task category in CRM360, click Tax Exempt Info.

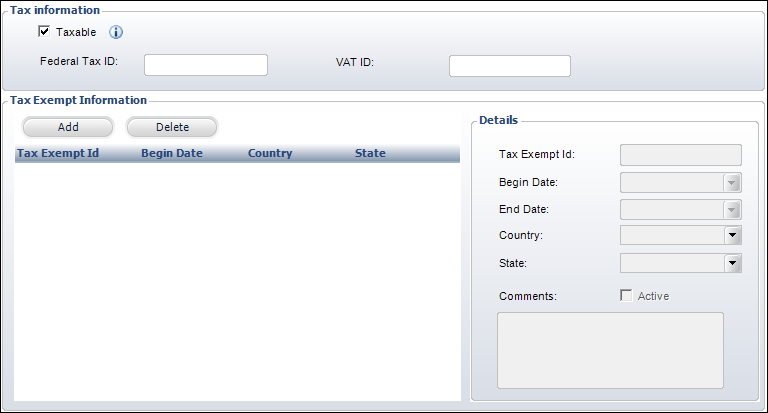

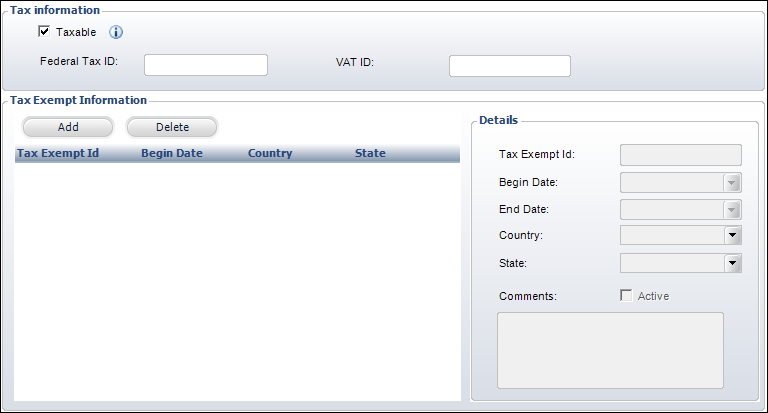

The Tax Exempt Information screen displays, as shown below.

2. If the constituent is tax exempt nationally:

a. Uncheck the Taxable checkbox.

b. Enter the constituent's Federal Tax ID and/or VAT ID.

As of 7.6.0, if the Federal Tax ID is defined for a customer record that is linked to the org unit, when a web user submits an online donation, this Tax ID will display on the Donation Thank You page.

As of 7.6.0, if the Federal Tax ID is defined for a customer record that is linked to the org unit, when a web user submits an online donation, this Tax ID will display on the Donation Thank You page.

3. If the constituent is ONLY tax exempt in specific states:

a. Check the Taxable checkbox.

b. From the Tax Exempt Information section, click Add.

c. Enter the constituent's Tax Exempt Id.

d. Select the constituent's tax exemption Begin Date.

e. If necessary, select the constituent's tax exemption End Date.

f. Select the Country for which the tax exemption applies.

Values in the drop-down are populated based on the active countries defined on the Country and State Code Maintenance screen.

g. Select the State for which the tax exemption applies.

Please note that this field is required if you select "USA" as the country. Values in the drop-down are populated based on the states defined for the selected country on the Country and State Code Maintenance screen.

h. If necessary, enter any Comments.

i. The Active checkbox is read-only and is computed based on Begin Date and End Date of the record. If current date is greater than or equal to the Begin Date and the End Date is null or greater than or equal to current date, then the Active checkbox will be checked.

4. To delete a tax exemption record, click Delete.

Please note that for historical record purposes, it is recommended that you select an End Date rather than delete a record, unless the record was added by mistake.

5. Click Save.

Click the Main Page link to return to the overview page, as shown below.

If a constituent is exempt from tax, the TAXABLE_FLAG field in the Order_Detail table is set to 'N' during the order entry process.

If a constituent is exempt from tax, the TAXABLE_FLAG field in the Order_Detail table is set to 'N' during the order entry process.

Sales tax is calculated based on the ship-to location, but the tax exemption is owned by the bill-to customer. If the bill-to customer is tax exempt in the ship-to location (i.e., state, country, etc.), the order will remain tax exempt. For more information on sales tax, please see Defining Sales Tax.

Sales tax is calculated based on the ship-to location, but the tax exemption is owned by the bill-to customer. If the bill-to customer is tax exempt in the ship-to location (i.e., state, country, etc.), the order will remain tax exempt. For more information on sales tax, please see Defining Sales Tax. For a video demonstration on adding tax information, please see

For a video demonstration on adding tax information, please see

As of 7.6.0, if the Federal Tax ID is defined for a customer record that is

As of 7.6.0, if the Federal Tax ID is defined for a customer record that is

If a constituent is exempt from tax, the TAXABLE_FLAG field in the Order_Detail table is set to 'N' during the order entry process.

If a constituent is exempt from tax, the TAXABLE_FLAG field in the Order_Detail table is set to 'N' during the order entry process.