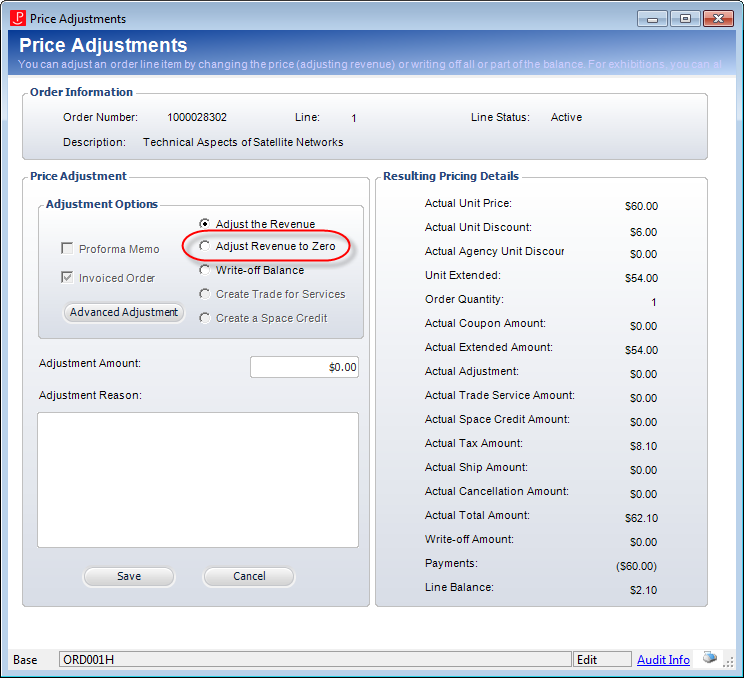

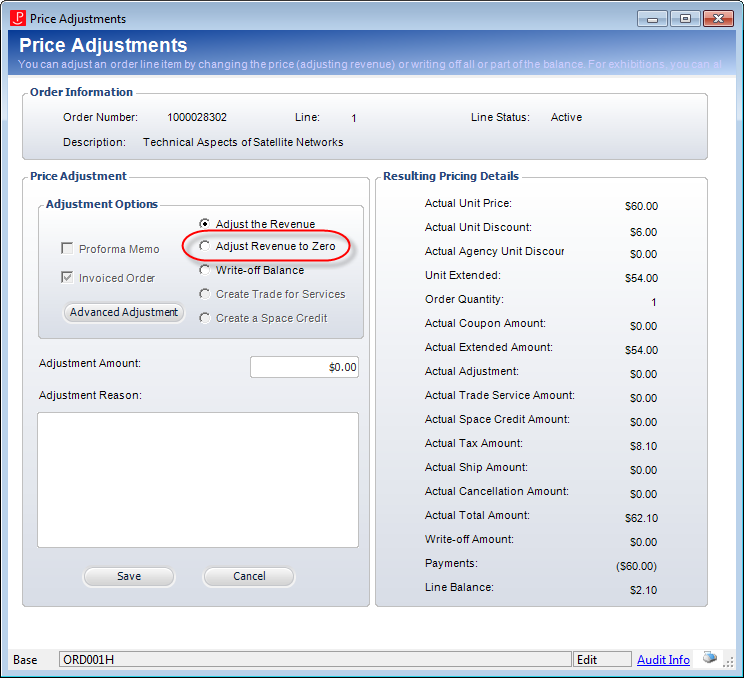

The Price Adjustments screen displays, as shown below.

As of 7.5.2, if you select the Adjust Revenue to Zero option from the Price Adjustment screen, the system will create a Type 6 adjustment transaction that will reverse the amounts in all of the type 4 and Type 6 transactions. The system will identify the transaction details to be created and will calculate the amounts by grouping all far_txn_detail records for type 4 and type 6 txns by Far_Txn_Detail.TXN_FUNCTION_CODE, Far_Txn_Detail.ACCOUNT then (sum (Far_Txn_Detail.BASE_AMOUNT) times -1) and create a new Type 6 with those far_txn_detail records. Existing base logic that evaluates write-off transactions when AR transaction are created is used.

If Order_Detail.RECOGNITION_STATUS_CODE = ‘C’, the system will create a Far_Txn_Detail record to reverse revenue instead of deferred revenue. This is also true for shipping revenue and discount revenue.

If Order_Detail.RECOGNITION_STATUS_CODE = ‘A’, the system will follow the same logic and FAR670 will then correct the amounts if they need to be updated.

See example transactions below.

To adjust the revenue to zero:

1. From the Order Entry screen, select the appropriate line item.

2. From the

Work with Line Items task category, click Adjust Price.

The Price Adjustments screen displays, as shown below.

3. From the Adjustment Options section, select the Adjust Revenue to Zero radio button, as highlighted above.

If

the order is active, the Invoiced Order

checkbox is checked and cannot be edited. If the order is proforma, the

Proforma Memo checkbox is checked

and cannot be edited.

If

the order is active, the Invoiced Order

checkbox is checked and cannot be edited. If the order is proforma, the

Proforma Memo checkbox is checked

and cannot be edited.

4. Enter the Adjustment Amount.

5. Enter the Adjustment Reason (required).

6. Click Save.

Assume a MISC order line with a discount. After the order line is saved, a coupon is added. The order line has the following transactions:

Far_Txn records:

far_txn_no |

txn_type_code |

base_amount |

Description |

|---|---|---|---|

11008 |

4 |

160.00 |

Sales transaction |

11009 |

6 |

-16.00 |

Coupon |

Far_Txn_Detail records:

far_txn_no |

txn_type_code |

base_amount |

Description |

|---|---|---|---|

11008 |

AR |

160.00 |

Sales transaction |

11008 |

DISC |

40.00 |

Sales transaction |

11008 |

REVENUE |

-200.00 |

Sales transaction |

11009 |

AR |

-16.00 |

Coupon |

11009 |

CPNDISC |

16.00 |

Coupon |

If the user selects the “Adjust Revenue to Zero” radio button, the system will create the Type 6 transaction as follows:

Far_Txn records:

far_txn_no |

txn_type_code |

base_amount |

Description |

|---|---|---|---|

11008 |

4 |

160.00 |

Sales transaction |

11009 |

6 |

-16.00 |

Coupon |

11010 |

6 |

-144.00 |

Revenue adjustment to zero |

Far_Txn_Detail records:

far_txn_no |

txn_type_code |

base_amount |

Description |

|---|---|---|---|

11008 |

AR |

160.00 |

Sales transaction |

11008 |

DISC |

40.00 |

Sales transaction |

11008 |

REVENUE |

-200.00 |

Sales transaction |

11009 |

AR |

-16.00 |

Coupon |

11009 |

CPNDISC |

16.00 |

Coupon |

11010 |

AR |

-144.00 |

Revenue adjustment to zero |

11010 |

CPNDISC |

-16.00 |

Revenue adjustment to zero |

11010 |

DISC |

-40.00 |

Revenue adjustment to zero |

11010 |

REVENUE |

200.00 |

Revenue adjustment to zero |

Assume a SUB order line with a discount. Assume revenue has been recognized for three issues. The order line has the following transactions:

Far_Txn records:

far_txn_no |

txn_type_code |

base_amount |

Description |

|---|---|---|---|

11015 |

4 |

108.00 |

Sales transaction |

11009 |

7 |

0.00 |

Deferred revenue recognition |

Far_Txn_Detail records:

far_txn_no |

txn_type_code |

base_amount |

Description |

|---|---|---|---|

11015 |

AR |

108.00 |

Sales transaction |

11015 |

DISC |

12.00 |

Sales transaction |

11015 |

DEFREV |

-120.00 |

Sales transaction |

11021 |

DEFREV |

10.00 |

Deferred revenue recognition |

11021 |

REVENUE |

-10.00 |

Deferred revenue recognition |

11137 |

DEFREV |

10.00 |

Deferred revenue recognition |

11137 |

REVENUE |

-10.00 |

Deferred revenue recognition |

11211 |

DEFREV |

10.00 |

Deferred revenue recognition |

11211 |

REVENUE |

-10.00 |

Deferred revenue recognition |

Now the user wants to adjust the revenue to zero. The user checks the “Adjust Revenue to Zero” radio button, and the system will create the Type 6 transaction as follows:

Far_Txn records:

far_txn_no |

txn_type_code |

base_amount |

Description |

|---|---|---|---|

11015 |

4 |

108.00 |

Sales transaction |

11310 |

6 |

-120.00 |

Revenue adjustment to zero |

Far_Txn_Detail records:

far_txn_no |

txn_type_code |

base_amount |

Description |

|---|---|---|---|

11015 |

AR |

108.00 |

Sales transaction |

11015 |

DISC |

12.00 |

Sales transaction |

11015 |

DEFREV |

-120.00 |

Sales transaction |

11021 |

DEFREV |

10.00 |

Deferred revenue recognition |

11021 |

REVENUE |

-10.00 |

Deferred revenue recognition |

11137 |

DEFREV |

10.00 |

Deferred revenue recognition |

11137 |

REVENUE |

-10.00 |

Deferred revenue recognition |

11211 |

DEFREV |

10.00 |

Deferred revenue recognition |

11211 |

REVENUE |

-10.00 |

Deferred revenue recognition |

11310 |

AR |

-108.00 |

Revenue adjustment to zero |

11310 |

DISC |

-12.00 |

Revenue adjustment to zero |

11310 |

DEFREV |

120.00* |

Revenue adjustment to zero |

FAR670

will adjust the deferred revenue to the correct amount.

FAR670

will adjust the deferred revenue to the correct amount.