You cannot

send a pre note and a deduction transaction for the same person in the

same batch.

You cannot

send a pre note and a deduction transaction for the same person in the

same batch.Electronic Funds Transfer (EFT) is one type of auto-payment that the system supports. It uses a standard Automated Clearing House (ACH) file. Transactions received by the financial institution during the day are stored and processed later in batch mode. Rather than sending each payment separately, ACH transactions are accumulated and sorted by destination for transmission during a predetermined time period.

The basic process includes the following steps:

1. The association arranges a deal with a bank for EFT and sets up their connection information.

2. When customers request an auto-pay situation through EFT for memberships, fundraising activities, show management, and anything that includes scheduled payments, they will provide the association with their bank’s EFT routing information.

3. Prior to the transfer of funds, the customer’s information can be sent to the bank as a “pre note,” which verifies that everything is in place to make this automatic in the future.

4. After the pre note is recorded, the association periodically sends a “deduction” transaction to the bank. This automatically moves some amount of money from the customer’s account to the association’s account.

You cannot

send a pre note and a deduction transaction for the same person in the

same batch.

You cannot

send a pre note and a deduction transaction for the same person in the

same batch.

5. Run the outgoing EFT680 process. This creates a file with pre-notifications and deductions transactions which will be sent to the bank.

6. Periodically, the association processes a file returned from the bank that lists all errors encountered with the original EFT transmission. This is the EFT681 process.

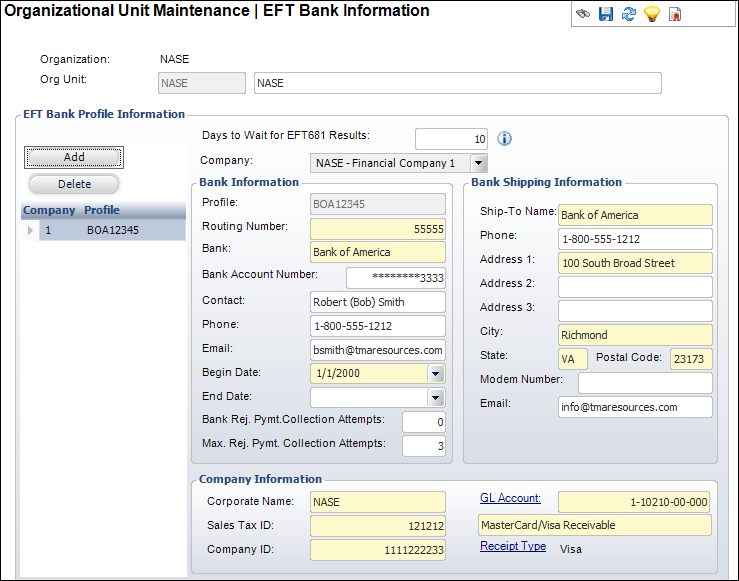

The EFT Bank Information screen is used to define the bank information of the association to the system. This screen is completed once and does not require updates unless specific data elements change.

To set up the EFT bank information:

1. From the Personify360 main toolbar, select System Admin > Organization Structure > Organization Unit Definition.

2. Search

for an organization unit and double-click it or highlight it and click

Select Org Unit.

The Organizational Unit Maintenance General Parameters screen displays.

3. From the

System Information task category, click EFT Bank Information.

The Organizational Unit Maintenance EFT Bank Information screen displays,

as shown below.

4. Click

Add.

The fields in the EFT Bank Profile Information section are enabled.

5. Enter the Days to Wait for EFT681 Results.

6. Select the appropriate financial Company from the drop-down.

7. In the Bank Information section, enter the following bank information:

· Profile code

· Routing Number

· Bank name

· Bank Account Number

· Contact, Phone, and Email

· Begin Date

· End Date

· Bank Rej. Pymt. Collection Attempts

· Max. Rej. Pymt. Collection Attempts

8. In the Bank Shipping Information section, enter the following bank shipping information:

· Ship-To Name

· Phone number

· Address, including City, State, and Postal Code

· Modem Number and Email

9. In the Company Information section, perform the following:

a. Enter the Corporate Name.

b. Enter the Sales Tax ID.

c. Enter the Company ID.

d. Click

the GL Account link to search for a GL

Account associated with the company.

The field below automatically populates with the description of the GL

account.

e. The Receipt Type automatically populates based on the GL Account selected. If necessary, click the Receipt Type link to select a different receipt type.

10. Click Save.

Screen Element |

Description |

|---|---|

Add |

Button. When clicked, a row is added to the table and the corresponding fields are enabled to add EFT bank information. |

Delete |

Button. When clicked, the highlighted row from the table is deleted. |

Days to Wait for EFT681 Results |

Text box. As of 7.6.1, identifies the number of days that need to pass before a receipt created by EFT680 can be transferred or refunded. This also identifies the number of days that must pass before an order or order line can be cancelled if the order or order line has a recent payment created by EFT680. By default, this is set to 10. The maximum value allowed in 99.

|

Company |

Drop-down. The financial company to which you want to add the EFT bank information. |

Bank Information |

|

Profile |

Text box. A user-defined code for the bank. This is for Personify360 purposes only and is used to track multiple banks within one company. |

Routing Number |

Text box. The bank’s routing number. This is a nine-digit number that identifies a specific financial institution. |

Bank |

Text box. The bank’s name. |

Bank Account Number |

Text box. The bank’s account number. |

Contact |

Text box. The contact person at the bank. |

Phone |

Text box. The phone number of the contact person at the bank. |

Text box. The email of the contact person at the bank. |

|

Begin Date |

Drop-down. The date of when the member starts the EFT. |

End Date |

Drop-down. The date of when the member stops the EFT. |

Bank Rej. Pymt. Collection Attempts |

Text box. As of 7.5.2, identifies the total number of times a rejected bank draft is resubmitted for collection by the organization’s bank before the bank notifies the organization that the bank draft was rejected. The EFT680 submission is considered to be the first attempt. If the organization’s bank has a policy of resubmitting a rejected bank draft an additional one or two times, that needs to be reflected in the number defined here, as well. This value will then default into the rejected payment record (Order_Detail_EFT_Rejected_Pymt. REJECTED_PYMT_COLLECTION_ATTEMPTS) so that EFT680 can evaluate whether a rejected bank draft can be resubmitted for payment. Whatever the value here, the system will add 1 to this for the attempt made by EFT680. If the bank doesn’t resubmit a rejected payment, this should be left as 0. |

Max. Rej. Pymt. Collection Attempts |

Text box. As of 7.5.2, identifies the maximum payment collection attempts that should be made by EFT680 to collect a payment that was rejected by the bank, typically because of insufficient funds.

Although the rule in most states is that a bank draft rejected because of insufficient funds can be resubmitted three times, most banks automatically resubmit the draft at least once, which means that 2 attempts have been made. If your bank automatically resubmits a rejected bank draft for payment, the value in this field should be set to 2, because if EFT680 resubmits the scheduled payment a third time to attempt collection, if the scheduled payment is rejected again because of insufficient funds, the bank will again automatically resubmit the bank draft for payment, meaning that four attempts were made to collect the payment. Base is delivered with this value set to 3. |

Bank Shipping Information |

|

Ship-To Name |

Text box. The name of the bank. |

Phone |

Text box. The phone number of the bank. |

Address 1, 2, 3 |

Text box. The first, second, and third lines of the bank’s address. |

City |

Text box. The city associated with the bank. |

State |

Text box. The state associated with the bank. |

Postal Code |

Text box. The postal code associated with the address provided. |

Modem Number |

Text box. The modem number of the bank. This is needed when sending electronic shipments. |

Text box. The email address to which the EFT file will be sent. |

|

Company Information |

|

Corporate Name |

Text box. The corporate name for the EFT file. |

Sales Tax ID |

Text box. The sales tax ID of the company associated with the bank. |

Company ID |

Text box. The company ID of the company associated with the bank. |

GL Account |

Link. The GL cash account of the company associated with the bank. |

Receipt Type |

Link. Automatically populates based on the default receipt type set with the GL account selected. As of 7.4.2, if necessary, this can be changed. This is the receipt used for payment when the EFT680 creates payments. |