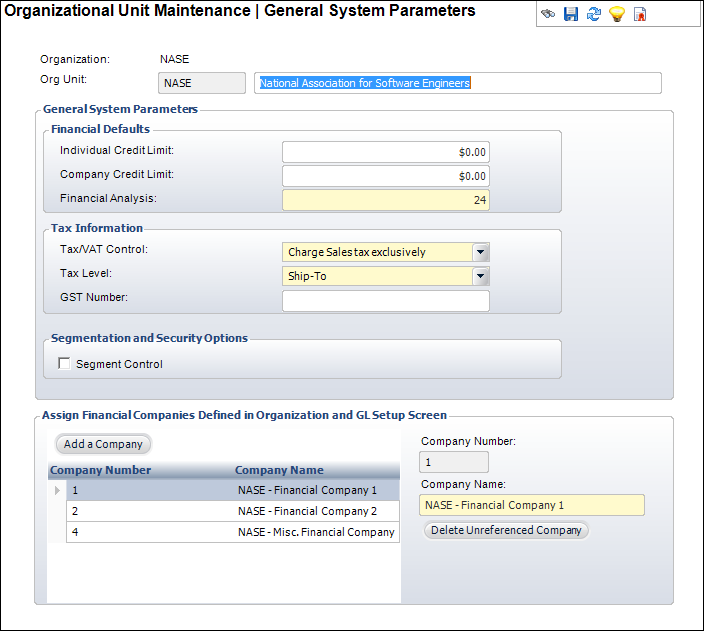

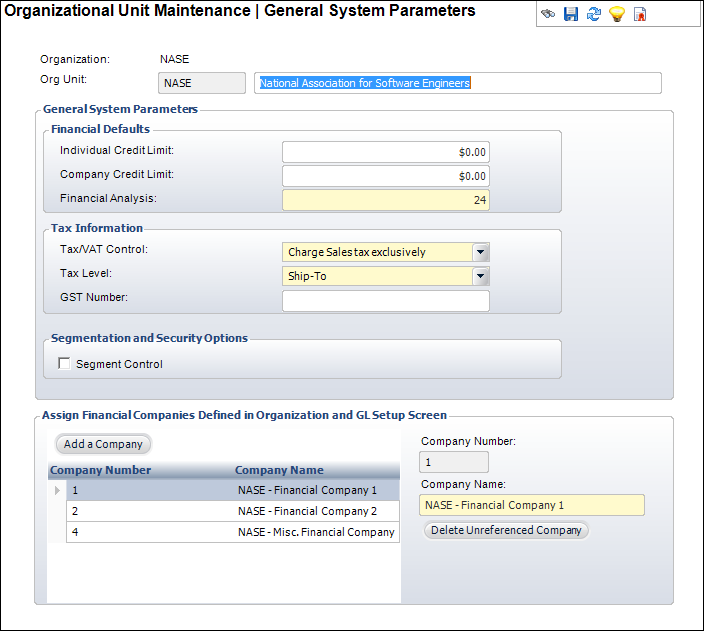

The Organizational Unit Maintenance General System Parameters screen displays, as shown below.

The tax information defined on the General System Parameters screen for the organization unit will determined which fields will be enabled in the Tax/VAT Control section on the General Ledger Accounts screen in Product Maintenance.

After defining the tax setup information on this screen, you must define the sales and VAT tax. And finally, you must define the product as taxable and select the type of tax to be charged on the GL Accounts screen.

To configure tax defaults for inventoried products:

1. Using the System Administrator persona, from the Personify360 main tool bar, select System Admin > Organization Structure > Organization Unit Definition.

The Organization Unit Maintenance search screen displays.

2. Click Search.

3. Select your organization/organization unit.

The Organizational Unit Maintenance General System Parameters screen displays, as shown below.

4. In the Tax Information section, perform the following:

a. Select the method by which your organization unit will be taxed from the Tax/VAT Control drop-down. Options include the following:

i. Charge both sales and VAT tax

Both the Tax Category and VAT Category drop-downs will be enabled on the General Ledger Accounts screen in Product Maintenance.

ii. Charge Sales tax exclusively

Only the Tax Category drop-down will be enabled on the General Ledger Accounts screen in Product Maintenance.

iii. Charge VAT exclusively

The VAT Category drop-down will be enabled on the General Ledger Accounts screen in Product Maintenance. The Charge VAT to All Customer checkbox will also be enabled. When selected, the VAT Country and VAT Category fields are required.

b. From the Tax Level drop-down, select either “Bill-To” or “Ship-To”.

c. If the organization unit uses Canadian tax, enter the GST Number.

5. Click Save.