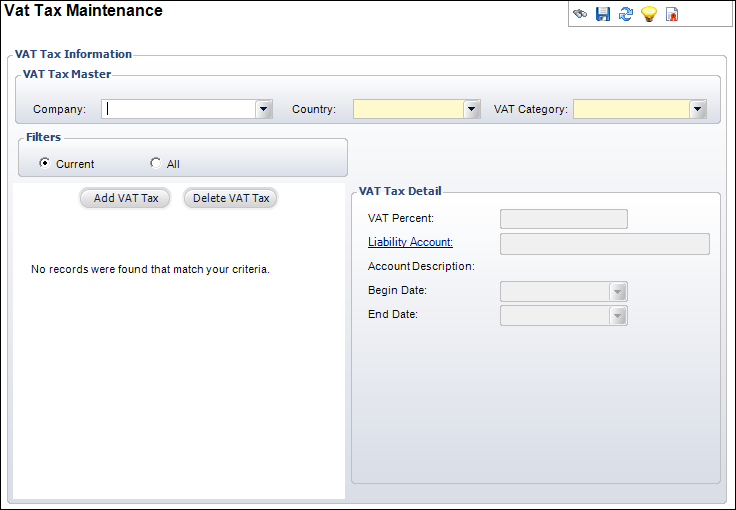

The VAT Tax Maintenance screen displays, as shown below.

Countries other than the U.S. charge a VAT (Value Added Tax) tax rather than the U.S. sales tax. VAT tax is a European sales and purchase tax that is collected and paid by the organizations with a turnover greater than £30,000 (in the United Kingdom). Personify360 maintains the VAT tax categories and percentages over time. Since tax liabilities are owned by the financial company, they must be defined by company to associate a company liability account.

To define VAT tax:

1. From the

Personify360 main toolbar, select Accounting > Accounting

Setup > VAT Tax Definition.

The VAT Tax Maintenance search screen displays.

2. Click

Create New.

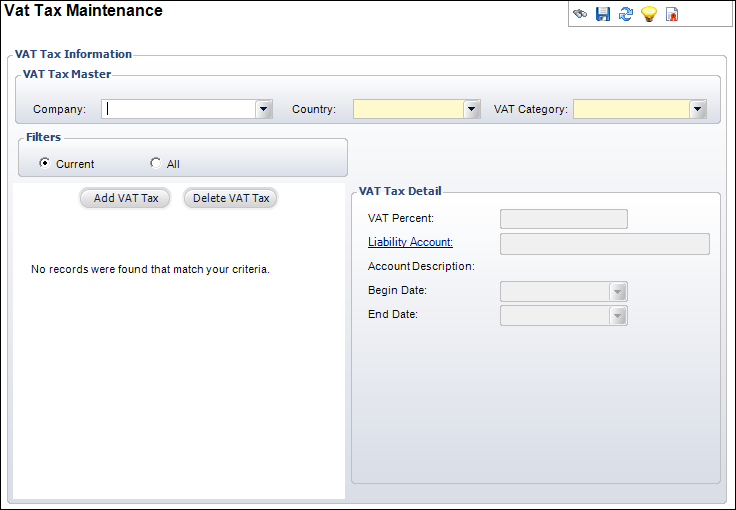

The VAT Tax Maintenance screen displays, as shown below.

3. Select the Company from the drop-down.

4. Select the Country from the drop-down.

5. Select the VAT Category from the drop-down.

6. Click

Add VAT Tax.

The VAT Tax Detail fields are enabled.

7. Enter the VAT Percent.

8. Click the Liability Account link to search for a liability account associated with the VAT.

9. Select the Begin Date and End Date from the drop-downs.

10. Click Save.

Screen Element |

Description |

|---|---|

VAT Tax Master |

|

Company |

Drop-down. This is the company associated with the VAT tax. Since the system works across companies, you must define the VAT tax at the company level to indicate that the taxes are valid for the company and location. |

Country |

Drop-down. This is the country associated with the VAT tax. |

VAT Category |

Drop-down. This is the category of the VAT tax. For example, 10%, 17.5%, or 5%. |

Add VAT Tax |

Button. When clicked, a row is added to the table and the corresponding fields are enabled to add VAT tax details. |

Delete VAT Tax |

Button. When clicked, the highlighted row from the table is deleted. |

VAT Tax Detail |

|

VAT Percent |

Text box. This is the percentage of VAT tax that will be levied, carried to four decimal places. Countries charge a percentage of their sales as VAT tax in the processing of their transactions. |

Liability Account |

Link. The liability account used to store the VAT tax amount. |

Account Description |

Read-only. The description of the liability account. |

Begin Date |

Drop-down. The date the VAT tax will be applied to orders. |

End Date |

Drop-down. The date the VAT tax will no longer be applied to orders. |

See Also: