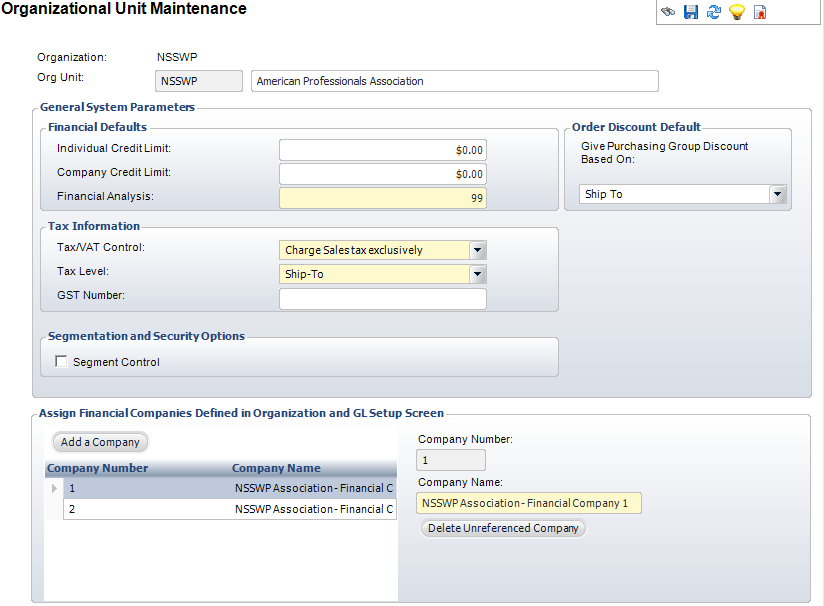

The Organizational Unit Maintenance General Parameters screen displays, as shown below.

To set up the general system parameters:

1. Select System Admin > Organization Structure > Organization Unit Definition from the toolbar.

2. Search

for an organization unit and double-click it or highlight it and click

Select Org Unit.

The Organizational Unit Maintenance General Parameters screen displays,

as shown below.

3. In the Financial Defaults section, perform the following:

a. Enter the Individual and Company Credit Limits.

b. Enter the Financial Analysis.

4. As of 7.5.2, in the Order Discount Default section, select whether to Give Purchasing Group Discount Based On "Ship To", "Bill To" or "Both".

5. In the Tax Information section, perform the following:

a. Select the Tax/VAT Control from the drop-down.

b. Select the Tax Level from the drop-down.

6. If the organization unit uses Canadian tax, enter the GST Number.

7. In the Segmentation and Security Options section, check the Segment Control checkbox, if necessary.

8. In the Assign Financial Companies Defined in Organization and GL Setup Screen section, click Add a Company.

Financial

companies are typically defined within the organization unit steps. Please

refer to Defining

Financial Companies within the Organization Unit for more information.

Financial

companies are typically defined within the organization unit steps. Please

refer to Defining

Financial Companies within the Organization Unit for more information.

9. Click Save.

Screen Element |

Description |

|---|---|

Org Unit |

Text box. The organization unit associated with the organization. |

Financial Defaults |

|

Individual Credit Limit |

Text box. Enter the default for an individual’s credit limit within the organization unit. When the limit is reached, the Order Entry screen displays an error. |

Company Credit Limit |

Text box. Enter the default for a company’s credit limit within the organization unit. When the limit is reached, the Order Entry screen displays an error. |

Financial Analysis |

Text box. The value entered corresponds to the number of months financial information should be defaulted for user analysis. |

Order Discount Default |

|

Give Purchasing Group Discount Based On |

Drop-down. As of 7.5.2, identifies whether, by default, a purchasing group discount should be given based on the bill-to customer, order-line ship-to customer or both. By default, this is set to "Ship To". For more information, please see Defining Purchasing Groups. |

Tax Information |

|

Tax/VAT Control |

Drop-down. Select the method by which the organization unit will be taxed. Options include Charge VAT exclusively, Charge Sales tax exclusively, or Charge both Sales and VAT tax. The VAT tax is used in the United Kingdom and the European Union countries. Values in the drop-down are populated based on the fixed codes defined for the APP "TAX_TYPE" system type. |

Tax Level |

Drop-down. Select to whom the tax will be applied. For example, Ship-to or Bill-to. Values in the drop-down are populated based on the fixed codes defined for the APP "TAX_LEVEL" system type. |

GST Number |

Text box. The number associated with the GST tax. |

Segmentation and Security Options |

|

Segment Control |

Checkbox. When checked, indicates the organization unit can only see customers related to their organization unit. For more information, please see Customer/Org Unit Segmentation. |

Assign Financial Companies Defined in Organization and GL Setup Screen |

|

Add a Company |

Button. When clicked, a row is added to the table and the corresponding fields are enabled to add a company. |

Company Number |

Text box. A unique alphanumeric code for the financial company within the organization unit. It must be unique within the organization unit. This number displays in Account and Transaction tables. |

Company Name |

Text box. The name of the association/foundation. This name is used in reporting. |

Delete Unreferenced Company |

Button. When clicked, the highlighted row from the table is deleted. |