All

of these accounts must be set, despite the fact that they may not be applicable

to your organization.

All

of these accounts must be set, despite the fact that they may not be applicable

to your organization.Personify controls which accounts are used. Personify allows:

· The accounting department to set the definitions.

· The product managers to use the definitions the accounting department defined.

System accounts are used for balance and receipt transfer along with the payable transfer account and unapplied receipt account.

All

of these accounts must be set, despite the fact that they may not be applicable

to your organization.

All

of these accounts must be set, despite the fact that they may not be applicable

to your organization.

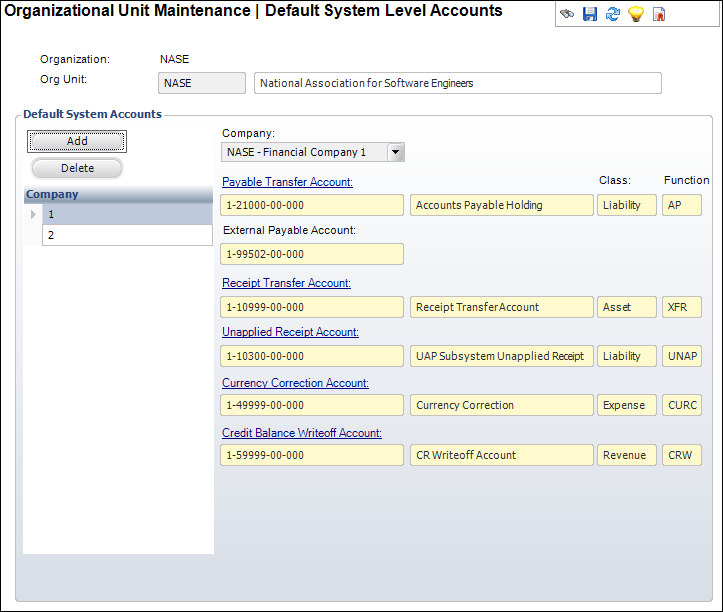

To set up the system-level accounts:

1. From the toolbar, select System Admin > Organization Structure > Organization Unit Definition.

2. Search

for an organization unit and select it.

The General System Parameters screen in Organizational Unit Maintenance

displays.

3. From the

Default GL Accounts task category, click System Accounts.

The Organizational Unit Maintenance: Default System Level Accounts screen

displays.

4. Click

Add.

The Default System Accounts fields are enabled.

5. Select a Company from the drop-down.

6. Click the Payable Transfer Account link and select the appropriate system-level account.

7. Enter the External Payable Account in the text box.

8. Click the Receipt Transfer Account link and select the appropriate system-level account.

9. Click the Unapplied Receipt Account link and select the appropriate system-level account.

10. Click the Currency Correction Account link and select the appropriate system-level account.

11. Click the Credit Balance Write-off Account link and select the appropriate system-level account.

12. Click Save.

Screen |

Description |

|---|---|

Add |

Button. When clicked, a row is added to the table and the corresponding fields are enabled to add default system accounts. |

Delete |

Button. When clicked, the highlighted row from the table is deleted. |

Company |

Drop-down. The company associated with the default system account. |

Payable Transfer Account |

Link. When a refund is created, Personify cannot access the external payable account directly, so this account is used. This is a clearing account to pass refund voucher data to your AP system. This account will clear out in your AP system, not in Personify. When a voucher is created in Personify, this account will be credited. When vouchers are entered into your AP system, this account should be debited and the external payable account (see below) should be credited in your AP system. This will need to be done as a journal entry by your AP (i.e., Personify will not create this entry) when the output file from the voucher transfer process is imported into your AP system. This account should not be the same as the actual payable account in your AP system or any AR, PPL or other account in Personify. |

External Payable Account |

Text box. This is the payable account in the external GL system. When the GL transfer is completed, this account is used to create the transaction in the external GL system. It is not validated against the Personify GL accounts and it is only used in the GL transfer. This account appears on vouchers and references the payables account. This account is external and is not a Personify account. |

Receipt Transfer Account |

Link. When transferring a receipt from one order to another, this account is used as a transfer account. The net result is always a wash (i.e., $0). |

Unapplied Receipt Account |

Link. If receipts are recorded but cannot be applied to a specific order/invoice, this account is used to maintain those amounts.

It is not recommended that the unapplied account be used for overpayments. In the case of an overpayment, the entire receipt can be applied to the order line resulting in a credit balance, which can then be refunded, transferred or held for another order. |

Currency Correction Account |

Link. Used for multi-currency transactions where there has been a change in the exchange rate between the time the order was placed and the time a foreign currency payment was received. It holds the difference in the exchange rate between the billed and the paid amount (i.e. the exchange rate may change because there is a difference in timing between these two events). |

Credit Balance Write-off Account |

Link. This is the default write-off account for credit balances for the company. When a small balance is due, the customer may write it off rather than refund it. This is not the same as the default write-off account that is set up for each module. The write-off account set up by module on the product accounts tab will be used as the default when setting up a product. The write-off account can be changed when actually performing the write-off.

This is also called an "Unearned Income Account". |