If a batch is not currently open, you are prompted to open a batch for processing. Click “Yes” and select the batch from the list.

Once a membership product(s) has been added to the order and shipping information has been defined where necessary, a receipt for the order should be created in order to activate the order. A partial or full payment can be made towards the order or, if necessary, a payment schedule can be setup to automatically charge a credit card or debit an electronic fund on a set schedule.

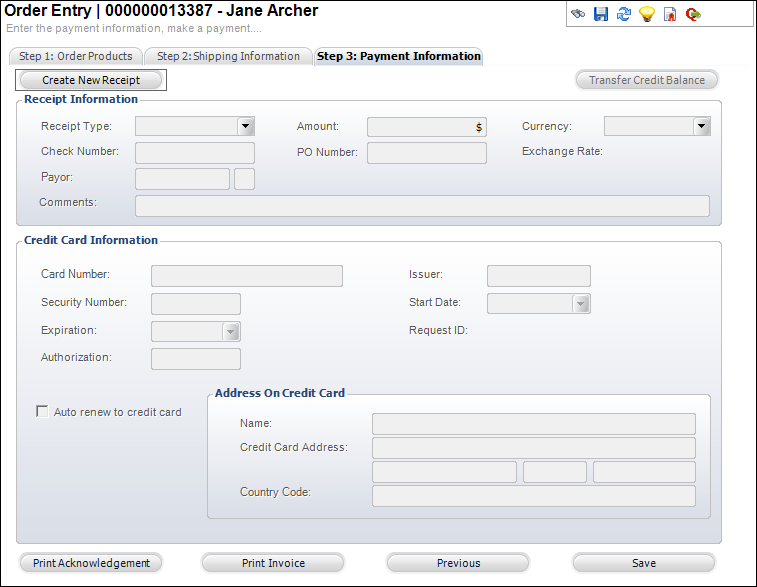

To create a receipt for a membership order:

1. Access

the Step 3: Payment Information tab.

If a batch is not currently open, you are prompted to open a batch for

processing. Click “Yes” and select the batch from the list.

2. Click Create New Receipt.

As of 7.4.0SP1,

if your order contains multiple line items and there is more

than one FND cash order line or if

there is only one FND cash order line but it has a price of

$0, the Receipt Entry screen will display when you click Create

New Receipt. This allows you to set the amount(s) to be applied

to the FND cash order line(s). Additionally, as of 7.5.2, if there is

a credit balance on the order, the system will display the following message:

"There is a credit balance on the order from a previous order line.

If you want to transfer this credit balance along with this payment, click

the “Auto Transfer Order Overpayment” button. Once the credit is distributed,

then apply the payment." For more information on the Receipt Entry

(FAR002) screen, please see Entering

a Receipt.

As of 7.4.0SP1,

if your order contains multiple line items and there is more

than one FND cash order line or if

there is only one FND cash order line but it has a price of

$0, the Receipt Entry screen will display when you click Create

New Receipt. This allows you to set the amount(s) to be applied

to the FND cash order line(s). Additionally, as of 7.5.2, if there is

a credit balance on the order, the system will display the following message:

"There is a credit balance on the order from a previous order line.

If you want to transfer this credit balance along with this payment, click

the “Auto Transfer Order Overpayment” button. Once the credit is distributed,

then apply the payment." For more information on the Receipt Entry

(FAR002) screen, please see Entering

a Receipt.

3. If applicable, to view any unapplied receipts or credit balances for the bill-to customer and apply the amount(s) available to the order, click Transfer Credit Balance. Only posted receipts will display.

4. From the Receipt Information section, enter the appropriate information:

a. Select

the Receipt Type from the drop-down.

Available receipt type options are defined for the org unit of the logged

in user. For more information, please see Defining

Organization Unit Receipt Types and Cash Accounts.

b. Enter

the appropriate Amount.

Please note that as of 7.5.0, if you enter an amount that results in a

credit balance on the order, if you add an additional line item to the

order and apply payment, the system will automatically perform an auto-adjustment

to transfer the credits to the debit balance on the new order line.

c. Change

the Currency, if necessary.

Please note that changing the Currency may result in a change to the Amount.

d. If you selected “Check”, enter the Check Number.

e. If you selected “Check” or “Cash”, enter the PO Number.

f. Enter

the Payor or click the link and search for a

payor.

The payor is the individual, customer, company, or committee who pays for

the order, who may not necessarily be the customer. Once the receipt is

processed you cannot change the payor. If the payor on the check is not

a customer in the system and you chose not to create a customer record

for that payor, if a refund is needed you will not be able to change the

payor to the correct name on the check.

You

can change the bill-to customer on the Step 2: Shipping Information tab

instead. This changes the Payor automatically.

You

can change the bill-to customer on the Step 2: Shipping Information tab

instead. This changes the Payor automatically.

g. Enter any Comments as necessary.

5. If a credit card was selected as the Receipt Type, enter payment information in the Credit Card Information section:

As of 7.6.2,

if a magnetic stripe reader device is hooked up, place your cursor in

the Card Number field, swipe the credit card, and the system will read

and process the credit card number. This functionality is available for

all payment gateways. Additionally, a new Vantiv

merchant parameter has been added in 7.6.2. If this parameter is enabled,

the system will send the track data from the credit card to Vantiv, letting

them know that the credit card is physically present, which will qualify

the transaction for a better transaction rate.

As of 7.6.2,

if a magnetic stripe reader device is hooked up, place your cursor in

the Card Number field, swipe the credit card, and the system will read

and process the credit card number. This functionality is available for

all payment gateways. Additionally, a new Vantiv

merchant parameter has been added in 7.6.2. If this parameter is enabled,

the system will send the track data from the credit card to Vantiv, letting

them know that the credit card is physically present, which will qualify

the transaction for a better transaction rate.

a. Verify that the appropriate credit card is selected as the Receipt Type in the Receipt Information section above.

b. Enter the Card number or click the link to select a saved credit card.

c. Enter the Issuer.

d. Enter

the Security Number.

This number is typically three digits and is located on the back of the

credit card.

As of 7.6.0,

if the IGNORE_CVV parameter

for your payment handler is set to "N" and you want to require

the security number (CVV) in the back office, you MUST add the "NULL"

value to the REJECT_CVV_RESULT_CODES parameter

for your payment handler. If so, if the credit card security number

is NOT entered in the back office, the following error message will display:

Your credit card cannot be charged at

this time. You may have left the CVV2 number blank. Please try again making

sure you entered the correct CVV2 number.

As of 7.6.0,

if the IGNORE_CVV parameter

for your payment handler is set to "N" and you want to require

the security number (CVV) in the back office, you MUST add the "NULL"

value to the REJECT_CVV_RESULT_CODES parameter

for your payment handler. If so, if the credit card security number

is NOT entered in the back office, the following error message will display:

Your credit card cannot be charged at

this time. You may have left the CVV2 number blank. Please try again making

sure you entered the correct CVV2 number.

e. Select the Start Date and Expiration date from the drop-downs.

f. Enter the Authorization number.

g. Verify the Address on Credit Card is correct. If not, then modify it.

h. As of 7.6.1, check the Auto renew to credit card checkbox if you want order lines in the order that are renewable to automatically renew to the customer's credit card.

6. If an electronic check was selected as the Receipt Type, enter payment information in the Bank Account Information section:

a. Enter the Routing Number.

b. Enter the Account Number.

c. Enter the Check Number.

d. Select the Personal Identifier from the drop-down.

e. If you selected "Social Security Number" as the Personal Identifier, enter the SSN and Date of Birth.

f. If you selected "Driver's License" as the Personal Identifier, enter the Drivers License No and State Issued.

g. Change the Name on Account, if necessary.

h. Change the CC Address, if necessary.

i. Enter a Email address.

j. Enter a Phone Number.

7. Click Save.

A message is displayed that the payment has been applied to the order and

the order becomes Active, if applicable.