The receipt reversal date is not the system date; it is the date entered by the user as the reversal date on the FAR003b screen.

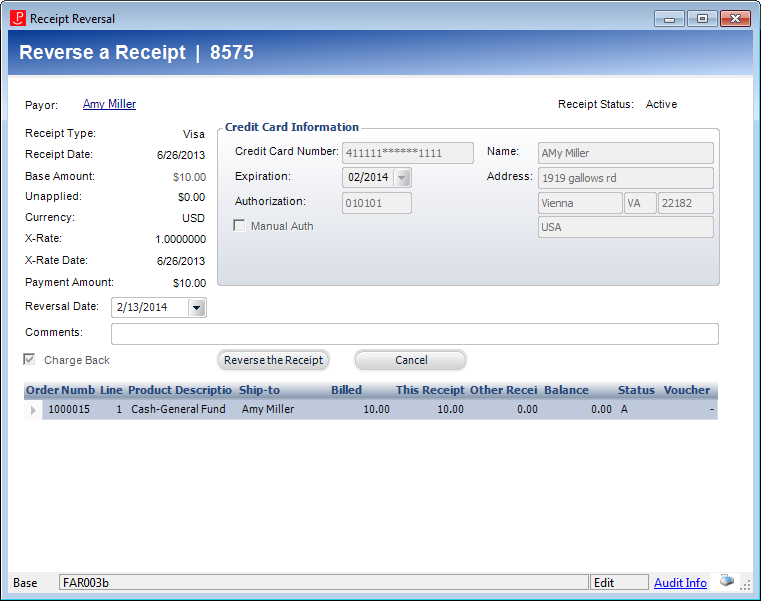

The receipt reversal date is not the system date; it is the date entered by the user as the reversal date on the FAR003b screen.This screen processes receipt reversals for misapplied receipts, insufficient funds on a check returned by the bank, or for credit card disputes (i.e. charge-backs). One receipt may cover multiple orders and line items. This screen can only reverse posted receipts.

As of 7.4.0SP1, if a receipt is reversed on same day as the receipt (if a deferred batch was used, it means the deferred batch has been posted):

· The Far_Txn.BATCH on the receipt reversal txn is set to the batch of the receipt, whether the batch is open or not

The receipt reversal date is not the system date; it is the date entered by the user as the reversal date on the FAR003b screen.

The receipt reversal date is not the system date; it is the date entered by the user as the reversal date on the FAR003b screen.

· The system will not update control counts or amounts; you can look at the receipt review tab and see that the receipt has been cancelled.

If a receipt is reversed on a different day than the date of the receipt:

· The system only writes the batch to the far_txn to the receipt reversal if there’s an adjustment batch open.

· Processing:

o FAR_Receipt.Receipt_Status_Code set to “C”

o FAR_Receipt.Receipt_Status_Date set to either the Adjustment Batch batch date or if none is open, set to SYSDATE.

o Type 1 transactions are created for all references to the receipt and type 3 transactions created for all referenced receipt transfers against those receipts

§ The cash account is found by tracking back to the batch and receipt type associated with the far_receipt record. The AR account is found at the order_detail level. One FAR_TXN and two FAR_TXN_DETAIL records are created for each order_detail record referenced by a receipt. Each references the receipt_ID of the receipt record.

§ For every record in FAR_Txn_Detail for the existing receipt transaction of FAR_Txn, we need to create a new record with a reversed sign. If the existing account is same as PPL account of order_detail and the order has been since been invoiced (i.e. Far_Txn.Invoice_no is not null), change the account to Order_Detail.AR_Account. All other fields should be copied from original transactions. What this means is that the result is an amount owed based on the AR account and not to leave a balance against the PPL account.

o Reversing Deferred Receipts: Deferred receipts (far_receipt.receipt_status_code=’Deferred’) is a special case of a credit card taken for back-ordered items where no actual charge was made to the card. What has to happen in this case is that the receipt is simply deleted and the associated proforma receipt transaction (far_txn.txn_type=’9’) is also deleted. There are no affects of this on the GL by this action.

· Only posted receipts can be reversed. Unposted cash receipts can be deleted directly from a batch. Unposted credit card receipts can be deleted from a batch but only if the credit card receipt has NOT been settled.

· Credit Card Reversals (Voids): For Credit Card receipts, only receipt transactions have not been settled can be reversed.

· Credit Card Reversals (Charge Backs) are usually charge reversals by bank itself (may be because customer notifies the bank that the charge un-authorized). Since the transaction has already been reversed by the bank, this transaction becomes very easy and is just the same as a receipt reversal for a check. There must be a property on a receipt reversal for “IsChargeBack” and when set to ‘Y’, will do this type of reversal for a credit card (i.e. not process it through the credit card company).

It is possible to have a negative receipt where the above transactions are reversed in structure. This can happen when a receipt is REVERSED as in the situation of a bad check or rejected credit card which was not pre-authorized.

Receipt reversals can affect both Receipts (Type 1) and Transfers (Type 3).

Here is the simple scenario:

1. A receipt is made to order #1 for $50.

2. That same receipt is transferred to order #2.

3. Then the original receipt is reversed for insufficient funds

The resulting transactions that are created are therefore:

1. Order #1:

a. Type 1 receipt reversal for the original receipt

b. Type 3 transfer reversal for the original transfer

2. Order #2

a. Type 3 transfer reversal

As of 7.6.1, if a credit card payment going through Vantiv authorization recycling is reversed, the system will:

· Generate a standard online “Authorization Reversal” transaction (which is done by creating a VOID-AUTH record in Ccp_Req_Ans), passing the LITLE_TXN_ID which is temporarily being stored in the PRE-SALE record in Ccp_Req_Ans.AUTH_REFERENCE field while the transaction is going through authorization recycling.

If the AUTH_REFERENCE field is blank because FAR681 has not been run, then the receipt will be reversed but no VOID-AUTH record will be created and no “Authorization Transaction” reversal will be sent.Generate a standard online “Authorization Reversal” transaction (which is done by creating a VOID-AUTH record in Ccp_Req_Ans), passing the LITLE_TXN_ID which is temporarily being stored in the PRE-SALE record in Ccp_Req_Ans.AUTH_REFERENCE field while the transaction is going through authorization recycling

· Generate receipt reversal transactions in Far_Txn and Far_Txn_Detail

· Update the payment status of scheduled payments paid by that payment from PAID to PENDING

· Update counts and totals in the receipt batch used for the reversed receipt

· Set Far_Receipt.AUTHORIZATION_RECYCLING_END_DATE to null

To reverse a receipt:

1. On the Customer Financial Analysis screen, on the Receipt Analysis tab, click Reverse Receipt.

You can also right-click a receipt on the Batch Control screen and select Reverse Receipt. The Receipt Reversal screen displays.

2. If necessary, change the Reversal Date.

3. Enter any Comments related to the reversal.

4. Highlight the receipt you want to reverse and click Reverse the Receipt.

A pop-up displays stating the receipt was successfully reversed.

Do not reverse credit card receipts that are already settled issue a refund instead.

Do not reverse credit card receipts that are already settled issue a refund instead.

See Also:

· Overview: Customer Financial Analysis

· Creating an Advanced Adjustment