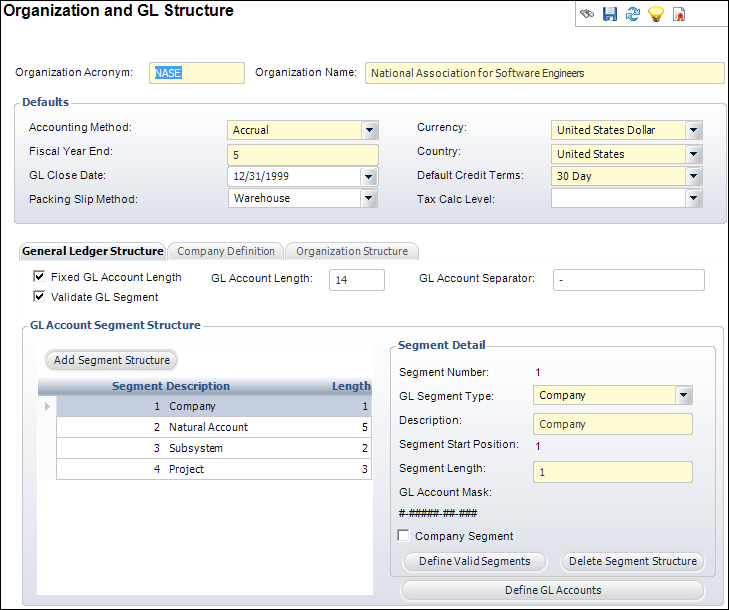

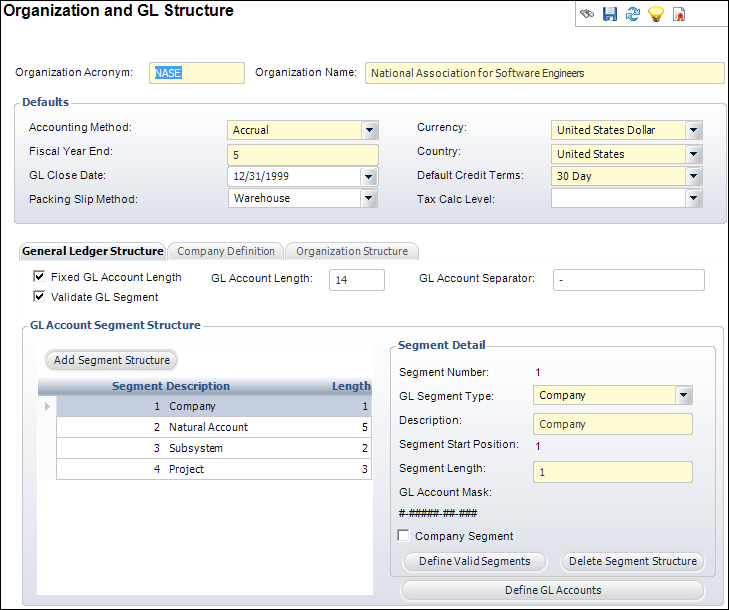

To set the defaults:

1. From the

Organization

and GL Structure screen, from the Defaults section, enter the Fiscal Year End.

2. Select the GL Close Date from the drop-down.

3. Select the Packing Slip Method from the drop-down.

4. Select the Currency from the drop-down.

5. Select the Country from the drop-down.

6. Select the Default Credit Terms from the drop-down.

7. Select the tax calculation level from the Tax Calc Level drop-down.

8. Click Save.

9. Now, you can perform the following tasks:

· Defining the organization structure

Screen Element |

Description |

|---|---|

Defaults |

|

Accounting Method |

Drop-down. The method of accounting used for the company. Personify360 is an accrual-based accounting system, which means revenue is recognized only when services are rendered. |

Fiscal Year End |

Text box. The month of the fiscal year. For example, if your fiscal year ends in June, enter 6 in this field. This number is used for reports that need to calculate amounts based on fiscal years, such as the Revenue Recognition report which determines deferred revenue for the current fiscal year and future fiscal years. |

GL Close Date |

Drop-down. The last date on which the GL was closed. This prevents users from creating batch or financials on or before this date. |

Packing Slip Method |

Drop-down. The method by which a packing slip is created. For example, Batch or Warehouse. |

Currency |

Drop-down. The type of currency used for the organization. |

Country |

Drop-down. The country associated with the organization. |

Default Credit Terms |

Drop-down. The default terms of the credit. For example, 30 days or upon receipt. The due date is calculated based on the credit terms selected here. |

Tax Calc Level |

Drop-down. The level at which the tax is calculated. For example, Tax at Order Line level or Tax at Order Total. |

See Also:

· Overview: Defining the Organization and GL Structure

· Defining the Organization Structure